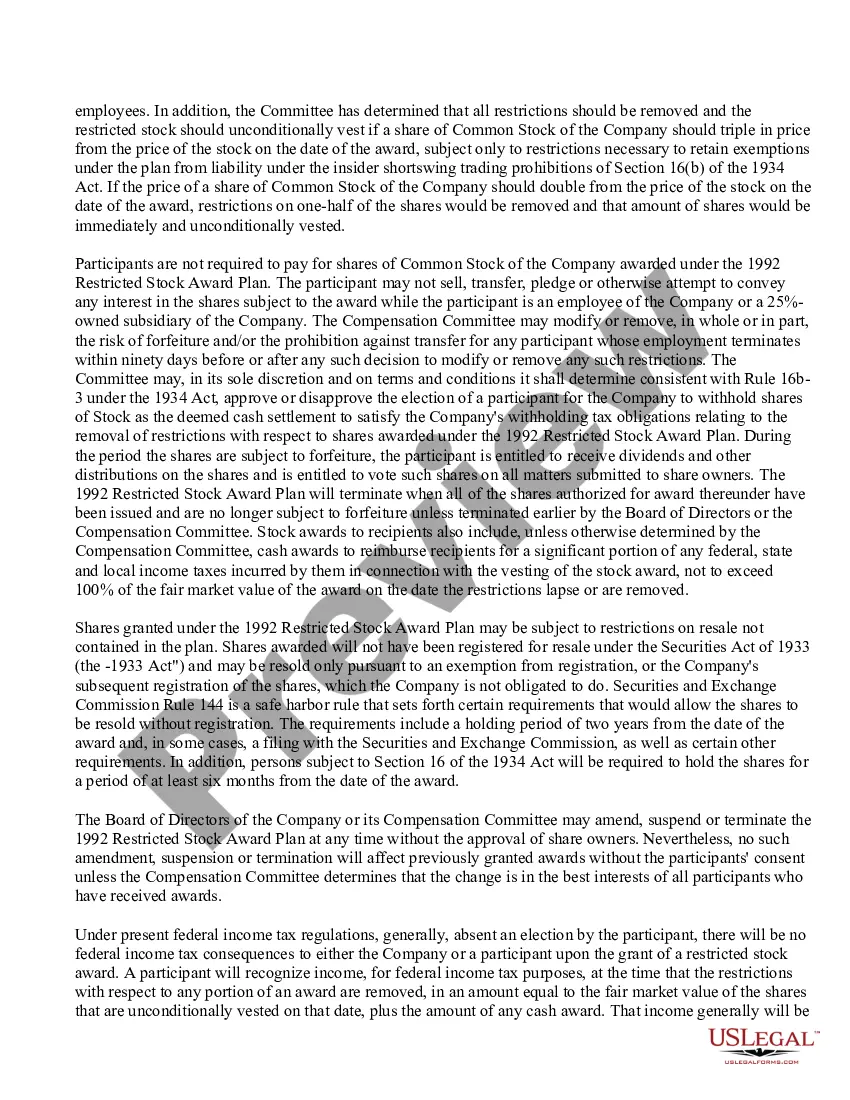

The King's New York Approval of Restricted Stock Award Plan for Coca-Cola Enterprises, Inc. is a comprehensive employee compensation program designed to provide key personnel with an incentive to drive the company's growth and success. This plan offers restricted stock awards as a form of compensation to eligible employees, acknowledging their contributions and aligning their interests with those of the company. Under this plan, employees who meet the eligibility requirements will be granted a specific number of restricted stock units (RSS) that will vest over a predetermined period. RSS represents a specified number of shares of Coca-Cola Enterprises, Inc. stock, and they are subject to certain restrictions and conditions during the vesting period. The New York Approval of Restricted Stock Award Plan aims to motivate and retain talented individuals within the company by linking a portion of their compensation to the company's performance. It reinforces a sense of ownership, as RSS granted to employees have value only when the stock price appreciates. This encourages employees to work towards long-term growth and boosts shareholder value. Key features of the Kings New York Approval of Restricted Stock Award Plan include: 1. Eligibility: Eligible employees can include top-level executives, key managers, and other employees who contribute significantly to the company's success. Eligibility criteria may vary based on seniority and job role. 2. Granting of RSS: Eligible employees will be granted RSS, representing a specific number of shares of the company's stock. The number of RSS granted may depend on factors such as job performance, seniority, and overall contribution to the organization. 3. Vesting Schedule: RSS typically vest over a period of time, incentivizing employees to remain with the company for a longer tenure. A vesting schedule determines when the RSS will convert into actual shares and become fully owned by the employee. 4. Restriction Period: During the vesting period, certain restrictions may apply to the RSS. This ensures that employees have a continued affiliation with the company and promotes focus on long-term company goals. 5. Performance-based Conditions: The Kings New York Approval of Restricted Stock Award Plan may include performance-based conditions that need to be met for the RSS to fully vest. These conditions can be related to the company's financial performance, individual goals, or specific performance metrics. 6. Tax Considerations: The plan takes into account the relevant tax regulations and guidelines applicable to RSS. These considerations aim to minimize tax liabilities for both the employee and the company. By implementing the Kings New York Approval of Restricted Stock Award Plan, Coca-Cola Enterprises, Inc. aims to attract, motivate, and retain talented individuals who can further the company's growth objectives. This compensation program aligns the interests of the employees with those of the shareholders, fostering a culture of ownership, commitment, and long-term success.

Kings New York Approval of Restricted Stock Award Plan for Coca-Cola Enterprises, Inc.

Description

How to fill out Kings New York Approval Of Restricted Stock Award Plan For Coca-Cola Enterprises, Inc.?

Creating legal forms is a must in today's world. However, you don't always need to look for professional help to draft some of them from the ground up, including Kings Approval of Restricted Stock Award Plan for Coca-Cola Enterprises, Inc., with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in different types varying from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching experience less overwhelming. You can also find detailed resources and guides on the website to make any tasks associated with paperwork execution straightforward.

Here's how to purchase and download Kings Approval of Restricted Stock Award Plan for Coca-Cola Enterprises, Inc..

- Go over the document's preview and outline (if provided) to get a basic idea of what you’ll get after getting the document.

- Ensure that the document of your choosing is specific to your state/county/area since state laws can affect the legality of some documents.

- Check the related forms or start the search over to find the right document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a suitable payment method, and buy Kings Approval of Restricted Stock Award Plan for Coca-Cola Enterprises, Inc..

- Select to save the form template in any available file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Kings Approval of Restricted Stock Award Plan for Coca-Cola Enterprises, Inc., log in to your account, and download it. Of course, our platform can’t replace an attorney completely. If you need to cope with an extremely complicated case, we advise getting an attorney to check your document before signing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of customers. Join them today and get your state-specific documents with ease!