The Suffolk New York Restricted Stock Award Plan of Coca-Cola Enterprises, Inc. is a compensation program designed to incentivize and reward key employees and executives for their contribution to the company's success. This plan offers restricted stock awards as a performance-based bonus that employees can earn over time. Additionally, it helps promote shareholder value and aligns the interests of employees with those of the company and its investors. Under this plan, eligible employees can receive restricted stock grants, which are shares of the company's stock that are subject to certain restrictions. These restrictions may include vesting requirements and holding periods, which ensure that employees have a continued interest in the company's long-term performance. The Suffolk New York Restricted Stock Award Plan consists of several types of awards tailored to different employee levels or job roles within Coca-Cola Enterprises, Inc. These include: 1. Executive Restricted Stock Award: This type of award is granted to top-level executives and includes a significant number of restricted stock units. Executives receiving this award typically have to meet certain performance targets or tenure requirements to become eligible. 2. Managerial Restricted Stock Award: Middle-level managers and leaders may be eligible for this type of award. It offers a moderate number of restricted stock units, and the vesting requirements might be aligned with managerial performance goals such as team performance or achieving set targets. 3. Employee Restricted Stock Award: This award category is open to a broader range of employees throughout the organization. It grants a smaller number of restricted stock units, typically as an appreciation for their long-term commitment and dedication. Vesting requirements may be based on tenure or overall company performance. 4. Performance-based Restricted Stock Award: This type of award is linked directly to the achievement of specific performance metrics or financial targets set by the company. It may apply to employees at various levels and is used as a means to drive superior performance and align the interests of employees with the company's strategic goals. Overall, the Suffolk New York Restricted Stock Award Plan of Coca-Cola Enterprises, Inc. aims to attract and retain top talent, foster a sense of ownership among employees, and ensure their dedication to the long-term growth and success of the company. This plan provides an additional incentive beyond regular compensation, motivating employees to contribute to the company's overall performance and enhance shareholder value.

Suffolk New York Restricted Stock Award Plan of Coca-Cola Enterprises, Inc.

Description

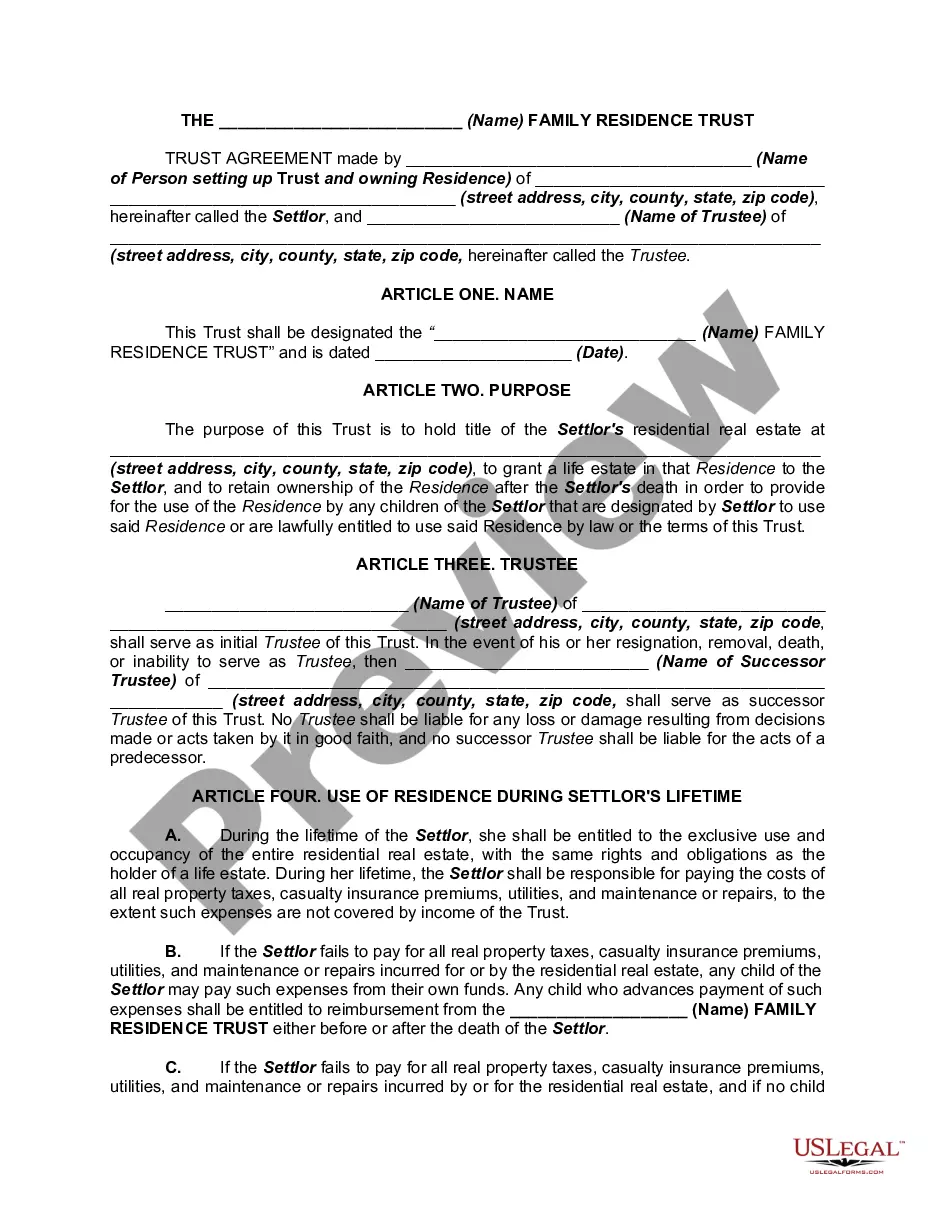

How to fill out Suffolk New York Restricted Stock Award Plan Of Coca-Cola Enterprises, Inc.?

Whether you intend to start your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain documentation meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business case. All files are grouped by state and area of use, so picking a copy like Suffolk Restricted Stock Award Plan of Coca-Cola Enterprises, Inc. is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few additional steps to get the Suffolk Restricted Stock Award Plan of Coca-Cola Enterprises, Inc.. Adhere to the instructions below:

- Make certain the sample meets your individual needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to get the file once you find the proper one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Suffolk Restricted Stock Award Plan of Coca-Cola Enterprises, Inc. in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you can access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

FAQ

PepsiCo Inc. already grants all its employees stock options equal to 10% of their previous year's pay. Employees can exercise the options over the following five to 10 years. And every year they earn more options.

Key Takeaways. Employee stock options are offered by companies to their employees as equity compensation plans. These grants come in the form of regular call options and give an employee the right to buy the company's stock at a specified price for a finite period of time.

A restricted stock award (RSA) is a form of equity compensation used in stock compensation programs. An RSA is a grant of company stock in which the recipient's rights in the stock are restricted until the shares vest.

Based on 47 current employees, 49% said they receive an annual bonus at The Coca-Cola Company. Unfortunately, there's a 18% difference between genders; 62% of women and 44% of men responded Yes to receiving bonuses.

You can buy Coca-Cola shares through an online share dealing platform such as the one offered by IG. This enables you to own the shares outright, meaning you will profit if the price of the shares increases, or from any Coca-Cola dividend payments.

The Coca-Cola Company is a publicly listed company, meaning there is not one sole owner, but rather the company is 'owned' by thousands of shareholders and investors around the world. However, the largest shareowner of the company is American businessman Warren Buffett.

Shares can be purchased through a Direct Stock Purchase and Dividend Reinvestment Plan sponsored and administered by Computershare Trust Company, N.A. Details about the Computershare Investment Plan, including any fees associated with the Plan, can be viewed and printed from Computershare's website.

We have complete compensation packages that include 401K, core and supplemental life insurance, as well as financial courses and advisors.

The Coca2011Cola Company is a public company that trades its shares on the New York stock exchange - so we are 'owned' by our thousands of shareholders and investors around the world. Did you know? The first Coca2011Cola shares were issued in 1919 and the initial stock symbol used for The Coca2011Cola Company was CCO.

Employee stock options (ESPPs) differ from RSUs and GSUs in that they aren't granted to employees free of charge. Instead, employees have the option to buy into company shares at a predetermined, discounted rate after a vesting period.