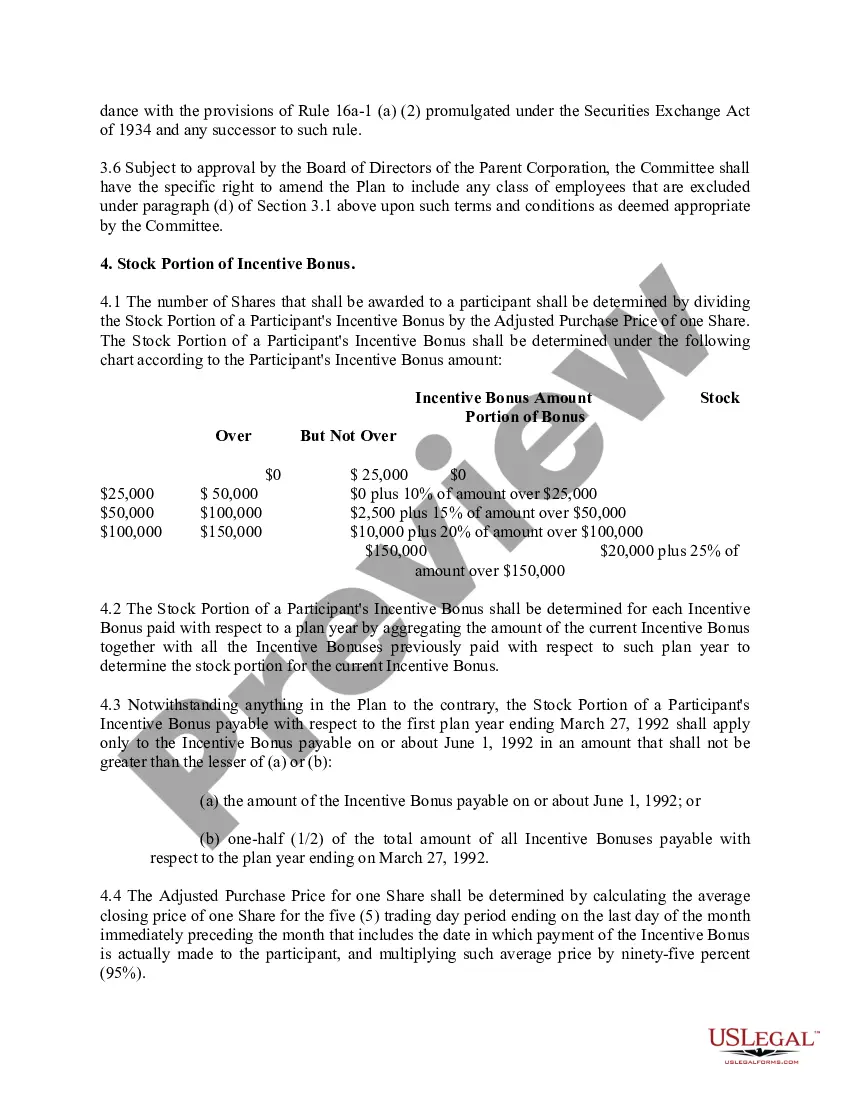

Fairfax Virginia Restricted Stock Bonus Plan of McDonald and Company Investments, Inc. is a compensation plan offered to employees of the company, primarily based in the Fairfax, Virginia area. This plan provides eligible employees with restricted stock as a bonus, which means that they are awarded company stock subject to specific vesting conditions and restrictions. Under this plan, employees are granted a certain number of shares of McDonald and Company Investments, Inc. stock as part of their annual bonus package. The number of shares awarded is typically based on a variety of factors, including the employee's position, performance, and length of service. These restricted stock grants are subject to a vesting schedule, which determines when the employee gains full ownership of the shares. Vesting periods can vary from a few months to several years, incentivizing employees to remain with the company for a certain duration to fully capitalize on the stock award. During the vesting period, employees cannot sell, transfer, or otherwise dispose of the granted shares. They may, however, receive dividends on the stock if McDonald and Company Investments, Inc. distributes them during this time. Once the shares fully vest, the employee gains unrestricted ownership and can decide whether to retain the shares or sell them on the open market. It's important to note that employees may be subject to certain restrictions even after the shares have vested. For instance, there may be a lock-up period during which the employee must hold onto the shares before selling them. This ensures that employees do not take immediate advantage of the stock award and demonstrates their commitment to the company's long-term success. In addition to the general Fairfax Virginia Restricted Stock Bonus Plan, McDonald and Company Investments, Inc. may have specific variations or sub-plans tailored to different employee groups or levels within the organization. These variations could include plans specifically designed for executives, senior management, or specific departments, each with its own eligibility criteria, vesting schedules, and requirements. The Fairfax Virginia Restricted Stock Bonus Plan of McDonald and Company Investments, Inc. is an attractive incentive for employees, as it not only provides them with a bonus tied to the company's performance but also aligns their interests with the long-term success of the organization. By awarding employees with restricted stock, the company motivates them to contribute to the growth and profitability of McDonald and Company Investments, Inc. while also fostering loyalty and retention among its workforce.

Fairfax Virginia Restricted Stock Bonus Plan of McDonald and Company Investments, Inc.

Description

How to fill out Fairfax Virginia Restricted Stock Bonus Plan Of McDonald And Company Investments, Inc.?

Creating forms, like Fairfax Restricted Stock Bonus Plan of McDonald and Company Investments, Inc., to take care of your legal affairs is a difficult and time-consumming task. Many situations require an attorney’s participation, which also makes this task expensive. However, you can consider your legal matters into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal forms intended for a variety of cases and life circumstances. We ensure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the Fairfax Restricted Stock Bonus Plan of McDonald and Company Investments, Inc. template. Simply log in to your account, download the template, and personalize it to your requirements. Have you lost your document? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is fairly easy! Here’s what you need to do before downloading Fairfax Restricted Stock Bonus Plan of McDonald and Company Investments, Inc.:

- Make sure that your document is compliant with your state/county since the regulations for creating legal paperwork may differ from one state another.

- Learn more about the form by previewing it or reading a brief description. If the Fairfax Restricted Stock Bonus Plan of McDonald and Company Investments, Inc. isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to begin using our service and download the form.

- Everything looks good on your end? Hit the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your template is good to go. You can try and download it.

It’s easy to locate and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!