The San Diego California Restricted Stock Bonus Plan offered by McDonald and Company Investments, Inc. is a comprehensive employee incentive program designed to reward and retain valuable talent within the company. This plan provides employees with restricted stock units (RSS) as a bonus, which are granted based on specific performance criteria and vest over a predetermined period of time. With a strong presence in San Diego, California, McDonald and Company Investments, Inc. has established multiple types of Restricted Stock Bonus Plans to cater to the diverse needs of its workforce. These plans include: 1. Standard Restricted Stock Bonus Plan: This is the primary plan offered by the company, wherein eligible employees are granted a specific number of RSS based on their performance and contribution to the organization. This RSS will vest over a defined timeframe, encouraging employees to remain committed to their roles and the company's growth. 2. Executive Restricted Stock Bonus Plan: This plan is designed exclusively for top-level executives and senior management within the company. It offers a more substantial allocation of RSS, reflecting their significant contributions to the organization's success. The vesting schedule may vary based on the executive's performance and retention objectives. 3. Long-Term Performance-Based Restricted Stock Bonus Plan: This plan emphasizes long-term performance goals, aligning employee incentives with the company's strategic objectives. Eligible employees, including both executives and non-executives, receive RSS based on the company's performance metrics over a certain period. The vesting of this RSS is tied to achieving specific targets, encouraging individuals to drive the company's growth and profitability. 4. Employee Stock Ownership Plan (ESOP): While not specifically a restricted stock bonus plan, an ESOP is another form of equity-based program offered by McDonald and Company Investments, Inc. This plan allows eligible employees to acquire company shares, increasing their ownership stake and aligning their interests with that of the shareholders. Overall, the San Diego California Restricted Stock Bonus Plans of McDonald and Company Investments, Inc. provide employees with a valuable opportunity to participate in the company's growth and success. The allocation of RSS, along with the specific vesting schedule, varies depending on factors such as job role, performance, and tenure. Through these plans, McDonald and Company Investments, Inc. aims to attract, motivate, and retain talented employees while fostering a culture of ownership and long-term commitment within the organization.

San Diego California Restricted Stock Bonus Plan of McDonald and Company Investments, Inc.

Description

How to fill out San Diego California Restricted Stock Bonus Plan Of McDonald And Company Investments, Inc.?

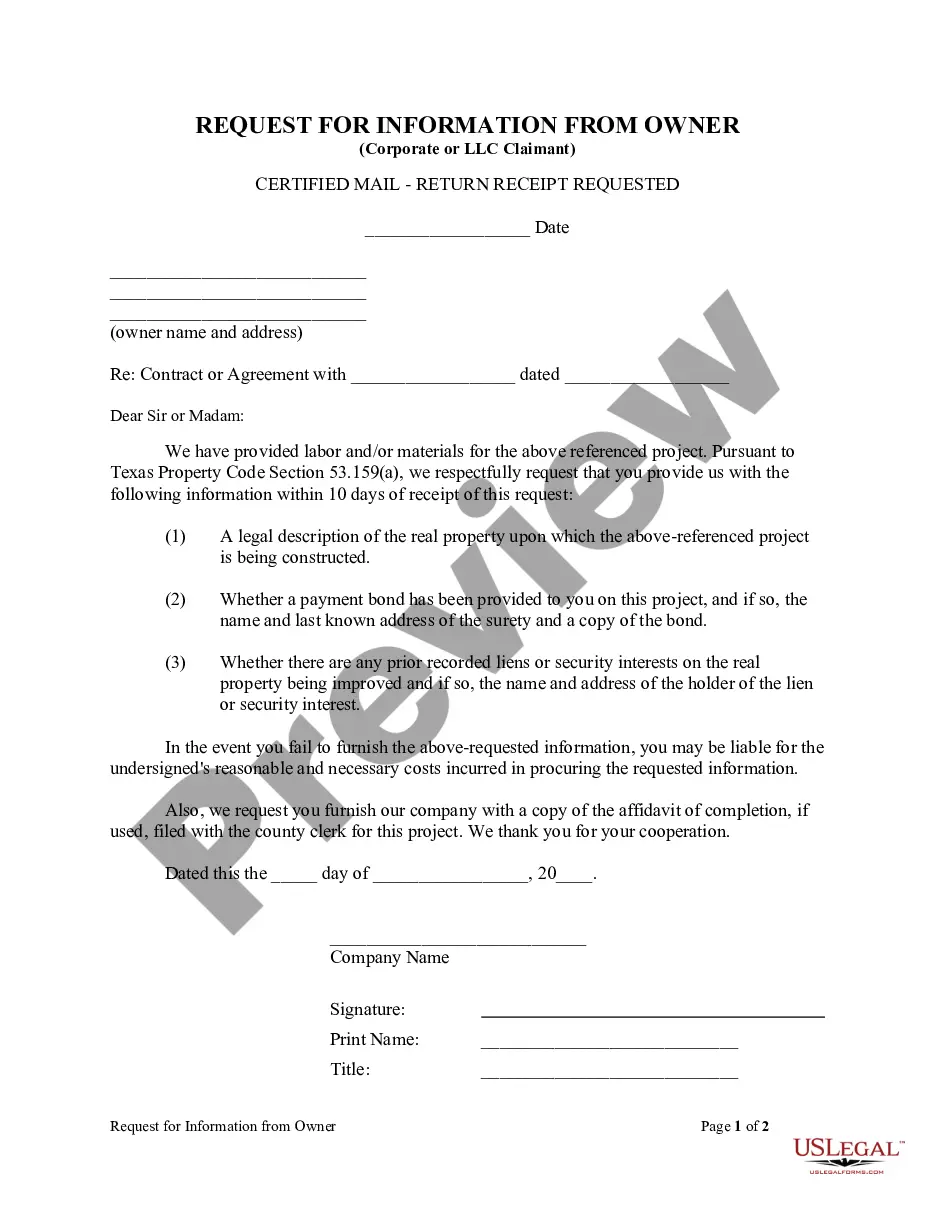

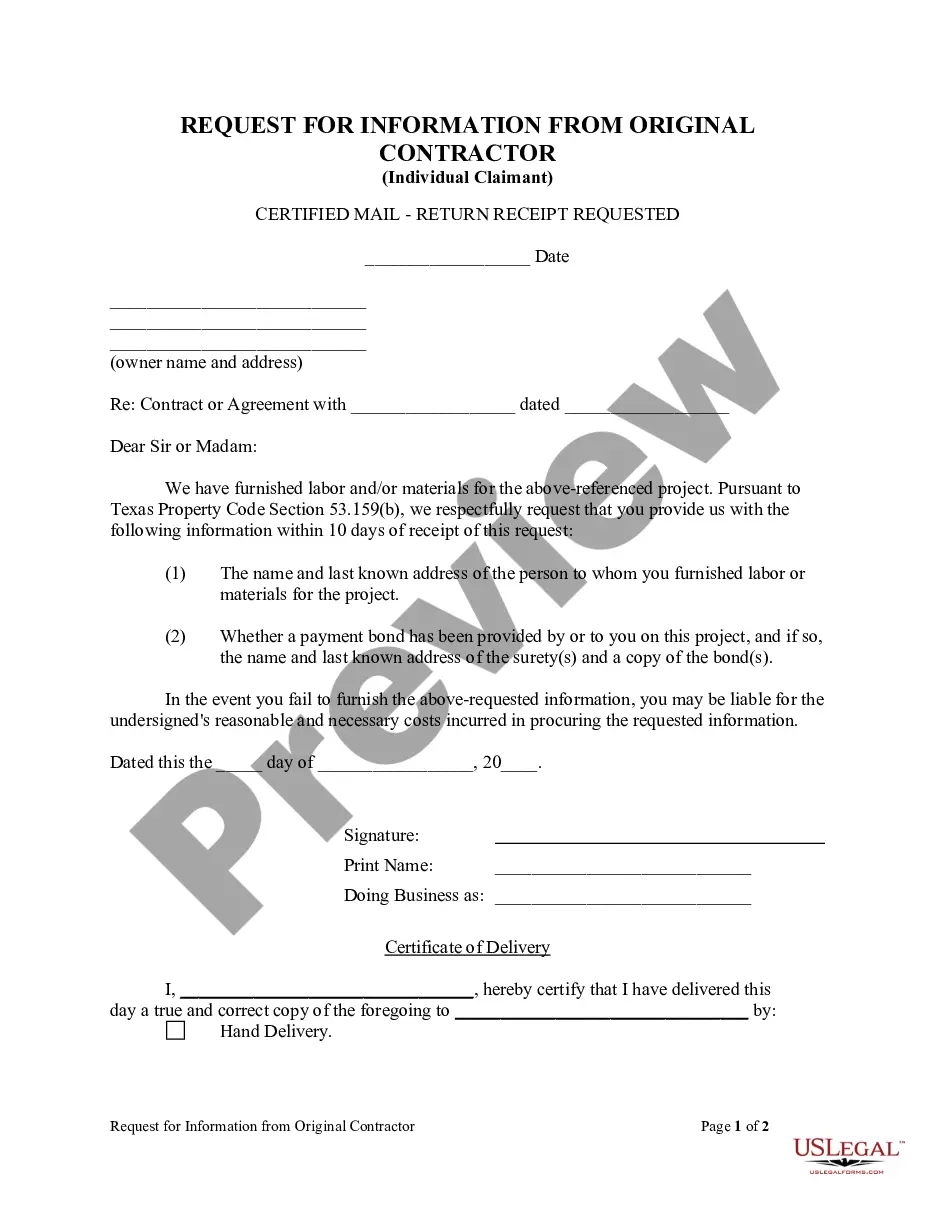

Laws and regulations in every sphere vary from state to state. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the San Diego Restricted Stock Bonus Plan of McDonald and Company Investments, Inc., you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used many times: once you obtain a sample, it remains accessible in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the San Diego Restricted Stock Bonus Plan of McDonald and Company Investments, Inc. from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the San Diego Restricted Stock Bonus Plan of McDonald and Company Investments, Inc.:

- Examine the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the document when you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

RSUs are claims for shares of company stock given to employees as a form of compensation. Unlike stock options, you don't have to pay to exercise RSUs once they vest, they're yours. Historically, RSUs were far more common for employees of public companies than those who work at private companies.

Restricted stock units (RSUs) are a form of stock based compensation where a company grants an employee with shares to the company. This method of issuing stock to employees is 'restricted' as stocks are issued through a 'vesting plan' and 'distribution schedule'.

Unlike with stock options, with RSUs you don't have to pay anything to get the stock. Instead, you are usually only responsible for paying the applicable taxes when you receive the shares.

Both are a type of employee equity compensation, but RSUs are given to the employee free of charge and only have financial value once vested. Stock options give the employee the right to buy company stock at a set price called the strike price; they are only valuable when the market price is higher than the set price.

Under normal federal income tax rules, an employee receiving a Restricted Stock Award is not taxed at the time of the grant (assuming no election under Section 83(b) has been made, as discussed below). Instead, the employee is taxed at vesting, when the restrictions lapse.

The advantages of restricted stock bonus/purchase plans are (1) the employee can make the §83(b) election; (2) the employee is generally entitled to capital gain treatment on sale of vested stock; and (3) the Company gets a wage deduction without paying cash wages.

Restricted stock units are issued to employees through a vesting plan and distribution schedule after they achieve required performance milestones or upon remaining with their employer for a particular length of time. RSUs give employees interest in company stock but no tangible value until vesting is complete.

Restricted stock units are a way an employer can grant company shares to employees. The grant is "restricted" because it is subject to a vesting schedule, which can be based on length of employment or on performance goals, and because it is governed by other limits on transfers or sales that your company can impose.

An RSU is an employer compensation feature that has gained more popularity recently. It stands for Restricted Stock Unit, and it functions similar to a bonus, but instead of a regular bonus that you get in cash/on your paycheck, you get stock units (shares) of your company.

Restricted stock units (RSUs) are a way your employer can grant you company shares. RSUs are nearly always worth something, even if the stock price drops dramatically. RSUs must vest before you can receive the underlying shares. Job termination usually stops vesting.