Kings New York is proposing to approve a restricted stock plan that aims to incentivize and reward its employees. This detailed proposal outlines the various aspects of the plan and its different types, ensuring a comprehensive understanding of the benefits and restrictions involved. The restricted stock plan of Kings New York is designed to provide eligible employees with shares of company stock, subject to certain restrictions and conditions. This plan serves as a long-term incentive, encouraging employees to contribute to the company's growth and success, thereby aligning their interests with those of shareholders. Under the proposed restricted stock plan, employees will receive a specified number of shares as a grant, with the vesting period determining when they gain ownership rights. The plan offers several types of restricted stock grants: 1. Time-based Restricted Stock: This grant type requires employees to fulfill a predetermined service period before gaining full ownership of the awarded shares. It helps ensure employee retention and commitment, promoting loyalty and dedication. 2. Performance-based Restricted Stock: Aimed at incentivizing high performance, this grant is contingent upon achieving predefined performance goals. It provides an extra motivation for employees to excel in their roles and contribute to the company's overall success. 3. Restricted Stock Units (RSS): Rather than direct stock ownership, RSS grant employees the right to receive company shares at a predetermined future date. They are subject to vesting criteria, after which they convert into actual shares of stock. To control the timing and possible dilution of shares, the restricted stock plan may include provisions such as holding periods, forfeiture conditions, and minimum vesting requirements, ensuring a responsible allocation of company ownership. The proposal also highlights that the restricted stock plan is subject to regulatory requirements and compliance. It emphasizes the importance of considering legal and tax implications, while fostering transparency and fairness in the distribution of shares. By implementing this restricted stock plan, Kings New York aims to motivate and retain its talented workforce, fostering a sense of ownership, and aligning employee goals with the long-term success of the company. This proposal reflects the company's commitment to ensuring sustained growth and recognizing the valuable contributions of its employees.

Kings New York Proposal to approve restricted stock plan

Description

How to fill out Kings New York Proposal To Approve Restricted Stock Plan?

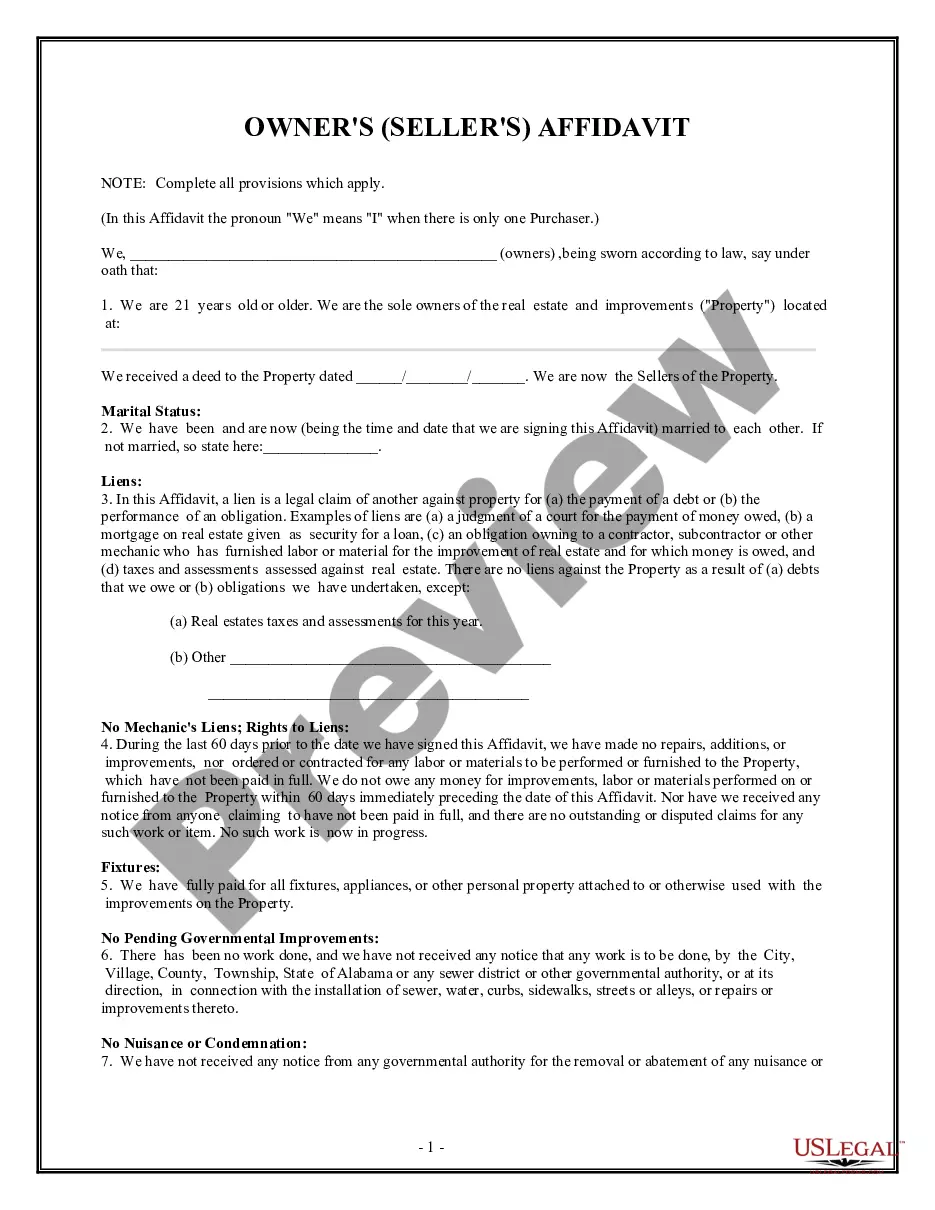

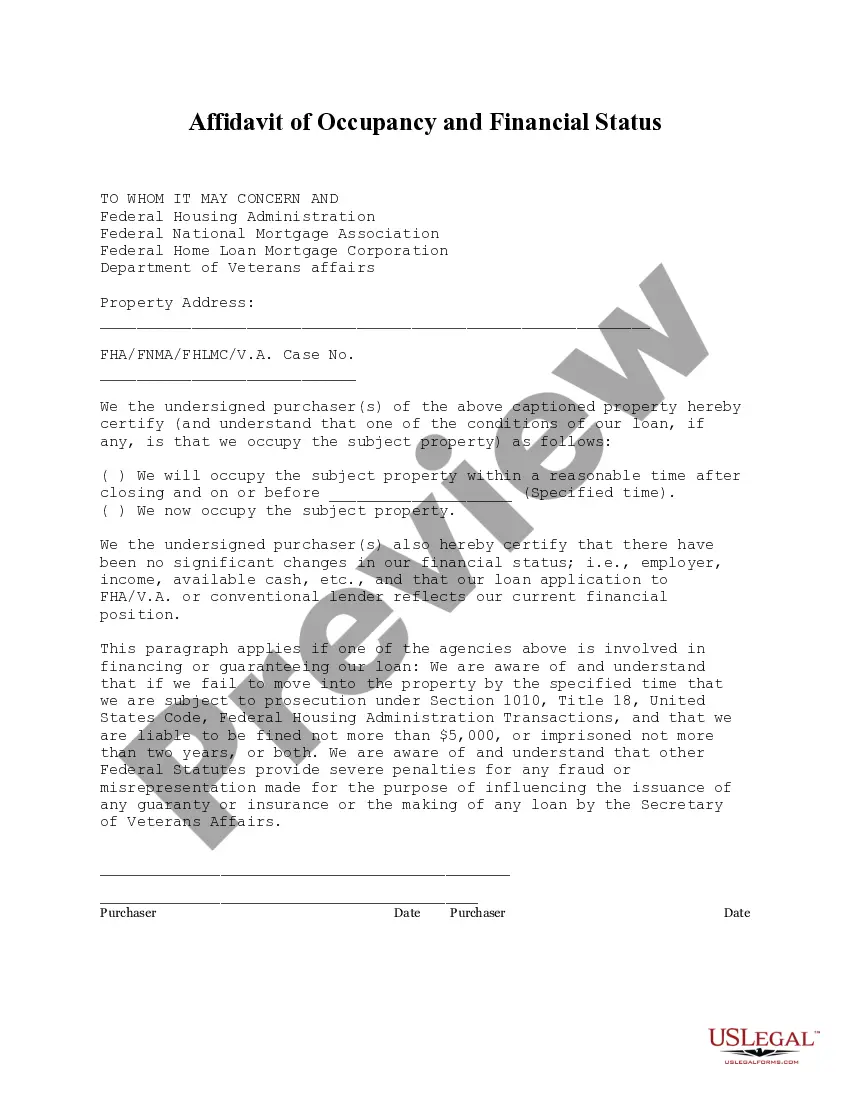

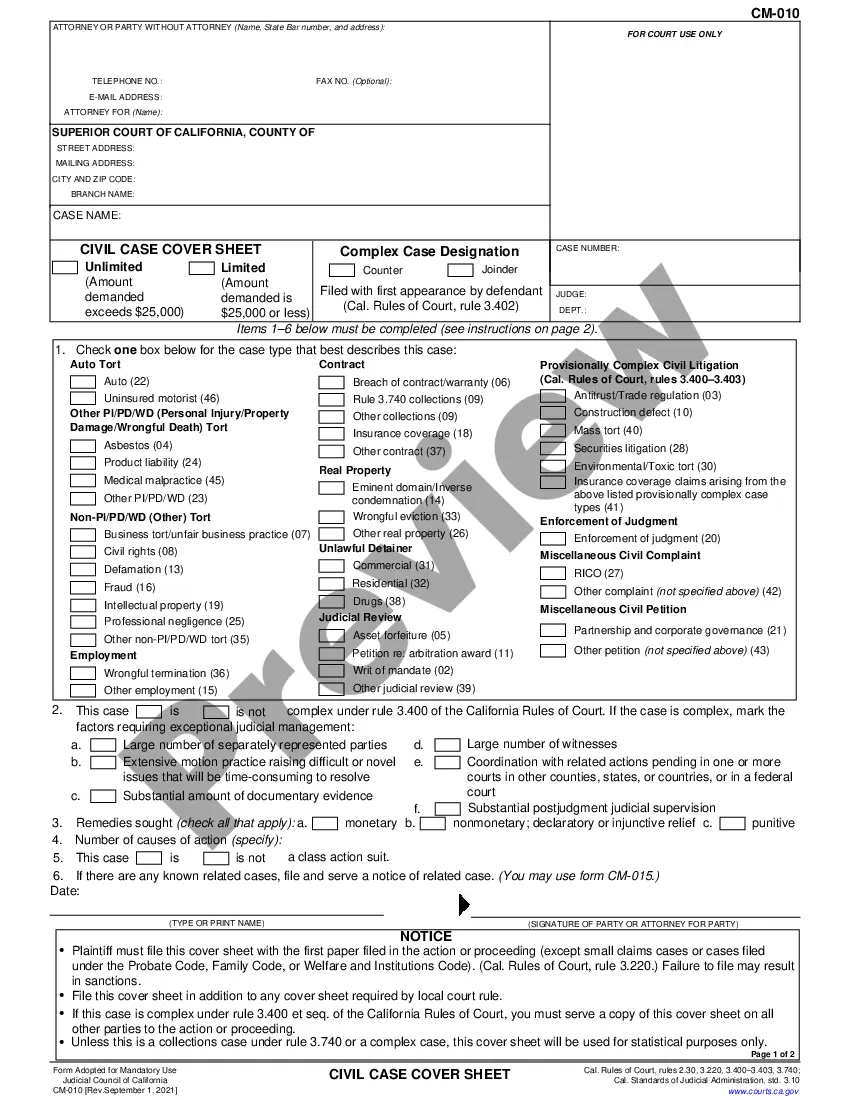

How much time does it typically take you to draw up a legal document? Because every state has its laws and regulations for every life sphere, finding a Kings Proposal to approve restricted stock plan suiting all regional requirements can be tiring, and ordering it from a professional lawyer is often costly. Numerous web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web catalog of templates, collected by states and areas of use. In addition to the Kings Proposal to approve restricted stock plan, here you can get any specific form to run your business or personal deeds, complying with your regional requirements. Professionals verify all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can pick the file in your profile at any time later on. Otherwise, if you are new to the platform, there will be some extra steps to complete before you get your Kings Proposal to approve restricted stock plan:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Kings Proposal to approve restricted stock plan.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!