Title: Phoenix, Arizona Proposal to Approve a Restricted Stock Plan Introduction: In the thriving city of Phoenix, Arizona, a proposal has been introduced to approve a restricted stock plan. This detailed description aims to shed light on the concept, benefits, and potential variations of such a plan. Several types of the Phoenix Arizona Proposal to approve restricted stock plan can include non-qualified stock options (Nests), incentive stock options (SOS), and restricted stock units (RSS). 1. Understanding the Restricted Stock Plan: A restricted stock plan refers to an incentive program designed by companies to offer their employees an opportunity to purchase or receive company stocks at a predetermined price within a specific time frame. 2. Key Features and Benefits of a Restricted Stock Plan in Phoenix, Arizona: — Retention of Key Employees: By offering restricted stock as an incentive, companies can motivate and retain talented individuals, leading to increased productivity and loyalty. — Alignment of Interests: With a vested interest in the company's success, employees may work harder towards achieving the organization's goals. — Potential Tax Advantages: Depending on the plan structure, employees may receive favorable tax treatment on their stock options or RSS. — Capital Accumulation: The opportunity to purchase company stock may enable employees to accumulate personal wealth while contributing to the company's growth. — Performance-driven Culture: Restricted stock plans promote a performance-driven work culture as employees strive to achieve specific goals and targets to unlock stock incentives. 3. Non-Qualified Stock Options (Nests): Nests are a type of stock option offered to employees at a predetermined exercise price, usually below the market value. Employees can exercise their options after a specified vesting period, converting them into shares of company stock. 4. Incentive Stock Options (SOS): SOS are another type of stock option granted to employees, often with tax advantages. To qualify for SOS, employees must meet certain criteria, such as working for the company for a specified period and holding the options for a specific duration after exercise. 5. Restricted Stock Units (RSS): RSS are a form of compensation where employees are awarded units that convert into company stock after a predetermined vesting period. Unlike stock options, RSU grants do not require the employee to purchase shares at a specific price. Conclusion: The proposal to approve a restricted stock plan in Phoenix, Arizona, provides an exciting opportunity for companies to incentivize and reward their workforce while aligning interests and fostering a performance-driven culture. By offering various types of stock options like Nests and SOS, as well as RSS, businesses can empower employees to share in the company's success while promoting long-term commitment and motivation.

Phoenix Arizona Proposal to approve restricted stock plan

Description

How to fill out Phoenix Arizona Proposal To Approve Restricted Stock Plan?

Whether you intend to start your company, enter into a contract, apply for your ID update, or resolve family-related legal issues, you need to prepare certain documentation meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any individual or business occurrence. All files are grouped by state and area of use, so picking a copy like Phoenix Proposal to approve restricted stock plan is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you several more steps to get the Phoenix Proposal to approve restricted stock plan. Follow the guidelines below:

- Make certain the sample fulfills your individual needs and state law regulations.

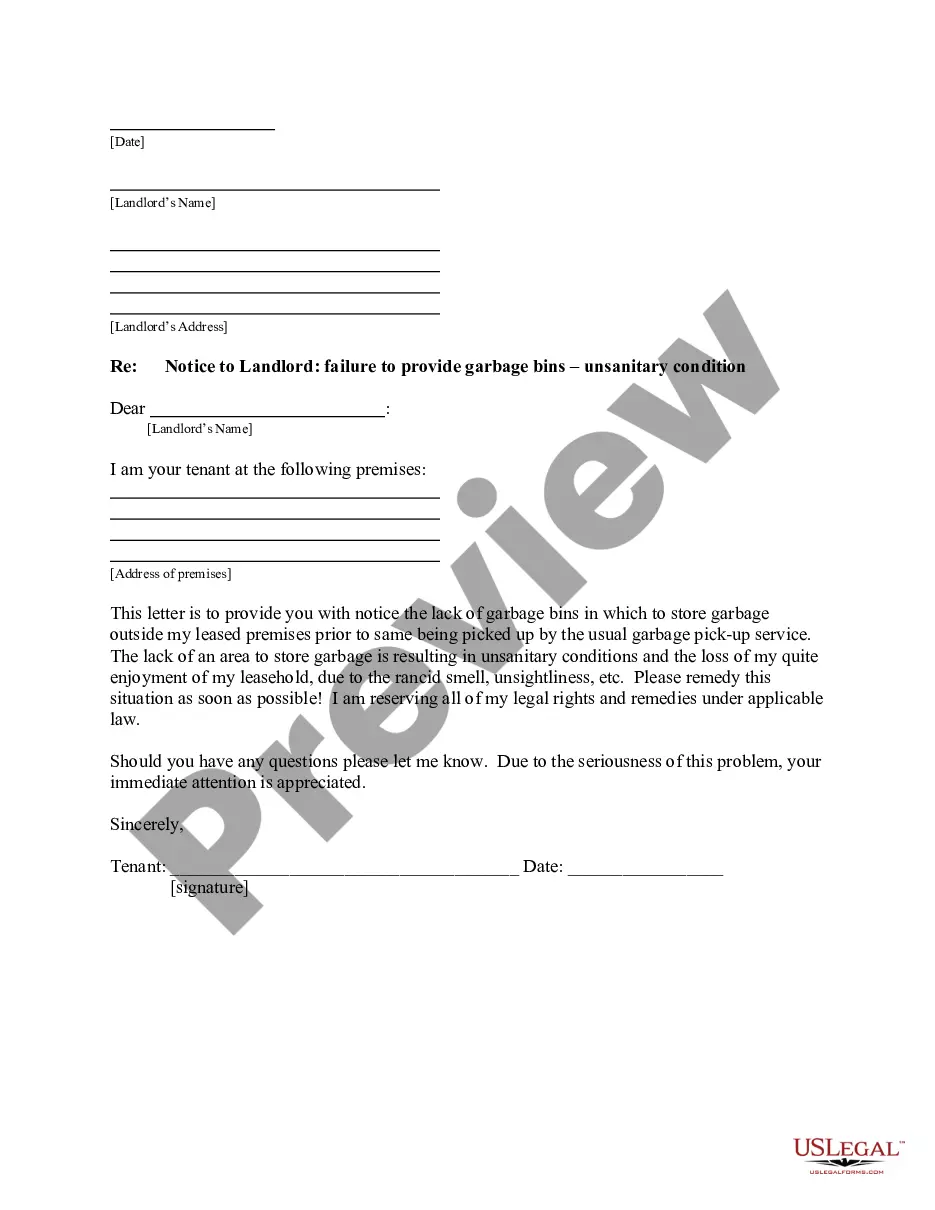

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to get the sample once you find the correct one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Phoenix Proposal to approve restricted stock plan in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you are able to access all of your earlier acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!