The Franklin Ohio Restricted Stock Plan is a specific type of employee benefit program offered by Guilford Mills, Inc., a well-established textile company based in Franklin, Ohio. This plan focuses on providing restricted stock grants to eligible employees as a means of incentivizing and retaining key talent within the organization. Below, we will delve into the details of the Franklin Ohio Restricted Stock Plan of Guilford Mills, Inc. Restricted Stock: The primary feature of this plan is the issuance of restricted stock to eligible employees. Unlike regular stocks, restricted stock grants come with specific conditions or restrictions on the shares, which must be met before full ownership rights are granted. These restrictions can include a vesting period, performance goals, or continued employment with the company. Employee Incentive: The Franklin Ohio Restricted Stock Plan serves as a powerful tool for Guilford Mills, Inc. to motivate and reward its employees for their contribution to the company's success. By granting eligible employees restricted stock, the company demonstrates its commitment to fostering long-term employee engagement and loyalty. Retention Strategy: With the presence of restricted stock grants, the plan serves as a valuable retention strategy for Guilford Mills, Inc. The program aims to retain top talent by ensuring that employees have a vested interest (both literally and figuratively) in the company's long-term performance. This creates a sense of ownership and fosters a deeper level of commitment among employees. Vesting Periods: Within the Franklin Ohio Restricted Stock Plan, there may be different vesting periods associated with the granted shares. For example, the company may structure the plan in a way that employees become eligible for ownership of a certain percentage of the restricted stock each year over a specified period, commonly known as a vesting schedule. This gradual vesting allows for employee retention and alignment with the company's long-term goals. Performance-based Goals: Additionally, the Franklin Ohio Restricted Stock Plan may incorporate performance-based goals for employees to meet for full ownership of the granted shares. These goals can be tied to individual, team, or company-wide achievements and serve as performance incentives to drive the growth and success of Guilford Mills, Inc. Franklin Ohio Restricted Stock Plan Variations: It is essential to note that the specific details and variations of the Franklin Ohio Restricted Stock Plan may differ from those mentioned above, as it is primarily defined by Guilford Mills, Inc. The varying terms and conditions associated with the plan ensure that it aligns with the company's unique objectives, culture, and legal obligations. In conclusion, the Franklin Ohio Restricted Stock Plan of Guilford Mills, Inc. is a strategic employee benefit program that offers restricted stock grants to eligible employees. It encourages employee loyalty, serves as a retention tool, and aligns employees with the company's long-term success.

Franklin Ohio Restricted Stock Plan of Guilford Mills, Inc.

Description

How to fill out Franklin Ohio Restricted Stock Plan Of Guilford Mills, Inc.?

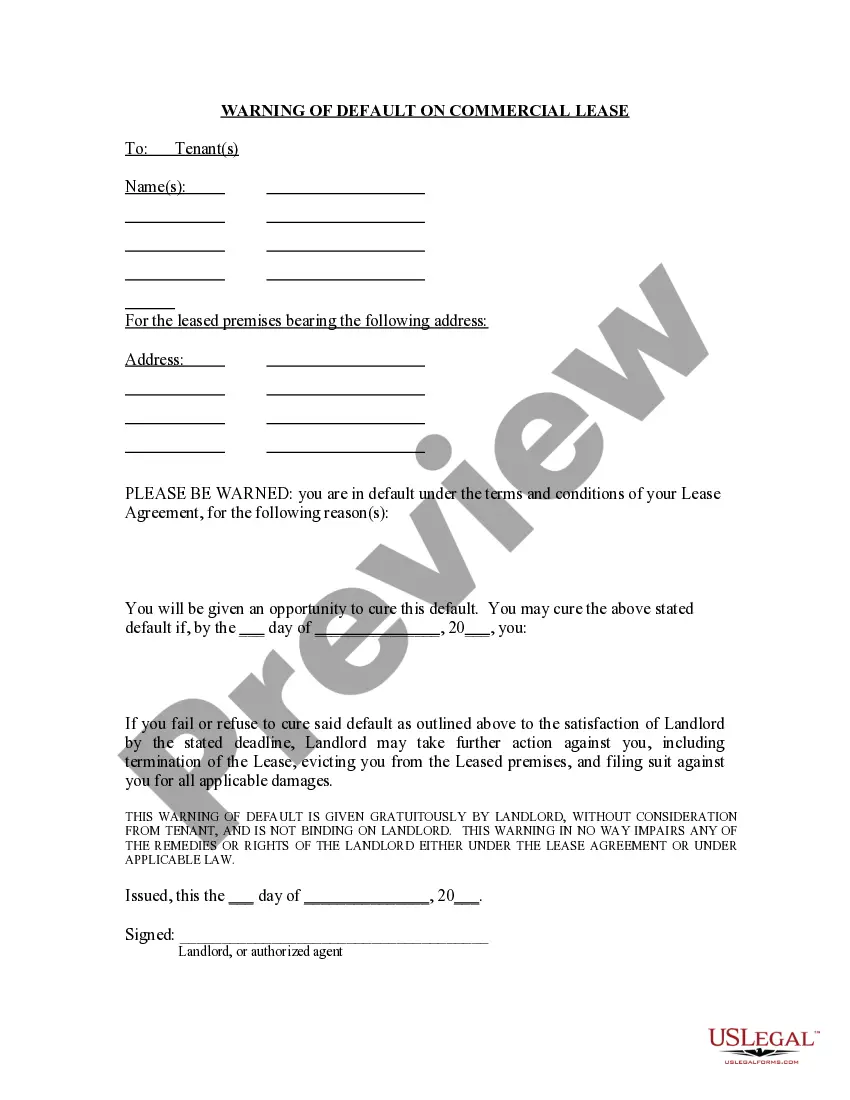

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to seek qualified assistance to create some of them from scratch, including Franklin Restricted Stock Plan of Guilford Mills, Inc., with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in various categories ranging from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching experience less overwhelming. You can also find detailed materials and tutorials on the website to make any tasks related to paperwork execution straightforward.

Here's how to purchase and download Franklin Restricted Stock Plan of Guilford Mills, Inc..

- Take a look at the document's preview and description (if provided) to get a general idea of what you’ll get after downloading the document.

- Ensure that the document of your choosing is adapted to your state/county/area since state regulations can affect the validity of some documents.

- Check the related document templates or start the search over to locate the appropriate file.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the option, then a suitable payment gateway, and purchase Franklin Restricted Stock Plan of Guilford Mills, Inc..

- Select to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Franklin Restricted Stock Plan of Guilford Mills, Inc., log in to your account, and download it. Needless to say, our platform can’t take the place of an attorney entirely. If you have to deal with an exceptionally complicated situation, we recommend getting an attorney to examine your form before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of customers. Become one of them today and get your state-specific paperwork with ease!