The Kings New York Restricted Stock Plan of Bandstand Corp., also known as the Kings NY RSP, is a comprehensive employee compensation program offered by Bandstand Corp. It provides eligible employees with an opportunity to acquire company shares at a reduced price or as part of their compensation package. Under the Kings NY RSP, eligible employees are granted restricted stock units (RSS) or stock options as a means of incentivizing their performance and aligning their interests with the company's long-term success. The RSS or stock options are subject to certain vesting conditions, usually tied to the employee's tenure or achievement of specific performance targets. The Kings NY RSP offers various types of restricted stock plans based on the employee's level within the organization and their role. Some different types of plans include: 1. Executive Restricted Stock Plan: This plan is designed specifically for high-ranking executives within Bandstand Corp. It provides them with a significant number of RSS or stock options, often as part of their executive compensation package. Executives usually have a longer vesting period and may have additional performance criteria tied to their RSS or stock options. 2. Employee Stock Purchase Plan (ESPN): This plan allows eligible employees to purchase company stock at a discounted price, usually through payroll deductions. The ESPN encourages broader employee ownership and aligns the interests of employees with the company's performance. 3. Performance-Based Restricted Stock Plan: This type of plan is focused on rewarding employees based on their individual or team performance. It may have additional vesting conditions tied to specific performance metrics, such as revenue growth, profitability, or achieving key strategic goals. 4. Equity Incentive Plan: The Equity Incentive Plan aims to attract and retain top talent by offering them RSS or stock options as a form of additional compensation. It may provide grants to employees at different levels within the organization, including mid-level managers and key individual contributors. The Kings NY RSP aims to foster a culture of ownership and teamwork within Bandstand Corp. By offering eligible employees the opportunity to become shareholders and benefit from the company's growth, it aligns their interests with the long-term success of the organization. The specific details, terms, and eligibility criteria of the various plans may vary and are subject to the company's policies and the individual's employment agreement.

Kings New York Restricted Stock Plan of Sundstrand Corp.

Description

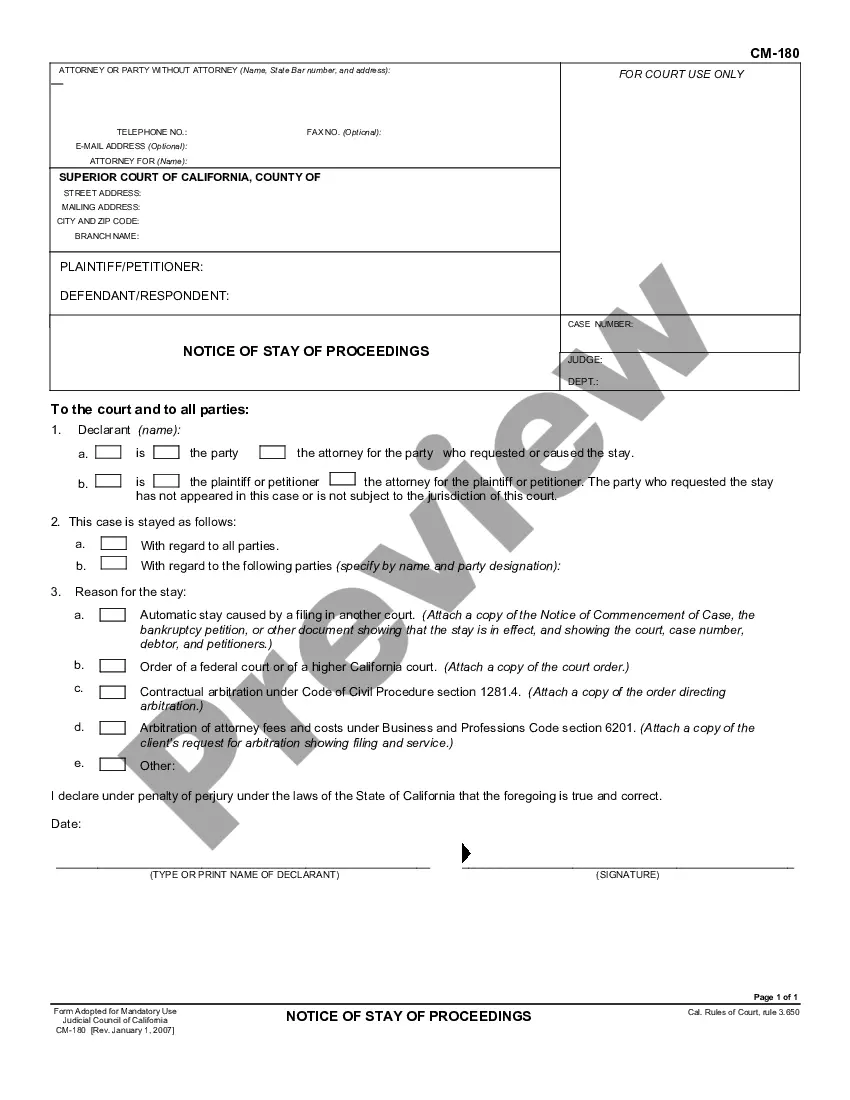

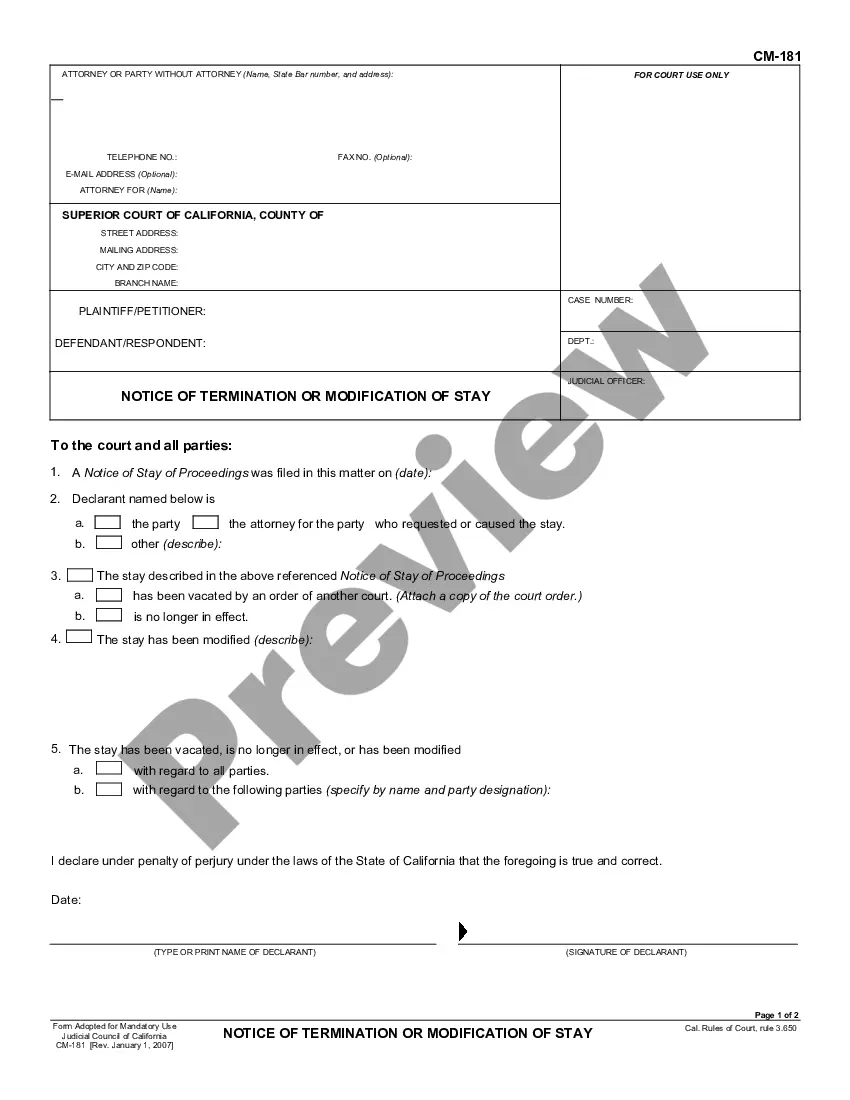

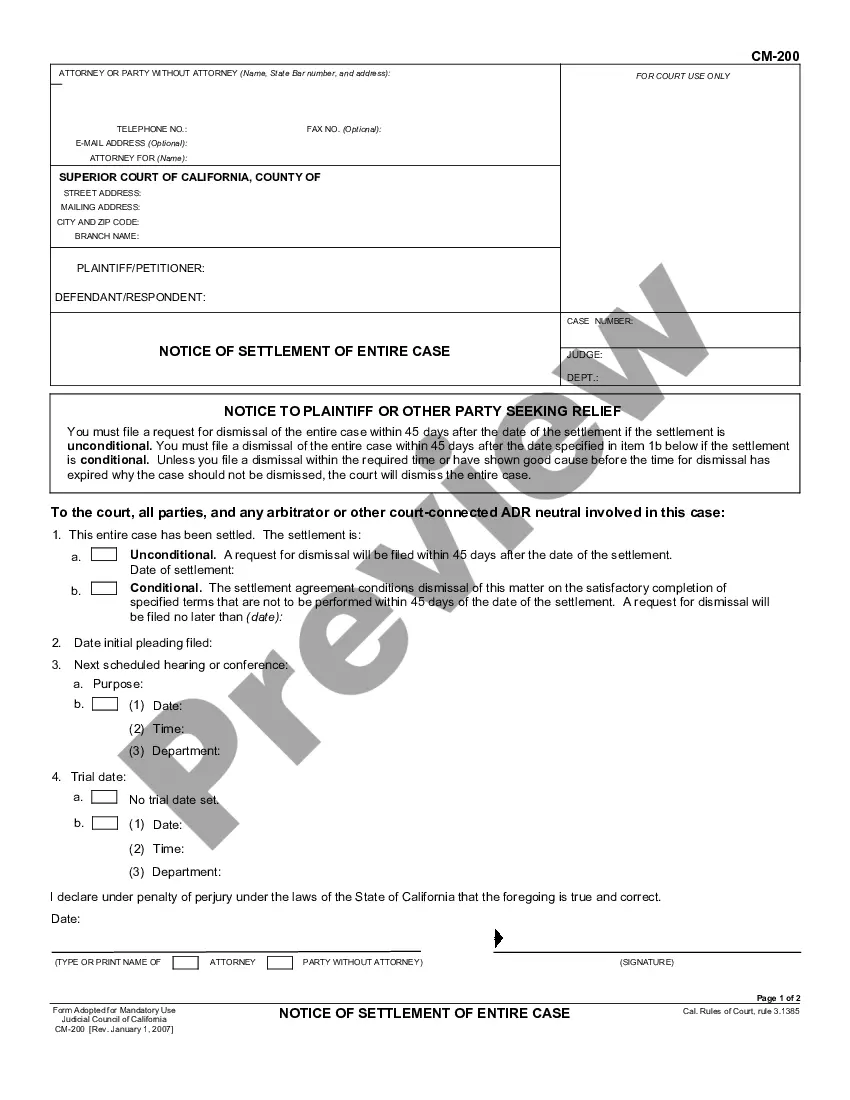

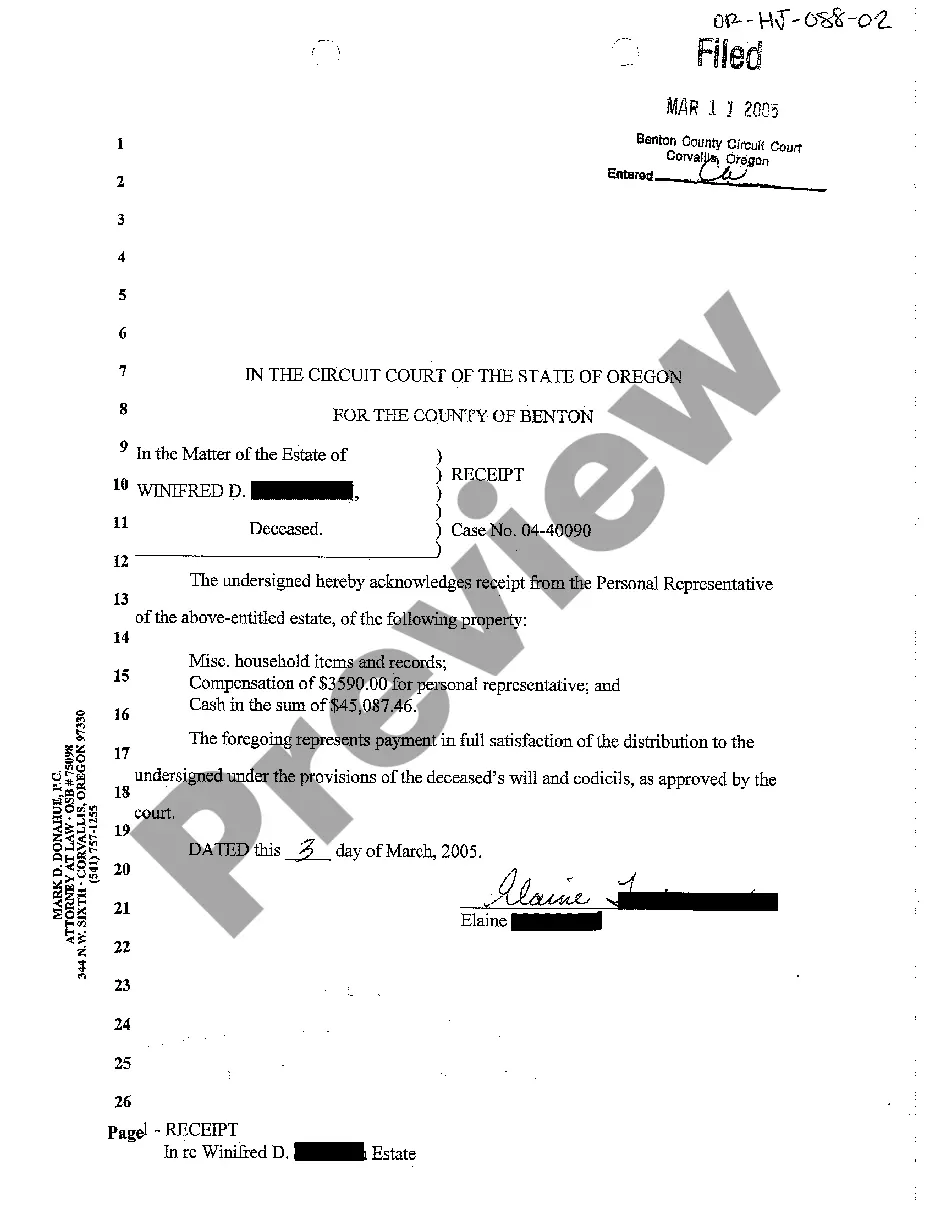

How to fill out Kings New York Restricted Stock Plan Of Sundstrand Corp.?

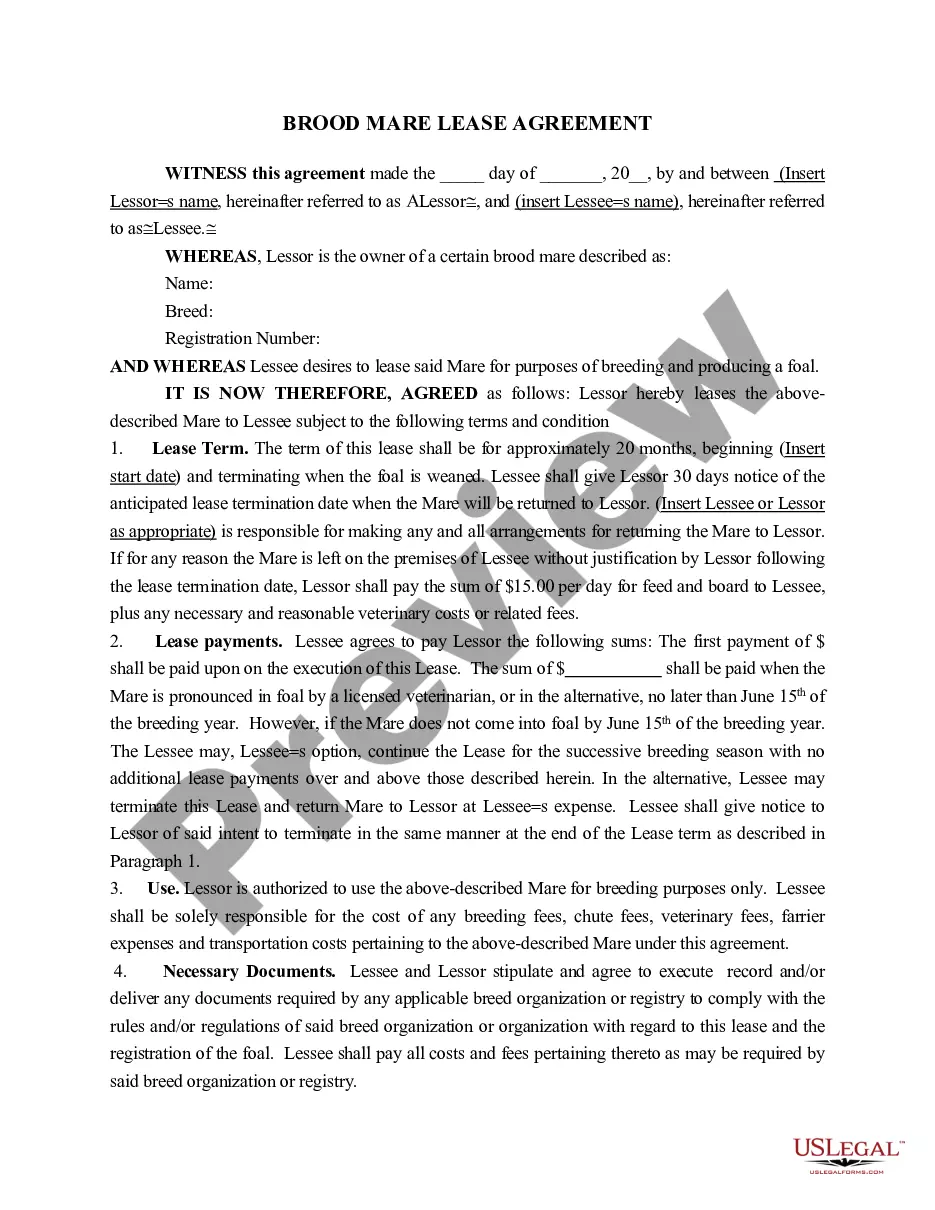

Preparing legal documentation can be burdensome. In addition, if you decide to ask a legal professional to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the Kings Restricted Stock Plan of Sundstrand Corp., it may cost you a fortune. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario collected all in one place. Therefore, if you need the current version of the Kings Restricted Stock Plan of Sundstrand Corp., you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Kings Restricted Stock Plan of Sundstrand Corp.:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the file format for your Kings Restricted Stock Plan of Sundstrand Corp. and save it.

When finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

Taxes are usually withheld on income from RSUs. Since RSUs amount to a form of compensation, they become part of your taxable income, and because RSU income is considered supplemental income, the withholding rate can vary from 22% to 37%.

The tax amounts, along with the value of your shares, are reported on your W-2. Form 1099-NEC. The information on your W-2 (or 1099-NEC) is used to fill out tax form 1040.

The value of RSUs is typically recorded in Box 14 of the W-2, which is labeled "Other." Box 14 doesn't have a standard list of codes, thus allowing employers to enter any description they like. You might see the value of your vested stock followed by "RSU."

When you receive an RSU, you don't have any immediate tax liability. You only have to pay taxes when your RSU vests and you receive an actual payout of stock shares. At that point, you have to report income based on the fair market value of the stock.

Here is how RSUs are taxed: RSUs are taxed as income to you when they vest. If you sell your shares immediately, there is no capital gain tax, and you only pay ordinary income taxes. If instead, the shares are held beyond the vesting date, any gain (or loss) is taxed as a capital gain (or loss).

Even though you do not purchase stock acquired from restricted stock/RSUs, your tax basis for reporting the stock sale on Form 8949 is the amount of compensation income recognized at vesting that appeared on your Form W-2. If you made a Section 83(b) election, the basis amount is the value at grant on your Form W-2.

When you receive an RSU, you don't have any immediate tax liability. You only have to pay taxes when your RSU vests and you receive an actual payout of stock shares. At that point, you have to report income based on the fair market value of the stock.

RSUs give employees interest in company stock but no tangible value until vesting is complete. The RSUs are assigned a fair market value (FMV) when they vest. They are considered income once vested, and a portion of the shares is withheld to pay income taxes.

Restricted stock units (RSUs) are a way your employer can grant you company shares. RSUs are nearly always worth something, even if the stock price drops dramatically. RSUs must vest before you can receive the underlying shares. Job termination usually stops vesting.