The Maricopa Arizona Restricted Stock Plan of Bandstand Corp. is an employee compensation program that offers eligible employees the opportunity to acquire company stock, subject to certain restrictions and conditions. This plan is designed to incentivize employees, align their interests with the long-term success of the company, and promote employee retention. Under this plan, eligible employees are granted restricted stock units (RSS) as part of their compensation package. RSS represents a promise to deliver a certain number of shares of company stock at a future date, usually after a vesting period. The vesting period is an important component of the plan, as it determines when employees gain ownership rights to the granted RSS. One key aspect of the Maricopa Arizona Restricted Stock Plan is the restriction on the transferability of the RSS. Typically, employees cannot sell, transfer, or pledge their RSS until they have vested. This restriction ensures that employees remain committed to the company's success, as they must wait until they have fulfilled the vesting requirements before realizing the full benefits of the RSS. Another notable feature of this plan is the eligibility criteria. Different types of employees may have different eligibility requirements to participate in the Maricopa Arizona Restricted Stock Plan. For instance, the plan may be available only to certain levels of employees, such as executives or managers, while excluding lower-ranking employees. The specific eligibility criteria can vary depending on the organization's policies and objectives. Additionally, the Maricopa Arizona Restricted Stock Plan may include provisions for accelerated vesting. In certain circumstances, such as a change of control, merger, acquisition, or the death or disability of the participant, the vesting restrictions on RSS may be relaxed or waived, allowing employees to receive the stock earlier than originally scheduled. These provisions are intended to provide flexibility while ensuring employee incentives and overall program effectiveness. Overall, the Maricopa Arizona Restricted Stock Plan of Bandstand Corp. is an effective tool for attracting and retaining talented employees. By offering the opportunity to acquire company stock, this plan motivates employees to work towards the company's success and fosters a sense of ownership and loyalty. By incorporating vesting periods and transfer restrictions, the plan reinforces the long-term commitment of employees and aligns their interests with the growth and profitability of the organization.

Maricopa Arizona Restricted Stock Plan of Sundstrand Corp.

Description

How to fill out Maricopa Arizona Restricted Stock Plan Of Sundstrand Corp.?

Preparing documents for the business or individual demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the specific region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to draft Maricopa Restricted Stock Plan of Sundstrand Corp. without professional assistance.

It's possible to avoid wasting money on attorneys drafting your paperwork and create a legally valid Maricopa Restricted Stock Plan of Sundstrand Corp. by yourself, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed document.

If you still don't have a subscription, adhere to the step-by-step guide below to get the Maricopa Restricted Stock Plan of Sundstrand Corp.:

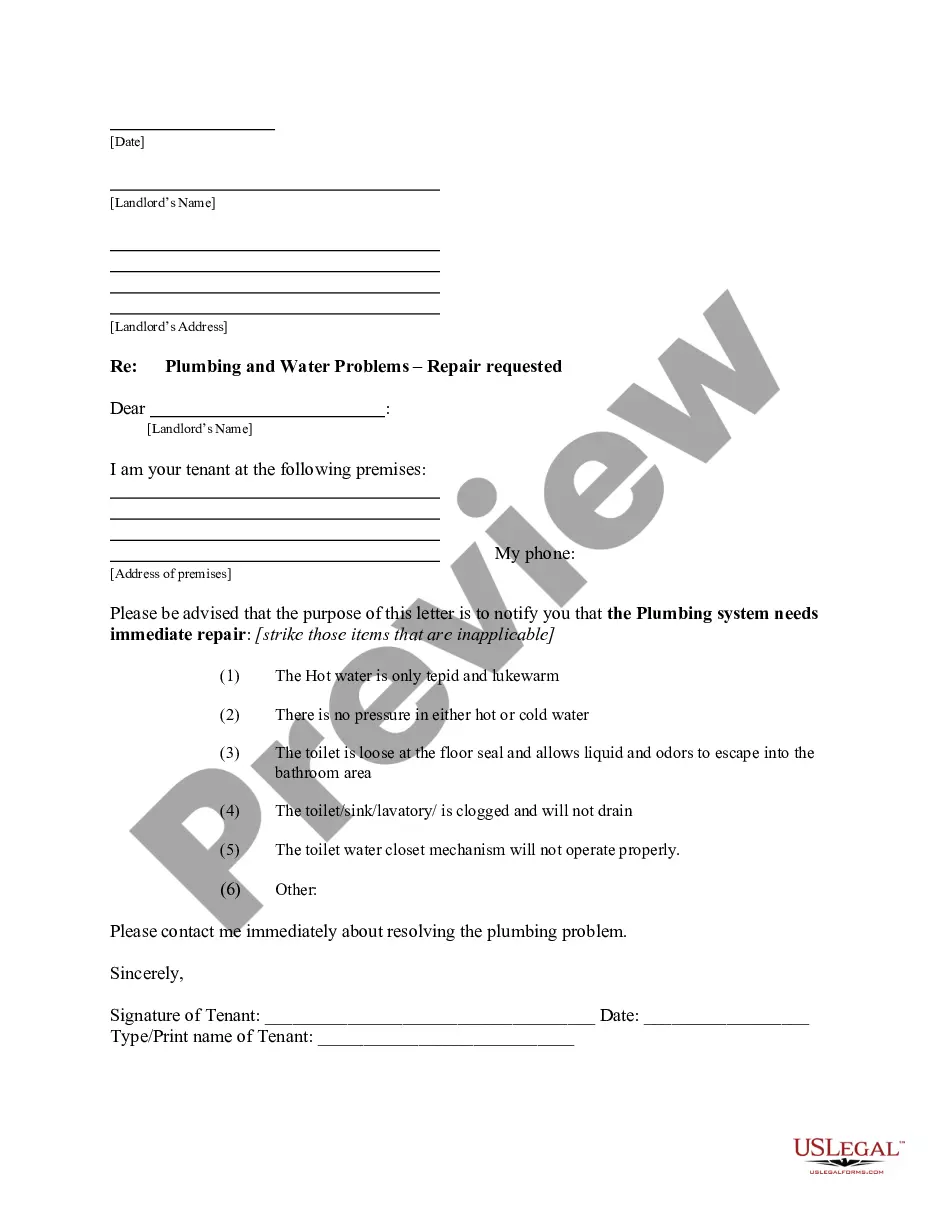

- Look through the page you've opened and verify if it has the sample you need.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that meets your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal forms for any situation with just a few clicks!