Philadelphia Pennsylvania Restricted Stock Plan of Bandstand Corp. is a comprehensive employee benefit program offered by Bandstand Corp., a prominent company based in Philadelphia, Pennsylvania. This plan is designed to reward and incentivize employees by granting them ownership in the company through restricted stock units (RSS). Under the Philadelphia Pennsylvania Restricted Stock Plan, employees receive a certain number of RSS as part of their compensation package. This RSS represents a specific number of shares of Bandstand Corp.'s stock, which are granted to the employees but remain restricted until certain conditions are fulfilled. These conditions typically include a specific vesting period, where the employee must stay with the company for a predetermined period before the RSS fully vest and become unrestricted. Once the RSS vest, the employees have the opportunity to convert them into actual shares of Bandstand Corp.'s common stock. This provides employees with a direct ownership stake in the company, aligning their interests with that of the shareholders. This ownership can also result in financial benefits if the company performs well and the stock value appreciates over time. The Philadelphia Pennsylvania Restricted Stock Plan has several variations to cater to different employee groups within Bandstand Corp. These variations may include the Executive Restricted Stock Plan, the Employee Stock Purchase Plan, and the Non-Qualified Restricted Stock Plan, among others. Each of these plans may have specific eligibility criteria and terms, which are tailored to meet the needs of the respective employee groups. The Executive Restricted Stock Plan is typically offered to top-level executives, providing them with a more significant number of RSS compared to other employees. This plan aims to attract and retain high-caliber executives, encouraging their long-term commitment and rewarding their performance. The Employee Stock Purchase Plan may allow eligible employees to purchase Bandstand Corp.'s common stock at a discounted price, further promoting employee ownership. This plan typically includes specific periods during which employees can enroll and contribute a portion of their salary towards purchasing the company's stock. The Non-Qualified Restricted Stock Plan is designed for select employees who may not meet the criteria for other restricted stock plans. This plan offers similar features and benefits but usually has more flexible requirements. Overall, the Philadelphia Pennsylvania Restricted Stock Plan of Bandstand Corp. stands as a valuable employee benefit program, motivating employees by offering an opportunity to become owners and providing potential financial rewards. It serves as a means to foster loyalty, improve retention rates, and align the interests of employees with the long-term success of the company.

Philadelphia Pennsylvania Restricted Stock Plan of Sundstrand Corp.

Description

How to fill out Philadelphia Pennsylvania Restricted Stock Plan Of Sundstrand Corp.?

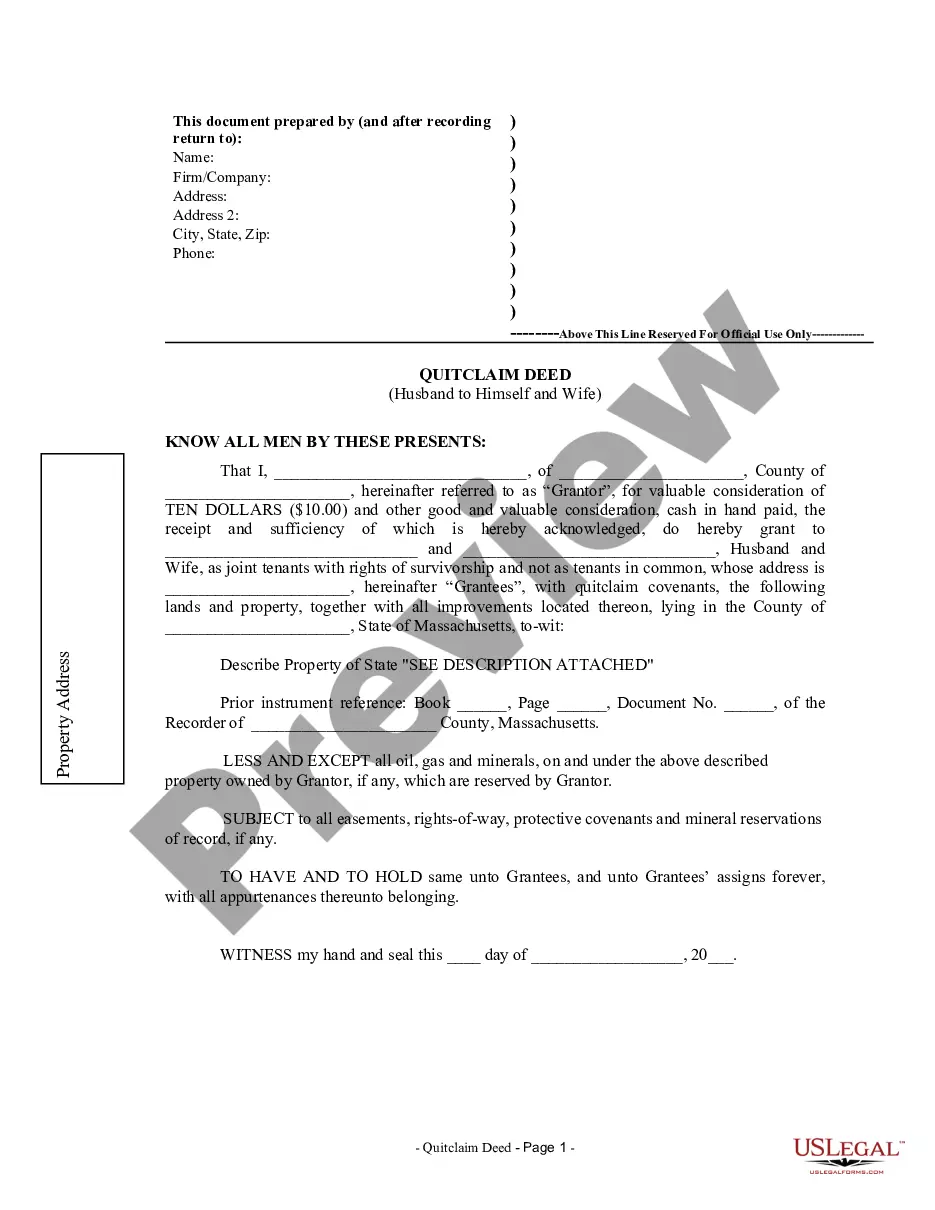

How much time does it usually take you to create a legal document? Considering that every state has its laws and regulations for every life scenario, finding a Philadelphia Restricted Stock Plan of Sundstrand Corp. meeting all regional requirements can be exhausting, and ordering it from a professional lawyer is often costly. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online catalog of templates, grouped by states and areas of use. Apart from the Philadelphia Restricted Stock Plan of Sundstrand Corp., here you can get any specific document to run your business or individual affairs, complying with your county requirements. Professionals check all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed sample, and download it. You can pick the file in your profile at any moment in the future. Otherwise, if you are new to the website, there will be a few more steps to complete before you get your Philadelphia Restricted Stock Plan of Sundstrand Corp.:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Philadelphia Restricted Stock Plan of Sundstrand Corp..

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

When your award is vested or distributed, your employer will withhold ordinary income and FICA2020 taxes. The tax amounts, along with the value of your shares, are reported on your W-2. Form 1099-NEC. The information on your W-2 (or 1099-NEC) is used to fill out tax form 1040.

When you receive an RSU, you don't have any immediate tax liability. You only have to pay taxes when your RSU vests and you receive an actual payout of stock shares. At that point, you have to report income based on the fair market value of the stock.

Here is how RSUs are taxed: RSUs are taxed as income to you when they vest. If you sell your shares immediately, there is no capital gain tax, and you only pay ordinary income taxes. If instead, the shares are held beyond the vesting date, any gain (or loss) is taxed as a capital gain (or loss).

With RSUs, you are taxed when the shares are delivered, which is almost always at vesting. Your taxable income is the market value of the shares at vesting. You have compensation income subject to federal and employment tax (Social Security and Medicare) and any state and local tax.

A Restricted Stock Plan is a common way to share stock with employees in public companies. The shareholder approved plan simply allows for the issuance of stock to selected employees. Unlike stock options, employees receive the full starting value of the shares.

If you're granted a restricted stock award, you have two choices: you can pay ordinary income tax on the award when it's granted and pay long-term capital gains taxes on the gain when you sell, or you can pay ordinary income tax on the whole amount when it vests.

Restricted Stock Unit Taxes: Looking at Your W-2 RSU income is reported in Box 14 Other on your W-2. It will likely list the total dollar amount followed by the acronym RSU. Any sell-to-cover withholdings will be combined with your regular withholdings in boxes 2, 4, and 6.

Taxation. With RSUs, you are taxed when the shares are delivered, which is almost always at vesting. Your taxable income is the market value of the shares at vesting. You have compensation income subject to federal and employment tax (Social Security and Medicare) and any state and local tax.

How Do I Enter Restricted Stock Unit (RSU) Sales in TurboTax? - YouTube YouTube Start of suggested clip End of suggested clip With your return open search for 1099-b. And select the jump 2 link have your 1099-b. And w2 handyMoreWith your return open search for 1099-b. And select the jump 2 link have your 1099-b. And w2 handy you'll need them for this section. When you enter your 1099b.

When you receive an RSU, you don't have any immediate tax liability. You only have to pay taxes when your RSU vests and you receive an actual payout of stock shares. At that point, you have to report income based on the fair market value of the stock.