The Dallas Texas Long Term Performance and Restricted Stock Incentive Plan of INALCOL Enterprises, Inc. is a comprehensive compensation program designed to attract and retain top talent within the organization. With the strategic use of long-term performance incentives and restricted stock options, this plan aims to align the interests of employees and shareholders towards the long-term success of the company. The plan includes various types of incentives specifically tailored to meet the diverse needs and expectations of employees. One such type is the Long Term Performance Incentive, which rewards employees based on the company's overall performance over a specified period. The performance goals are carefully established to drive growth, productivity, and profitability, ensuring a mutually beneficial relationship between the employees and the organization. Another type offered under this plan is the Restricted Stock Incentive. This type of incentive ensures that employees have a vested interest in the long-term success of the company by granting them shares of restricted stock. These shares are subject to certain vesting schedules and may be subject to specific conditions, such as continued employment or achieving predefined performance targets. By linking the value of these shares to the company's performance, employees are incentivized to actively contribute to achieving the company's goals. The Dallas Texas Long Term Performance and Restricted Stock Incentive Plan of INALCOL Enterprises, Inc. is designed to motivate employees to contribute their best efforts towards the company's long-term growth and success. By combining performance-based incentives with restricted stock options, the plan fosters a sense of ownership and accountability among employees. Key features of the plan include competitive performance targets, transparent performance measurement criteria, and clear communication channels to ensure that employees understand the purpose and potential benefits of participating in the program. Additionally, the plan may offer flexibility in structuring the incentives to accommodate the diverse needs of different employee groups or job levels within the organization. In summary, the Dallas Texas Long Term Performance and Restricted Stock Incentive Plan of INALCOL Enterprises, Inc. is a comprehensive compensation program that aligns the interests of employees and shareholders towards the long-term success of the organization. By incorporating various types of incentives, the plan motivates and rewards employees for their contributions to the company's performance and growth.

Dallas Texas Long Term Performance and Restricted Stock Incentive Plan of Ipalco Enterprises, Inc.

Description

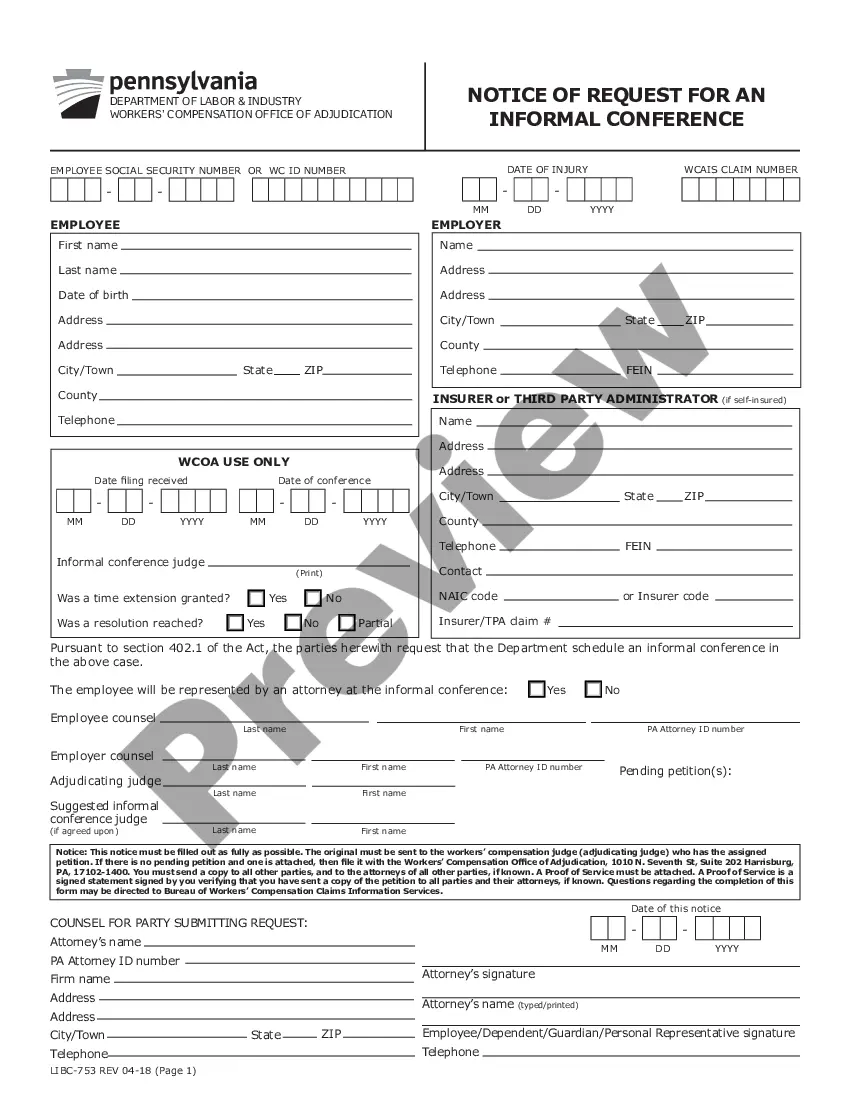

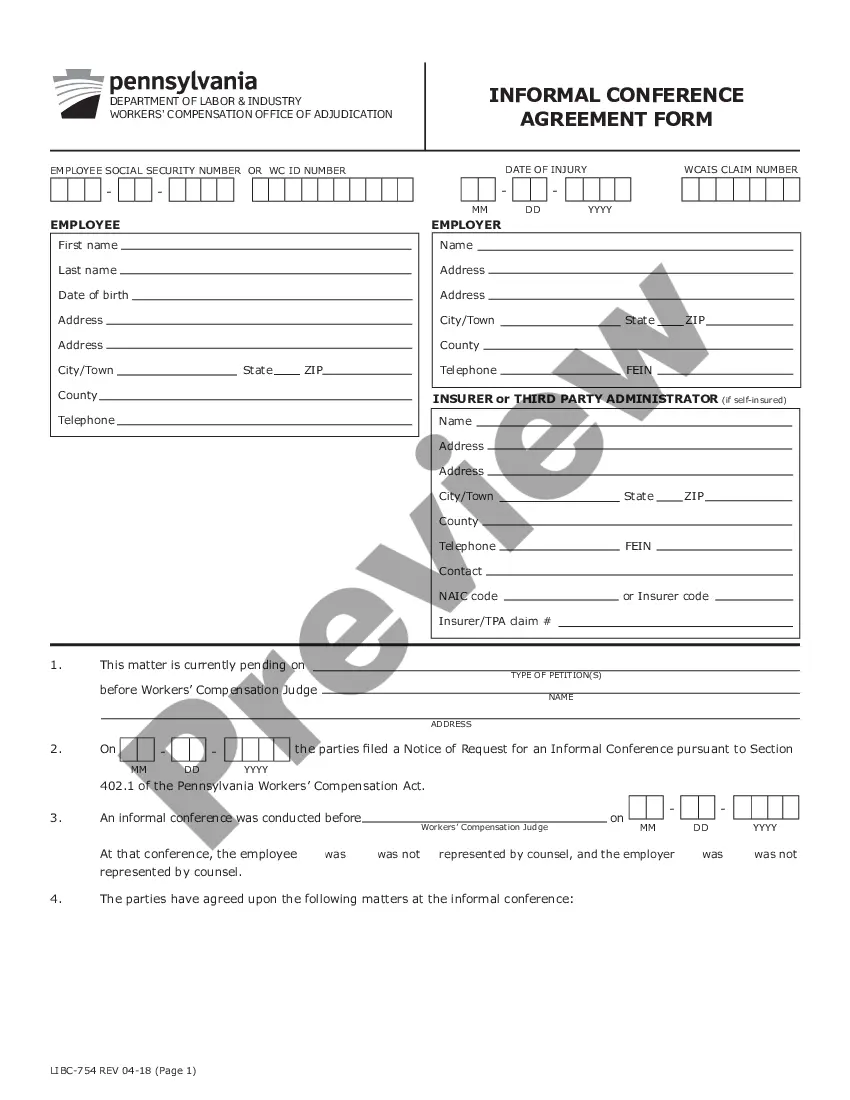

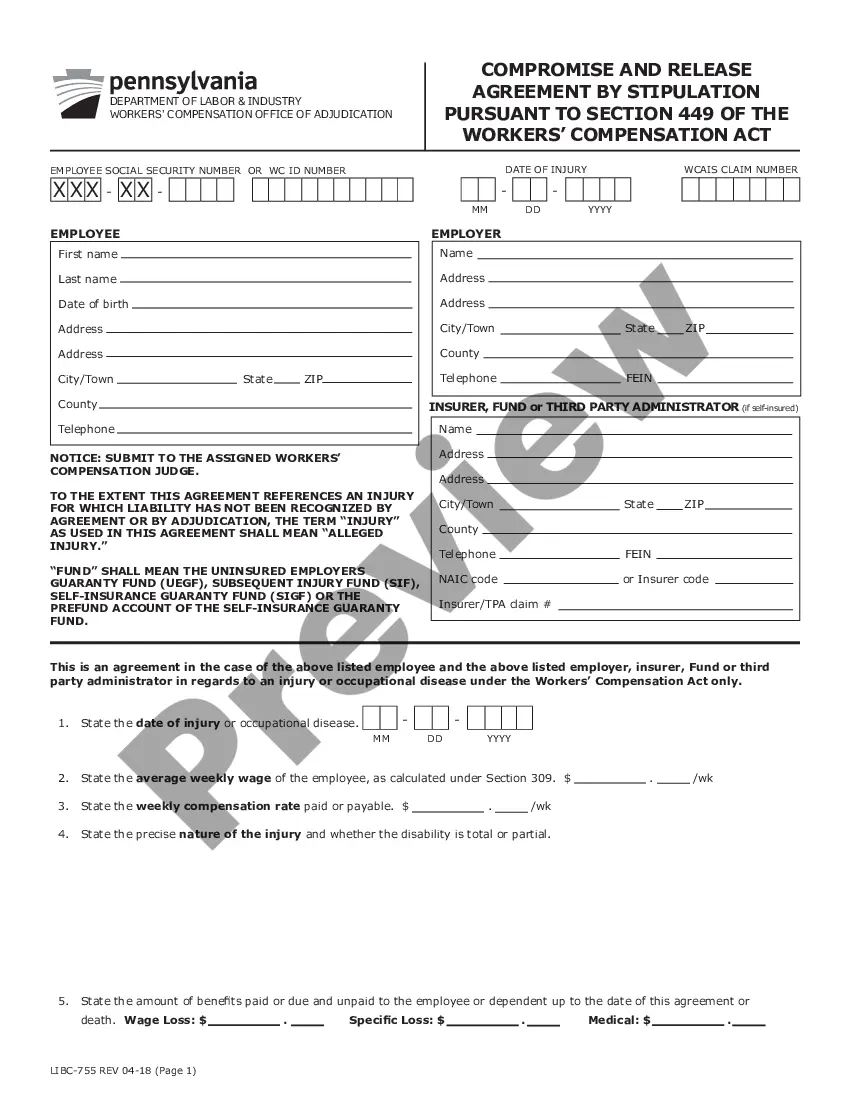

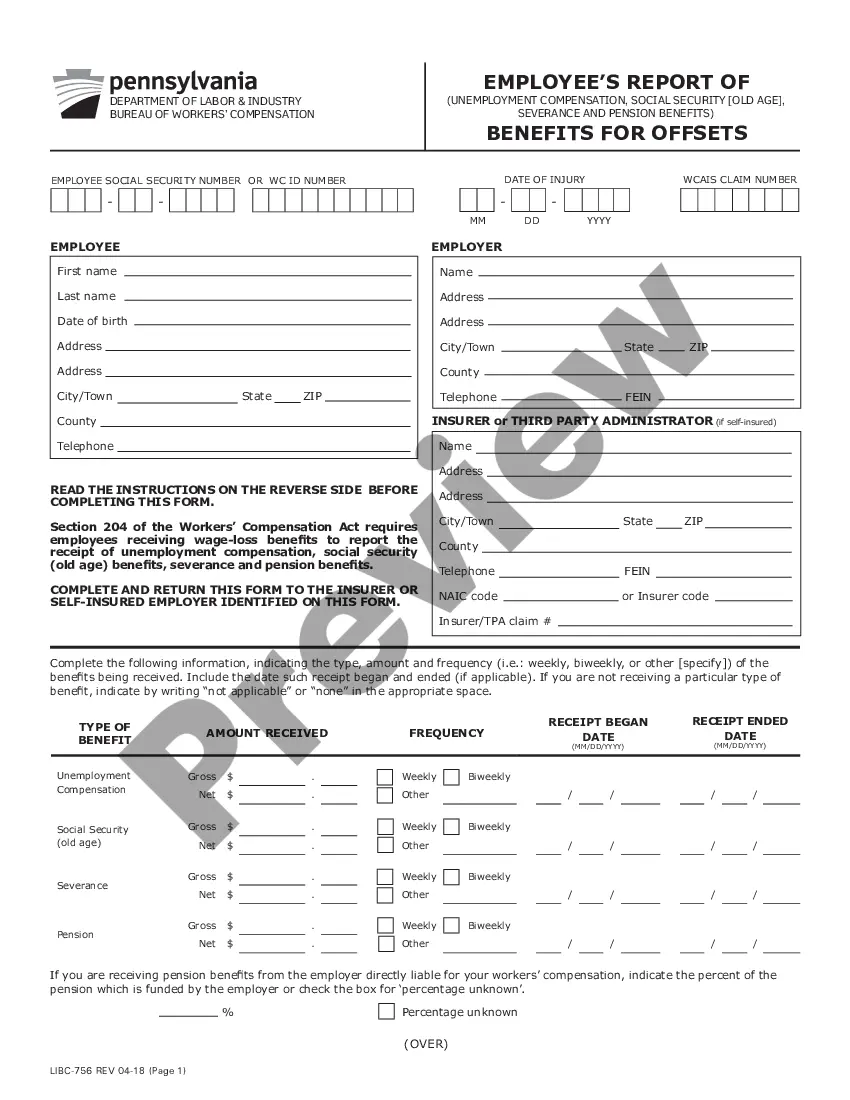

How to fill out Dallas Texas Long Term Performance And Restricted Stock Incentive Plan Of Ipalco Enterprises, Inc.?

Preparing documents for the business or individual demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state laws of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to create Dallas Long Term Performance and Restricted Stock Incentive Plan of Ipalco Enterprises, Inc. without professional assistance.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Dallas Long Term Performance and Restricted Stock Incentive Plan of Ipalco Enterprises, Inc. by yourself, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal templates that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required form.

If you still don't have a subscription, follow the step-by-step guide below to get the Dallas Long Term Performance and Restricted Stock Incentive Plan of Ipalco Enterprises, Inc.:

- Look through the page you've opened and check if it has the sample you require.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that meets your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any scenario with just a few clicks!

Form popularity

FAQ

A Restricted Stock Award is a grant of company stock in which the recipient's rights in the stock are restricted until the shares vest (or lapse in restrictions). The restricted period is called a vesting period. Vesting periods can be met by the passage of time, or by company or individual performance.

The advantages of restricted stock bonus/purchase plans are (1) the employee can make the §83(b) election; (2) the employee is generally entitled to capital gain treatment on sale of vested stock; and (3) the Company gets a wage deduction without paying cash wages.

You typically receive the shares after the vesting date. Only then do you have voting and dividend rights. Companies can and sometimes do pay dividend equivlent payouts for unvested RSUs.

Restricted stock units are a way an employer can grant company shares to employees. The grant is "restricted" because it is subject to a vesting schedule, which can be based on length of employment or on performance goals, and because it is governed by other limits on transfers or sales that your company can impose.

Restricted stock awards let you take advantage of a so-called "83(b) election," which allows you to report the stock award as ordinary income in the year it's granted and then start the capital gain holding period at that time (caution: if the stock fails to appreciate, you don't get a refund of the tax you paid when

Restricted stock units are issued to employees through a vesting plan and distribution schedule after they achieve required performance milestones or upon remaining with their employer for a particular length of time. RSUs give employees interest in company stock but no tangible value until vesting is complete.

RSUs are appealing because if the company performs well and the share price takes off, employees can receive a significant financial benefit. This can motivate employees to take ownership. Since employees need to satisfy vesting requirements, RSUs encourage them to stay for the long term and can improve retention.

Restricted stock units are issued to employees through a vesting plan and distribution schedule after they achieve required performance milestones or upon remaining with their employer for a particular length of time. RSUs give employees interest in company stock but no tangible value until vesting is complete.

RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. This is different from incentive stock options , which are taxed at the capital gains rate and tax liability is triggered when the options are exercised .

A Restricted Stock Plan is a common way to share stock with employees in public companies. The shareholder approved plan simply allows for the issuance of stock to selected employees. Unlike stock options, employees receive the full starting value of the shares.