Dallas, Texas, is known for being a forward-thinking city that is home to numerous successful businesses across various industries. In order to attract and retain talented individuals, many companies in Dallas have implemented an Approval of Company Stock Award Plan. This plan allows employees to receive company stock as a form of compensation, incentivizing their dedication and commitment to the organization. The Dallas Texas Approval of Company Stock Award Plan is structured to align the interests of employees with that of the company's shareholders. It offers a unique opportunity for employees to benefit from the long-term growth and success of the organization. By granting employees ownership in the form of company stock, it fosters a sense of ownership, motivation, and loyalty, ultimately leading to improved overall performance. There are different types of Dallas Texas Approval of Company Stock Award Plans that companies may implement, based on their specific goals and objectives. These may include: 1. Employee Stock Ownership Plans (Sops): Sops are retirement plans designed to provide employees with ownership in the company. Employees earn shares of company stock over time, often through contributions made by the company itself. This type of plan allows employees to accumulate wealth and participate in the company's success. 2. Restricted Stock Units (RSS): RSS are a common form of stock award plan where employees are granted shares of company stock which vest over a specific period of time. Once vested, employees gain ownership of the shares and have the option to sell or hold them. 3. Stock Options: Stock options provide employees the right to purchase company stock at a predetermined price, known as the strike or exercise price. These options usually have an expiration date, encouraging employees to remain with the company and contribute to its growth. 4. Performance Stock Units (Plus): Plus are stock awards that are granted based on the achievement of predetermined performance goals or targets. These goals may include revenue growth, market share expansion, or other key performance indicators. Eligible employees receive shares of company stock if the targets are met. In conclusion, the Dallas Texas Approval of Company Stock Award Plan is implemented by companies in Dallas to attract and retain talented employees. Through various types of stock-based incentives such as Sops, RSS, stock options, and Plus, employees are rewarded for their contributions and share in the company's growth. This approach creates an aligned interest between the employees and the shareholders, driving overall success and performance.

Dallas Texas Approval of Company Stock Award Plan

Description

How to fill out Dallas Texas Approval Of Company Stock Award Plan?

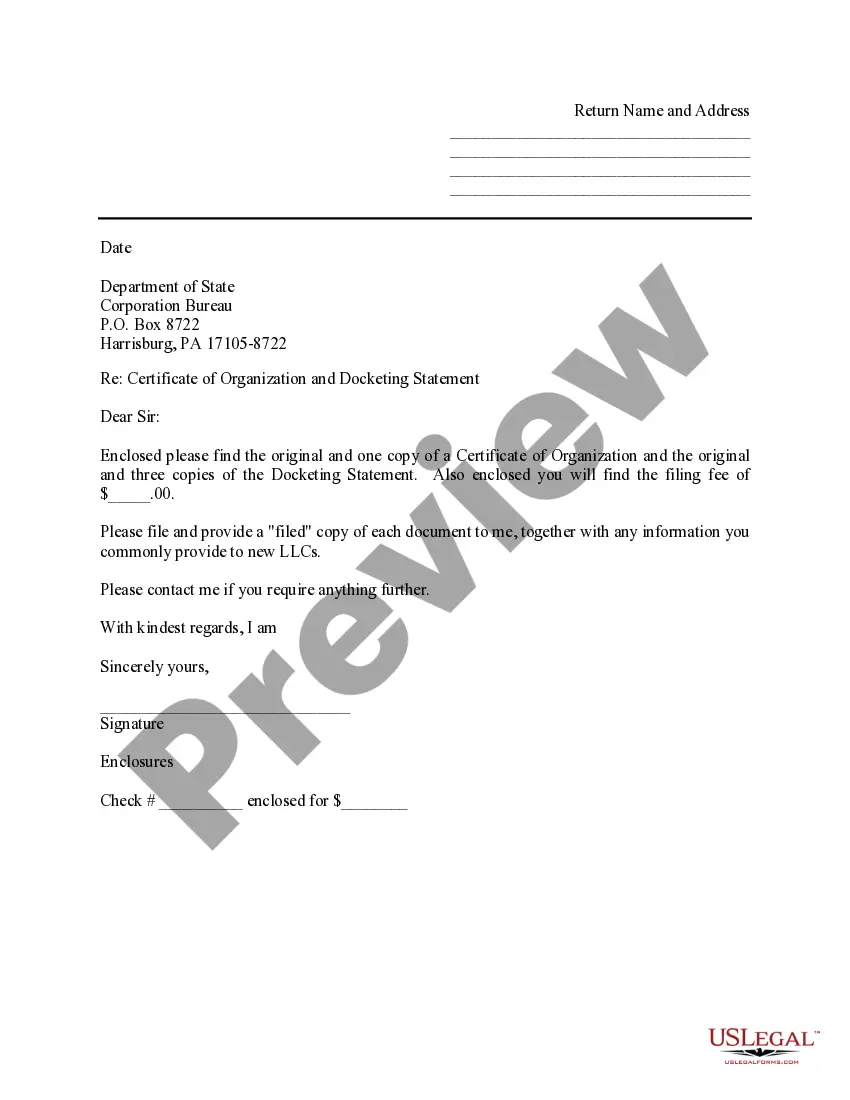

Do you need to quickly create a legally-binding Dallas Approval of Company Stock Award Plan or probably any other form to manage your own or corporate matters? You can select one of the two options: hire a legal advisor to write a legal document for you or create it completely on your own. Luckily, there's a third option - US Legal Forms. It will help you get professionally written legal paperwork without having to pay sky-high fees for legal services.

US Legal Forms provides a huge catalog of more than 85,000 state-specific form templates, including Dallas Approval of Company Stock Award Plan and form packages. We offer documents for a myriad of use cases: from divorce papers to real estate document templates. We've been out there for more than 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and get the necessary template without extra hassles.

- To start with, double-check if the Dallas Approval of Company Stock Award Plan is adapted to your state's or county's laws.

- In case the form includes a desciption, make sure to check what it's intended for.

- Start the searching process over if the template isn’t what you were seeking by utilizing the search box in the header.

- Select the subscription that best fits your needs and proceed to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Dallas Approval of Company Stock Award Plan template, and download it. To re-download the form, just go to the My Forms tab.

It's easy to find and download legal forms if you use our services. Additionally, the templates we offer are reviewed by law professionals, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Stock Award means any right to receive Common Stock granted under the Plan, including an Incentive Stock Option, a Nonstatutory Stock Option, a Restricted Stock Award, a Restricted Stock Unit Award, a Stock Appreciation Right, a Performance Stock Award or any Other Stock Award.

If you're granted a restricted stock award, you have two choices: you can pay ordinary income tax on the award when it's granted and pay long-term capital gains taxes on the gain when you sell, or you can pay ordinary income tax on the whole amount when it vests.

Stock compensation is a way corporations use stock or stock options to reward employees in lieu of cash. Stock compensation is often subject to a vesting period before it can be collected and sold by an employee.

With a stock award, you receive the company's stocks as compensation. Depending on the type of stock, you may have to wait for a certain period before you can fully own it. A stock option, on the other hand, only gives you the right to buy the company's stocks in the future at a certain price.

Related Definitions Stock Awards means any rights granted by the Company to Executive with respect to the common stock of the Company, including, without limitation, stock options, stock appreciation rights, restricted stock, stock bonuses and restricted stock units.

Overview of Three Types of ESOPs Nonleveraged ESOP. This first type of ESOP (Diagram 1) does not involve borrowed funds to acquire the sponsoring employer's stock.Leveraged Buyout ESOP.Issuance ESOP.

With a stock award, you receive the company's stocks as compensation. Depending on the type of stock, you may have to wait for a certain period before you can fully own it. A stock option, on the other hand, only gives you the right to buy the company's stocks in the future at a certain price.

A Restricted Stock Award Share is a grant of company stock in which the recipient's rights in the stock are restricted until the shares vest (or lapse in restrictions). The restricted period is called a vesting period.

ESOs are a form of equity compensation granted by companies to their employees and executives. Like a regular call option, an ESO gives the holder the right to purchase the underlying assetthe company's stockat a specified price for a finite period of time.