The Hennepin Minnesota Approval of Company Stock Award Plan is a comprehensive program established by companies operating within Hennepin County in Minnesota. This plan offers employees an opportunity to receive company stock awards as part of their compensation package. It serves as a tool for attracting, retaining, and motivating talented individuals, while aligning their interests with the long-term success of the company. Under the Hennepin Minnesota Approval of Company Stock Award Plan, employees are granted stock awards that represent ownership in the company. These awards can come in various forms, such as restricted stock units (RSS), stock options, or performance shares. The plan outlines the specific terms and conditions for receiving, vesting, and redeeming these stock awards. RSS are commonly included in the Hennepin Minnesota Approval of Company Stock Award Plan. These awards grant employees the right to receive a specified number of shares of company stock at a predetermined date in the future, usually after a vesting period. The employees do not have to purchase the shares but are restricted from selling or transferring them until they fully vest. Stock options are another type of stock award commonly found in the Hennepin Minnesota Approval of Company Stock Award Plan. These options provide employees with the right to purchase company stock at a predetermined price, known as the exercise price or strike price. Once the stock options vest, employees can exercise the options by purchasing the stock at the exercise price and potentially realizing a profit when selling the stock at a higher market price. Performance shares are a more performance-based type of stock award. Under this category, employees receive shares of the company's stock based on achieving specific performance goals or targets. The Hennepin Minnesota Approval of Company Stock Award Plan defines the metrics used to determine the allocation of these shares and the conditions under which they can be redeemed. To participate in the Hennepin Minnesota Approval of Company Stock Award Plan, employees must meet certain eligibility requirements set by the company. These criteria may include a minimum length of service, full-time employment, or other performance-related qualifications. Overall, the Hennepin Minnesota Approval of Company Stock Award Plan serves as an effective tool for companies operating within Hennepin County, Minnesota, to incentivize and reward their employees with ownership in the company. By offering various types of stock awards, such as RSS, stock options, and performance shares, companies can align employee interests with corporate success, fostering a motivated and dedicated workforce.

Hennepin Minnesota Approval of Company Stock Award Plan

Description

How to fill out Hennepin Minnesota Approval Of Company Stock Award Plan?

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Hennepin Approval of Company Stock Award Plan, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for various life and business scenarios. All the documents can be used many times: once you pick a sample, it remains accessible in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Hennepin Approval of Company Stock Award Plan from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Hennepin Approval of Company Stock Award Plan:

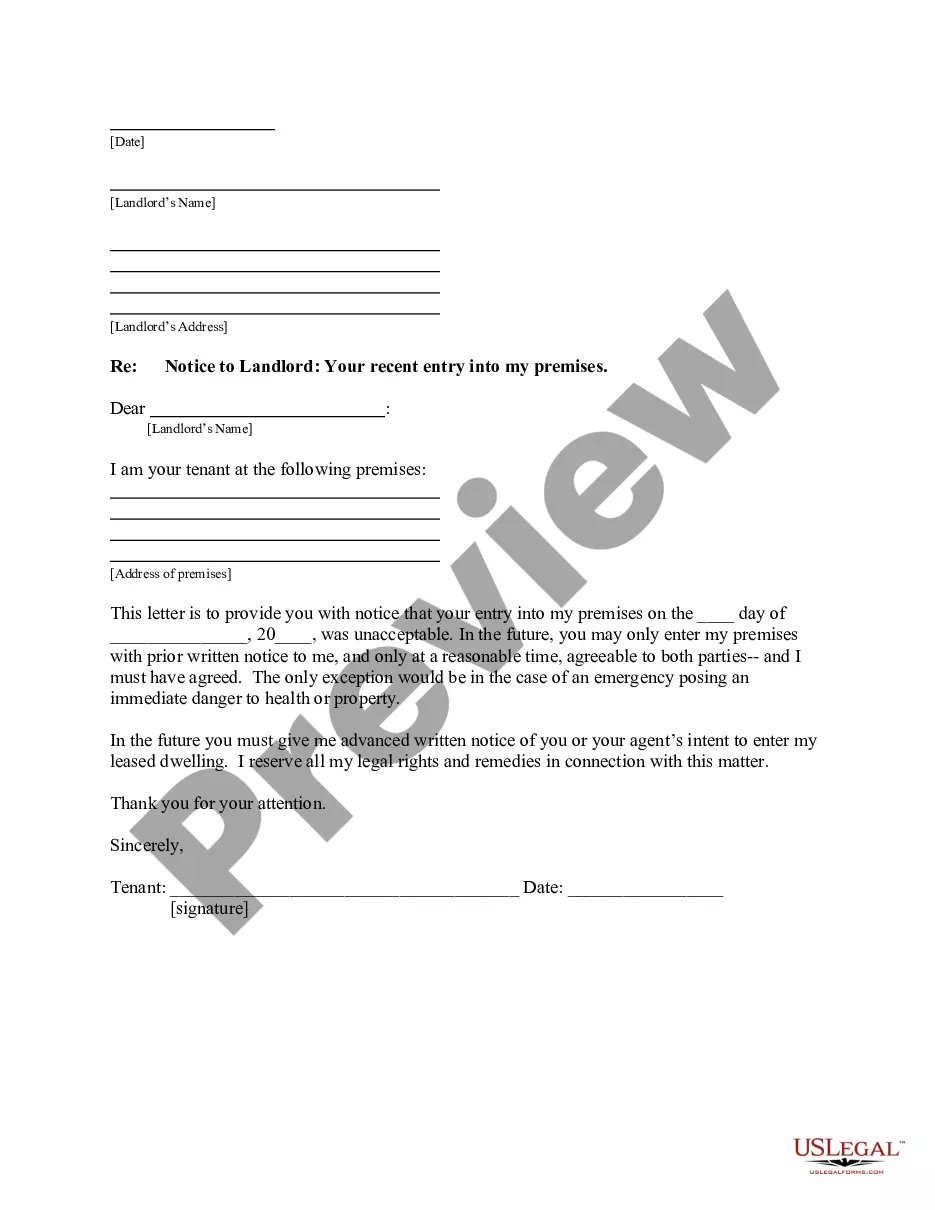

- Analyze the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the template once you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

A performance award is a grant of company shares or units in which the recipient's rights in the shares or units are contingent on the achievement of pre-established performance goals, and restricted until the end of a set performance period.

What are the income tax implications of a performance award? A. Under normal federal income tax rules, an employee receiving a performance award is not taxed at the time of the grant. Instead, the employee is taxed at vesting, unless the plan allows for the employee to defer receipt of the cash or shares.

A performance award is typically a grant of company shares or units in which the recipient's rights in the shares or units are contingent on the achievement of pre-established performance goals. Details of performance awards vary vastly based on company-defined rules.

The taxation of RSUs is a bit simpler than for standard restricted stock plans. Because there is no actual stock issued at grant, no Section 83(b) election is permitted.

A Performance Share Unit (a PSU) is equal in value to one share of common stock of the Corporation (Common Stock). PSUs are generally convertible into shares of Common Stock if and to the extent the associated pre-established performance targets are achieved (see Vesting below).

Like a Restricted Stock Award, a Restricted Stock Unit is a grant valued in terms of company stock. Unlike a Restricted Stock Award, no company stock is issued at the time of a Restricted Stock Unit grant, and therefore no Special Tax 83(b) Elections can be made at grant.

Performance shares are not issued up front and are usually part of a long-term performance or incentive plan (LTIP). You earn the payout in shares by meeting targets that are either absolute or relative to the performance of your company's peers.

Once your grant has vested and your company has released the shares to you, you can sell them at your discretion (outside of any company-imposed trading restrictions or blackout periods) or hold the shares as part of your portfolio.

Performance Stock Award (PSA) A company's award of a targeted number of shares of stock to an employee, which are held in escrow and cannot be sold until vested. The actual number of shares given will vary based on performance as measured against defined goals.