The King Washington Stock Bonus Plan of First West Chester Corp. is a unique and enticing employee benefit program aimed at rewarding and motivating employees by offering them the opportunity to own company stock. This comprehensive plan aims to establish a sense of ownership and loyalty amongst employees, aligning their interests with that of the company. Let's explore the various facets and types of the plan in more detail: 1. King Washington Stock Bonus Plan: The cornerstone of the King Washington Stock Bonus Plan is its provision that offers eligible employees the chance to receive a bonus in the form of company stock. This plan not only recognizes the hard work and dedication of employees but also serves as an excellent way to promote long-term commitment and personal investment in the success of First West Chester Corp. By becoming shareholders, employees gain a vested interest in the company's financial growth and prosperity. 2. Vesting Schedule: The King Washington Stock Bonus Plan implements a vesting schedule to ensure employee engagement and retention. Depending on the specifics of the plan, employees may need to remain with the company for a certain period, usually a few years, to fully realize the benefits of the stock bonus. This approach encourages longevity and discourages job hopping, enhancing stability within the workforce. 3. Differentiated Stock Bonus Plans: First West Chester Corp. may offer different variations of the King Washington Stock Bonus Plan to cater to the diverse needs and goals of its employees. For example, the company might provide options like the Performance-based Stock Bonus Plan or the Long-Term Incentive Stock Plan. These customized plans allow employees to align their rewards with their individual preferences or performance metrics. 4. Tax Advantages and Options: The King Washington Stock Bonus Plan may offer certain tax advantages for both the company and the employees. Employers can potentially deduct the cost of granting stock bonuses, whereas employees may be able to defer taxes on the stock bonus until a later date or take advantage of capital gains tax rates if they hold the stock for a specified period. These tax considerations make the plan even more advantageous for both parties involved. 5. Flexibility in Stock Acquisition: In addition to receiving stock bonuses, the King Washington Stock Bonus Plan may provide flexibility in how employees acquire their company shares. For instance, employees may have the option to purchase additional stock at a discounted rate, allowing them to further increase their ownership stake. This added flexibility empowers employees to enhance their financial position while further solidifying their commitment to the success of First West Chester Corp. Overall, the King Washington Stock Bonus Plan of First West Chester Corp. brings forth a comprehensive and enticing employee benefit program. By offering employees the opportunity to own company stock, the plan fosters a culture of ownership, dedication, and shared success. The various types and aspects of the plan provide flexibility, tailored rewards, and potential tax advantages, making it an attractive proposition for employees and the organization alike.

King Washington Stock Bonus Plan of First West Chester Corp.

Description

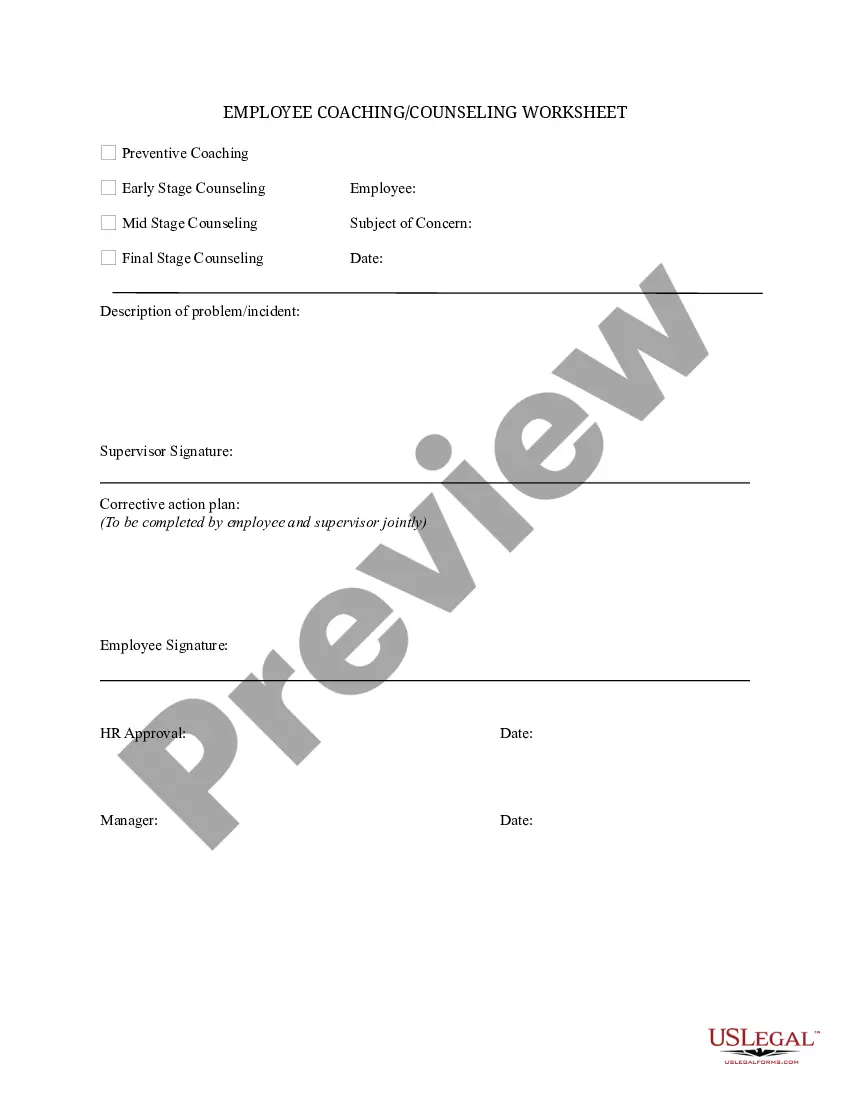

How to fill out King Washington Stock Bonus Plan Of First West Chester Corp.?

How much time does it normally take you to draft a legal document? Since every state has its laws and regulations for every life situation, finding a King Stock Bonus Plan of First West Chester Corp. meeting all local requirements can be tiring, and ordering it from a professional attorney is often costly. Many web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, grouped by states and areas of use. In addition to the King Stock Bonus Plan of First West Chester Corp., here you can find any specific document to run your business or personal affairs, complying with your county requirements. Experts verify all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can pick the file in your profile at any time later on. Otherwise, if you are new to the website, there will be a few more actions to complete before you get your King Stock Bonus Plan of First West Chester Corp.:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the King Stock Bonus Plan of First West Chester Corp..

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

Contributions to a stock bonus plan are discretionary, but they must be substantial and recurring. Further, stock bonus plans cannot discriminate toward highly compensated employees, such as executives. Annual contributions to a stock bonus plan are limited to 25% of each employee's total compensation.

One of the major benefits of a cash bonus, as opposed to a stock bonus, is the avoidance of stock market risk that you incur when being compensated with company stock. This risk is also compounded if you already own a concentrated equity position of your employer's stock.

A stock bonus plan is an incentive plan under which employees are compensated with shares of their employer's stock.

The advantage of incentive stock options is the favorable tax treatment for employees (generally employees' favorite variety of equity compensation). The disadvantages are the statutory requirements (quite constrictive) and the lack of any deduction for the Company.

If you're granted a restricted stock award, you have two choices: you can pay ordinary income tax on the award when it's granted and pay long-term capital gains taxes on the gain when you sell, or you can pay ordinary income tax on the whole amount when it vests.

Participants in a stock bonus plan receive pass-through voting rights for their shares and have the option to sell their shares to the employer, just like they would if they held a put option on the open market. An Employee Stock Ownership Plan (ESOP) is a similar type of plan, but isn't exactly the same thing.

A stock bonus plan is a defined-contribution profit sharing plan, to which employers contribute company stock. These are considered to be qualified retirement plans, and as such, they're governed by the Employee Retirement Income Security Act (ERISA).

Whereas a stock bonus plan is not required to invest in employer securities, an ESOP must invest primarily in employer securities, to the extent that employer stock is available. The employer can contribute company stock directly to the plan.