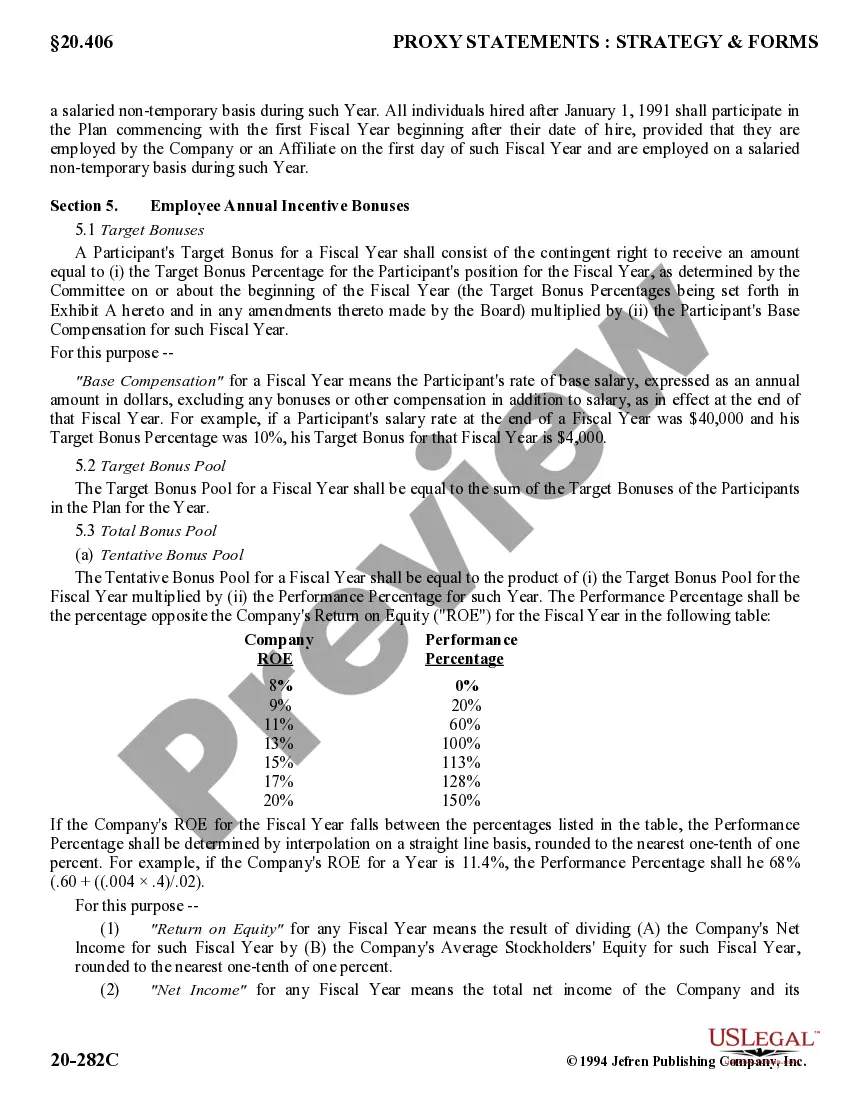

The Collin Texas Restated Employee Annual Incentive Bonus Plan is a comprehensive program designed to reward and motivate employees in Collin, Texas. This plan includes various attachments that outline the specific details and guidelines for eligibility, calculation, and distribution of annual incentive bonuses to employees. Under this plan, employees have the opportunity to earn an additional monetary reward based on their performance, contributions, and meeting predefined targets. It aims to recognize and encourage exceptional work, foster employee engagement, and align individual goals with the overall success of the organization. The plan's attachments comprise essential information to help employees and employers understand the mechanics and objectives of the bonus program. These attachments may include: 1. Eligibility Criteria: This attachment specifies the employees who are eligible to participate in the annual incentive bonus plan. It outlines the necessary employment conditions and tenure required for qualification, ensuring fairness and clarity in determining recipients. 2. Performance Measurement Metrics: This attachment lays out the specific performance indicators or metrics against which employees' performance is evaluated. These can include factors such as sales target achievement, cost reduction, customer satisfaction ratings, productivity, or any other relevant key performance indicators (KPIs). Clear benchmarks help establish fair standards for evaluating employees' contributions. 3. Bonus Calculation Formula: This attachment provides a detailed formula for calculating the annual incentive bonus for eligible employees. It may consider factors like the employee's base salary, performance ratings, and achievement of predetermined goals. The formula ensures transparency and consistency in determining bonus amounts across the organization. 4. Bonus Pool Allocation: If the Collin Texas Restated Employee Annual Incentive Bonus Plan includes a shared bonus pool, an attachment may outline how the pool is funded and allocated among eligible employees. The attachment may detail the proportions or percentages allocated to different departments, teams, or individuals based on their contributions or predetermined allocations. 5. Payment Schedule and Conditions: This attachment specifies the timing and conditions for distributing annual incentive bonuses. It may outline whether bonuses are paid out in a lump sum or structured over several installments. Additionally, it may clarify any prerequisites, such as employment status or staying within the company until a specific date, to qualify for the bonus payment. It is important to note that the above attachments are common components, but the specific types of Collin Texas Restated Employee Annual Incentive Bonus Plans with attachments may vary across organizations based on their respective policies and requirements. It is advisable to review the particular plan documents thoroughly to understand the intricacies and provisions applicable to a specific company's program.

Collin Texas Restated Employee Annual Incentive Bonus Plan with attachments

Description

How to fill out Collin Texas Restated Employee Annual Incentive Bonus Plan With Attachments?

Laws and regulations in every sphere vary from state to state. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Collin Restated Employee Annual Incentive Bonus Plan with attachments, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the forms can be used multiple times: once you pick a sample, it remains available in your profile for further use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Collin Restated Employee Annual Incentive Bonus Plan with attachments from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Collin Restated Employee Annual Incentive Bonus Plan with attachments:

- Take a look at the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template once you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!