The Contra Costa California Supplemental Retirement Plan is a retirement savings program specifically designed for employees of Contra Costa County, California. This plan serves as a valuable complement to the traditional pension plan and Social Security, aiming to provide additional financial security during retirement. The Contra Costa California Supplemental Retirement Plan offers several options to meet the diverse needs and preferences of participants. One type of Contra Costa California Supplemental Retirement Plan is the 457(b) Deferred Compensation Plan. This plan allows employees to contribute a portion of their pre-tax income to a retirement account, providing immediate tax benefits. The contributions are invested in various investment options, including mutual funds and annuities, allowing participants to potentially grow their savings over time. Another type of plan offered is the Roth 457(b) Plan. This plan allows employees to contribute a portion of their after-tax income to a retirement account. Unlike the traditional 457(b) plan, contributions made to the Roth 457(b) plan are not tax-deductible. However, the earnings on the contributions are tax-free when withdrawn during retirement, providing potential tax advantages for participants. Furthermore, the Contra Costa California Supplemental Retirement Plan offers a range of investment options to suit participants' individual financial goals and risk tolerance levels. These options may include diversified mutual funds, target-date funds, and fixed and variable annuity contracts. The plan also provides access to educational resources and tools to help employees make informed investment decisions. Participants of the Contra Costa California Supplemental Retirement Plan have the flexibility to contribute a percentage of their salary, up to the maximum allowable limits set by the Internal Revenue Service (IRS) each year. Additionally, participants who are close to retirement age may be eligible for catch-up contributions, allowing them to make higher contributions in the years leading up to retirement. Upon retirement, the Contra Costa California Supplemental Retirement Plan offers several distribution options to suit participants' individual needs. These options include lump-sum payments, periodic payments, or the option to roll over the funds into another eligible retirement account. Overall, the Contra Costa California Supplemental Retirement Plan serves as a valuable tool for employees of Contra Costa County, California, to enhance their retirement savings and financial security. With various plan types, investment options, and distribution choices, participants have the flexibility to tailor their retirement plan to their unique circumstances.

Contra Costa California Supplemental Retirement Plan

Description

How to fill out Contra Costa California Supplemental Retirement Plan?

Laws and regulations in every area differ around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Contra Costa Supplemental Retirement Plan, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the documents can be used multiple times: once you pick a sample, it remains available in your profile for further use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Contra Costa Supplemental Retirement Plan from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Contra Costa Supplemental Retirement Plan:

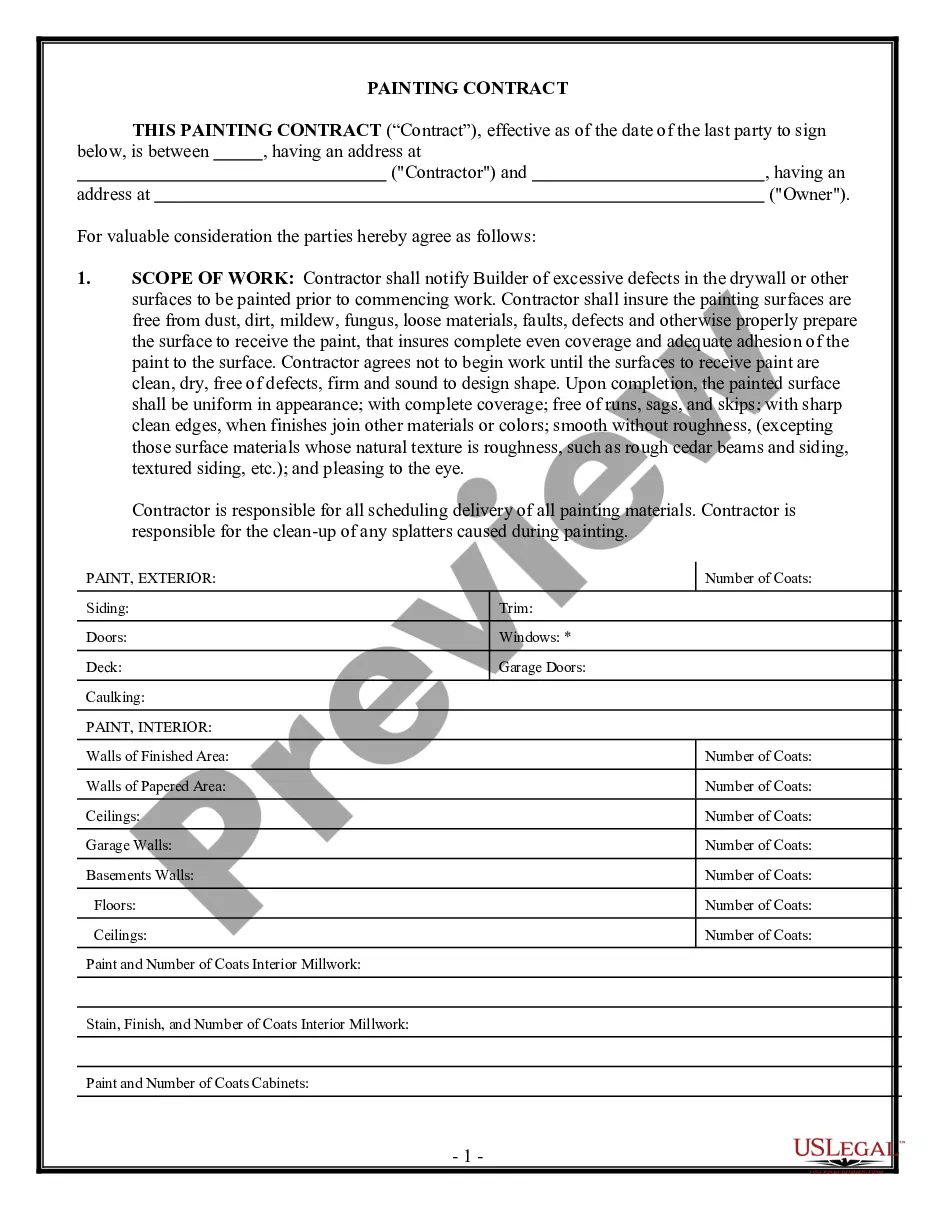

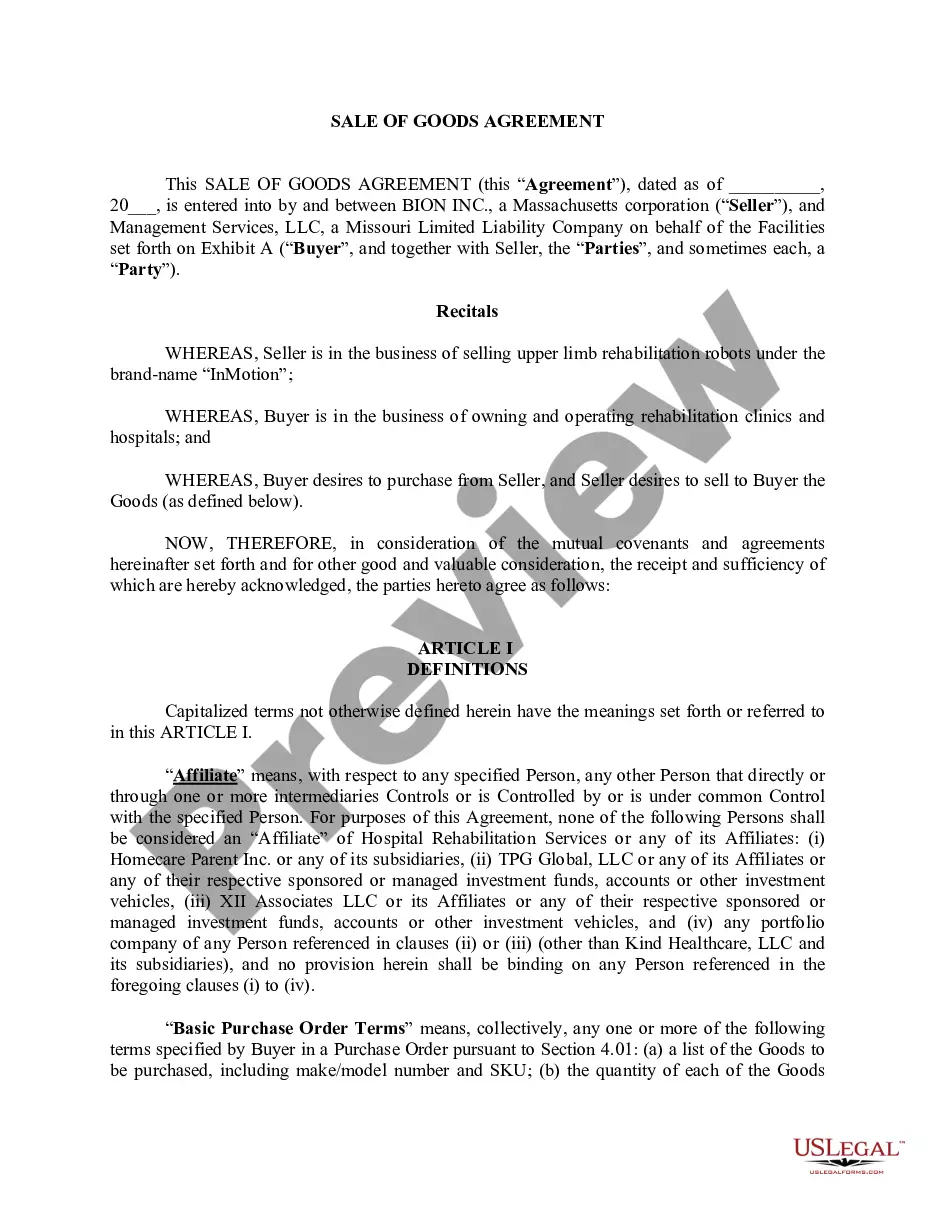

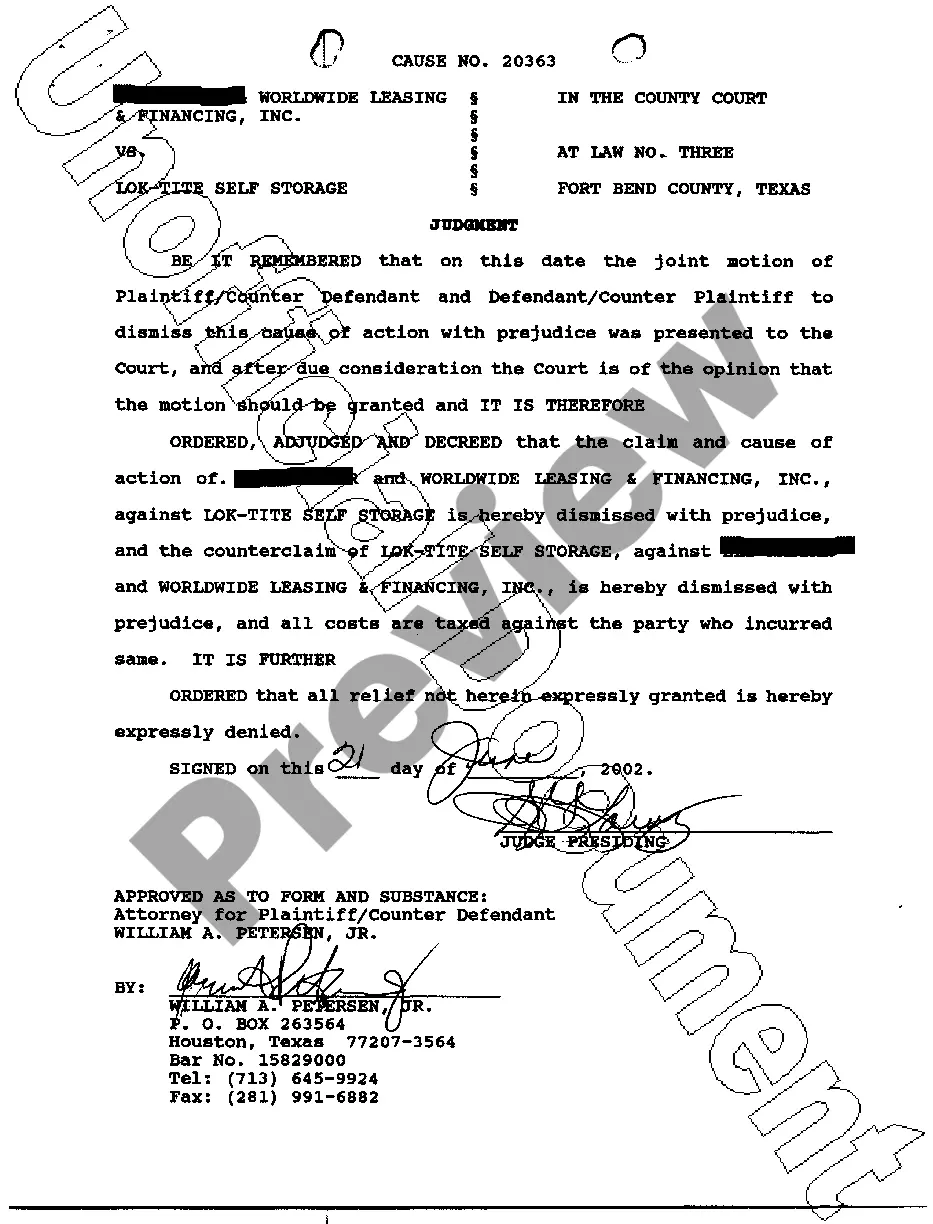

- Examine the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the document once you find the proper one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!