The Hennepin Minnesota Supplemental Retirement Plan is a retirement savings program offered to employees working for Hennepin County, Minnesota. This plan serves as an additional retirement benefit over and above any other retirement plans the employee may have. One of the primary goals of the Hennepin Minnesota Supplemental Retirement Plan is to provide employees with an opportunity to maximize their retirement savings by contributing additional funds towards their future financial security. This plan offers flexibility and various investment options to suit the individual needs and preferences of the employees. The Hennepin Minnesota Supplemental Retirement Plan is designed to complement the existing retirement plans such as the Hennepin County Retirement Plan. It allows employees to contribute additional funds towards their retirement savings, thereby boosting their overall retirement income. Contributions to the Hennepin Minnesota Supplemental Retirement Plan are made through pre-tax payroll deductions, enabling employees to enjoy potential tax advantages. The plan offers a range of investment options, including mutual funds, stocks, bonds, and various other financial instruments, allowing employees to customize their investment portfolio based on their risk tolerance and long-term financial goals. Additionally, the Hennepin Minnesota Supplemental Retirement Plan provides resources and educational materials to help employees make informed investment decisions. Educational seminars, workshops, and online tools are made available to participants to enhance their understanding of retirement planning and investment strategies. While there may not be different types of Hennepin Minnesota Supplemental Retirement Plans, the plan allows employees to choose between different investment options and contribution amounts based on their individual financial circumstances and retirement goals. In summary, the Hennepin Minnesota Supplemental Retirement Plan is a valuable retirement savings program offered to employees of Hennepin County, Minnesota. It provides an opportunity to enhance retirement savings through pre-tax contributions and a wide range of investment options. The plan aims to assist employees in achieving their long-term financial goals and securing a comfortable retirement.

Hennepin Minnesota Supplemental Retirement Plan

Description

How to fill out Hennepin Minnesota Supplemental Retirement Plan?

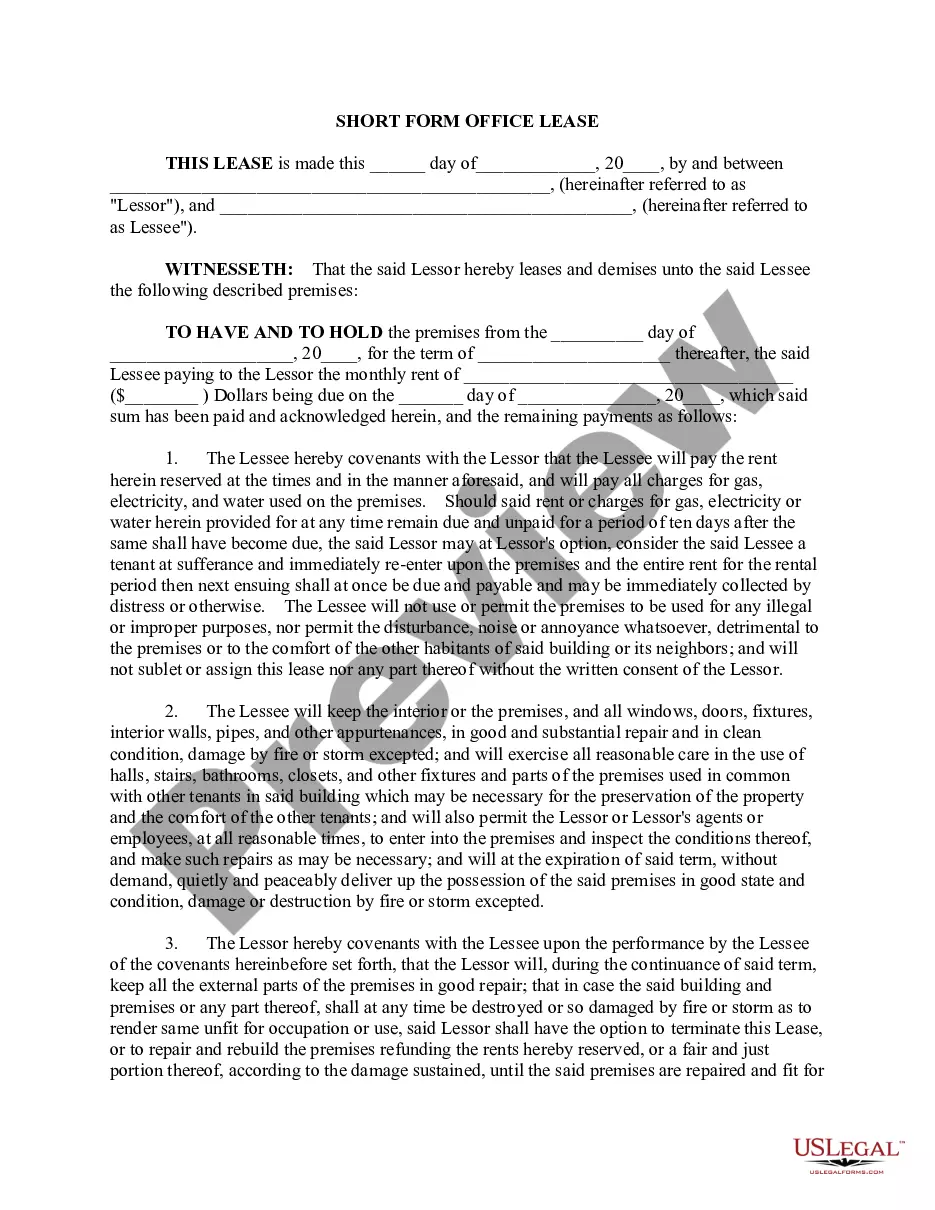

Preparing legal paperwork can be difficult. Besides, if you decide to ask an attorney to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Hennepin Supplemental Retirement Plan, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario gathered all in one place. Consequently, if you need the latest version of the Hennepin Supplemental Retirement Plan, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Hennepin Supplemental Retirement Plan:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the file format for your Hennepin Supplemental Retirement Plan and save it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

A Supplemental Executive Retirement Plan (SERP) is a deferred compensation agreement between the company and the key executive whereby the company agrees to provide supplemental retirement income to the executive and his family if certain pre-agreed eligibility and vesting conditions are met by the executive.

A traditional 403(b) plan allows the employee to have pretax money automatically deducted from each paycheck and paid into a personal retirement account. The employee has put away some money for the future and at the same time reduced his or her gross income (and income taxes owed for the year).

The CSU 403 (b) Supplemental Retirement Plan (SRP) is a voluntary program that allows eligible CSU employees to save toward retirement by investing pre-tax contributions in tax-deferred investments in either annuities or mutual funds, under Internal Revenue Code (IRC) Section 403 (b).

The CSU 403 (b) Supplemental Retirement Plan (SRP) is a voluntary program that allows eligible CSU employees to save toward retirement by investing pre-tax contributions in tax-deferred investments in either annuities or mutual funds, under Internal Revenue Code (IRC) Section 403 (b).

A supplemental retirement plan gives your top employees a chance to save more once they've maxed out their contribution to a qualified plan, which can increase engagement and retention.

With the investment component, Plan 3 has the potential to give you more income in retirement. However, members in Plan 2 often add a supplemental retirement savings account like Washington's DCP to increase their overall retirement savings. Many Plan 3 members also join DCP for even more retirement savings.

Benefit Overview As a PERA member, you contribute a percentage of every paycheck to PERA. In exchange, you'll receive a lifetime defined benefit payment, or a pension, at retirement. In addition to that monthly benefit, PERA also provides benefits life survivor and disability benefits.

Overview. The CSU 403 (b) Supplemental Retirement Plan (SRP) is a voluntary program that allows eligible CSU employees to save toward retirement by investing pre-tax contributions in tax-deferred investments in either annuities or mutual funds, under Internal Revenue Code (IRC) Section 403 (b).

A SERP is an employer-sponsored, non-qualified deferred compensation plan. It allows employers to select key, highly compensated employees with supplemental retirement benefits in addition to benefits from a qualified plan such as a pension, profit-sharing or 401(k) plan.

A supplemental executive retirement plan (SERP) is a set of benefits that may be made available to top-level employees in addition to those covered in the company's standard retirement savings plan. A SERP is a form of a deferred-compensation plan.