The Hillsborough Florida Supplemental Retirement Plan is a comprehensive program designed to provide additional retirement benefits to eligible employees in Hillsborough County, Florida. This plan serves as a supplement to the regular retirement plan offered by the county, helping individuals build a more secure financial future during their post-employment years. The Hillsborough Florida Supplemental Retirement Plan offers various options and benefits to meet the diverse needs and goals of employees. One of the primary features of this plan is its flexible contribution system. Participants can choose to contribute a certain percentage of their salary or opt for a fixed dollar amount, allowing them to tailor their savings according to their financial situation and objectives. An essential component of the Hillsborough Florida Supplemental Retirement Plan is the employer match. The county matches a certain percentage of the employee's contributions, thereby augmenting their savings. This matching contribution acts as an incentive for employees to save more and maximize their retirement benefits. Participants in the Hillsborough Florida Supplemental Retirement Plan have the opportunity to invest their contributions in a range of investment options. These options cater to individuals with varying risk tolerances and investment preferences, including stocks, bonds, and mutual funds. By diversifying their investments, employees can potentially grow their retirement savings over time. Moreover, the plan offers tax advantages. Contributions to the Hillsborough Florida Supplemental Retirement Plan are made on a pre-tax basis, reducing the employee's taxable income. This can lead to significant tax savings during the contribution period. However, withdrawals from the plan upon retirement are subject to taxes at ordinary income rates. In addition to the main Hillsborough Florida Supplemental Retirement Plan, there might be different types targeted towards specific employee groups or professions. For example, the Hillsborough County Educators Supplemental Retirement Plan is designed specifically for educators within the county, offering tailored benefits and features that cater to their unique retirement needs. Similarly, there might be plans customized for law enforcement officers, firefighters, or other county employees. Overall, the Hillsborough Florida Supplemental Retirement Plan aims to enhance employees' retirement savings by providing them with a flexible, incentivized, and tax-advantaged savings platform. It ensures that eligible workers have the opportunity to secure a comfortable retirement by supplementing their regular pension or retirement savings with additional contributions and employer matching. By offering various investment options and customization features, the plan empowers participants to take control of their financial future and achieve their retirement goals.

Hillsborough Florida Supplemental Retirement Plan

Description

How to fill out Hillsborough Florida Supplemental Retirement Plan?

How much time does it usually take you to create a legal document? Since every state has its laws and regulations for every life situation, locating a Hillsborough Supplemental Retirement Plan meeting all regional requirements can be exhausting, and ordering it from a professional lawyer is often costly. Numerous online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online catalog of templates, grouped by states and areas of use. Apart from the Hillsborough Supplemental Retirement Plan, here you can get any specific document to run your business or personal deeds, complying with your regional requirements. Experts check all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required sample, and download it. You can pick the document in your profile anytime in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Hillsborough Supplemental Retirement Plan:

- Check the content of the page you’re on.

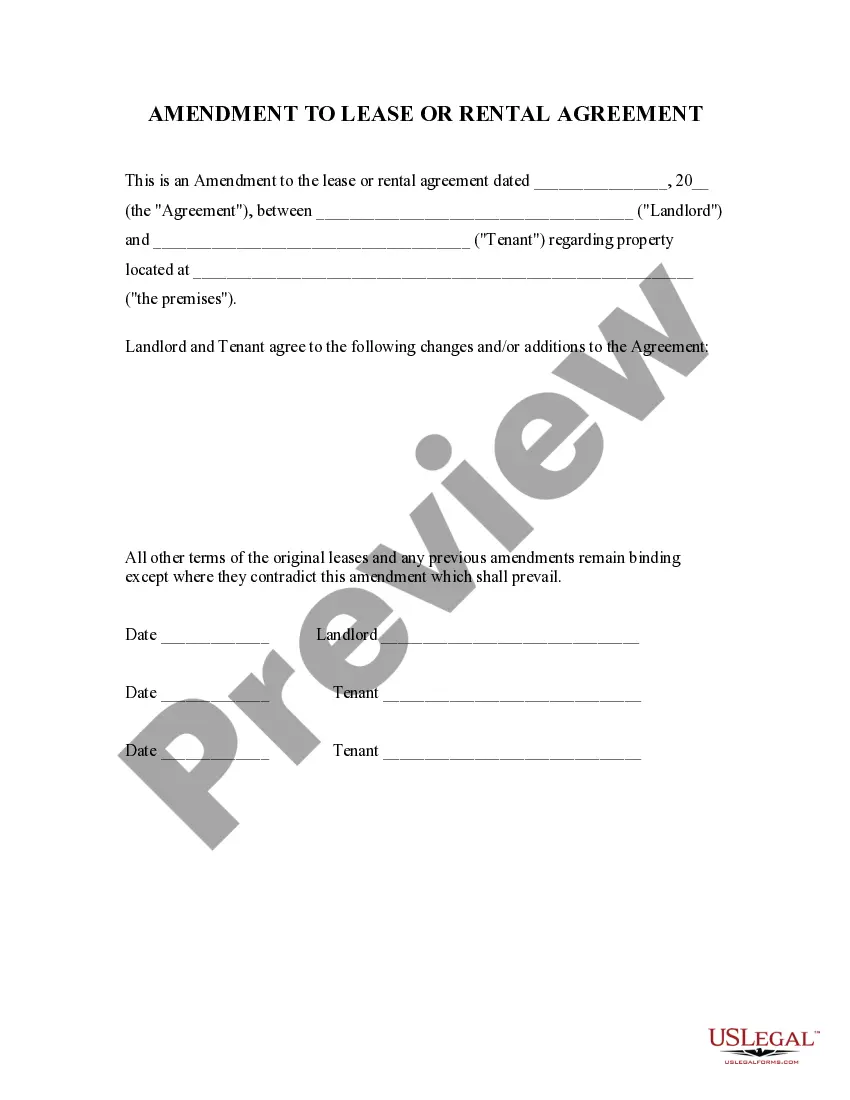

- Read the description of the template or Preview it (if available).

- Search for another document using the related option in the header.

- Click Buy Now once you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Hillsborough Supplemental Retirement Plan.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

Florida for each dollar invested by Florida taxpayers in FRS. Employees contribute 3% of salary out of each paycheck to the pension fund. The average retirement benefit is $18,625 per year, or $1,552 per month. FRS covers 623,011 active school employees and 334,682 retirees and beneficiaries.

Please call the MyFRS Financial Guidance Line at 1-866-446-9377, Option 2, so we can determine why Custom Home is not appearing for you. To access your Pension Plan account, click on the following button. Please select one of the buttons above to access your personal FRS information.

The statements are mailed to the member's address on file approximately 25 business days after the quarter ends. Investment Plan members can also review and download their statements on MyFRS.com after they log in and select "Investment Plan" from the top toolbar.

The Investment Plan directs contributions to individual member accounts, and you allocate your contributions and account balance among various investment funds. Your Investment Plan retirement benefit is the value of your account at termination. Unlike the Pension Plan, there is no fixed benefit level at retirement.

For normal retirement and to receive your full monthly benefit, you must be age 65 with at least 8 years of service or have 33 years of service regardless of age.

The average annual pension for FRS members is $23,060, according to a report from Florida's Department of Management Services. Those who choose the investment plan, a personal retirement account, do have good options for managing their retirement funds.

FRS Investment Plan You must be vested. If you enrolled in the FRS prior to July 1, 2011, you must have 6 years of service to vest. If you enrolled in the FRS on or after July 1, 2011, you must have at least 8 years of service to vest.

You will be eligible for a Pension Plan benefit (i.e. be vested) when you complete six years of service (if you were enrolled in the FRS prior to July 1, 2011) or eight years of service (if you were enrolled in the FRS on or after July 1, 2011).

You receive a set, monthly benefit based on your age at retirement, salary, position, and how long you worked for the FRS. You receive the balance of your investment account; based on how well the plan performed.

The FRS Investment Plan is similar to a 401(k) plan. Members own all employer contributions and earnings in their Investment Plan account after completing 1 year of service.

Interesting Questions

More info

Employees of the District of Columbia Public Schools (D.C.S.) who work within the District of Columbia are required to enroll in federal Social Security. FUTA-BASED FLEXIBILITY PLAN (FFSP) The FFSP, which was instituted in 1992, provides retirement benefits after 20 years of service after retirement on a salary of 51,000 with no cost-of-living adjustment. The FFSP provides for a 4% annual cost-of-living adjustment up to age 62. After age 62, the cost-of-living adjustment has a maximum of 2.5% and at that point continues to decrease. A higher contribution and higher annual cost-of-living adjustment is available for those working up to age 50. This plan also offers an income-based vesting schedule. To qualify for the FFSP, you must first be employed by an employer in Washington, D.C. or the District of Columbia, or a member of the Coast Guard and have worked 30 days out of the calendar year before the month in which you apply.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.