The San Bernardino California Supplemental Retirement Plan is a comprehensive retirement program specifically designed to provide additional financial support to eligible employees of San Bernardino, California. This plan aims to supplement the primary retirement plan and enable individuals to enhance their retirement savings for a secure and prosperous future. The San Bernardino California Supplemental Retirement Plan offers various options and benefits that cater to individual needs. There are three main types of plans under this program: 1. Deferred Compensation Plan: The Deferred Compensation Plan allows employees to defer a portion of their pre-tax income into a retirement account. This plan offers tax advantages as the contributions are made before taxes are withheld, reducing the current taxable income. The funds then grow tax-deferred until retirement, providing a higher potential for long-term growth. 2. Roth 457 Plan: Similar to the Deferred Compensation Plan, the Roth 457 Plan also allows employees to contribute a portion of their income towards retirement savings. However, contributions to this plan are made after tax, meaning they are taken from the employee's net pay. The advantage of this plan lies in the fact that qualified withdrawals during retirement are tax-free, enabling individuals to enjoy tax-free income upon retirement. 3. Health Savings Account (HSA): While not a retirement-specific plan, the Health Savings Account can also be part of the San Bernardino California Supplemental Retirement Plan. It allows employees to set aside tax-advantaged funds to cover eligible medical expenses, both now and during retirement. The HSA provides a triple tax advantage — contributions are tax-deductible, earnings grow tax-free, and withdrawals are tax-free when used for qualified medical expenses. These various plans offered under the San Bernardino California Supplemental Retirement Plan provide flexibility to employees in choosing the most suitable option according to their goals, risk tolerance, and financial situations. By taking advantage of these plans, employees can maximize their retirement savings, potentially achieve their desired lifestyle in retirement, and secure a financially stable future.

San Bernardino California Supplemental Retirement Plan

Description

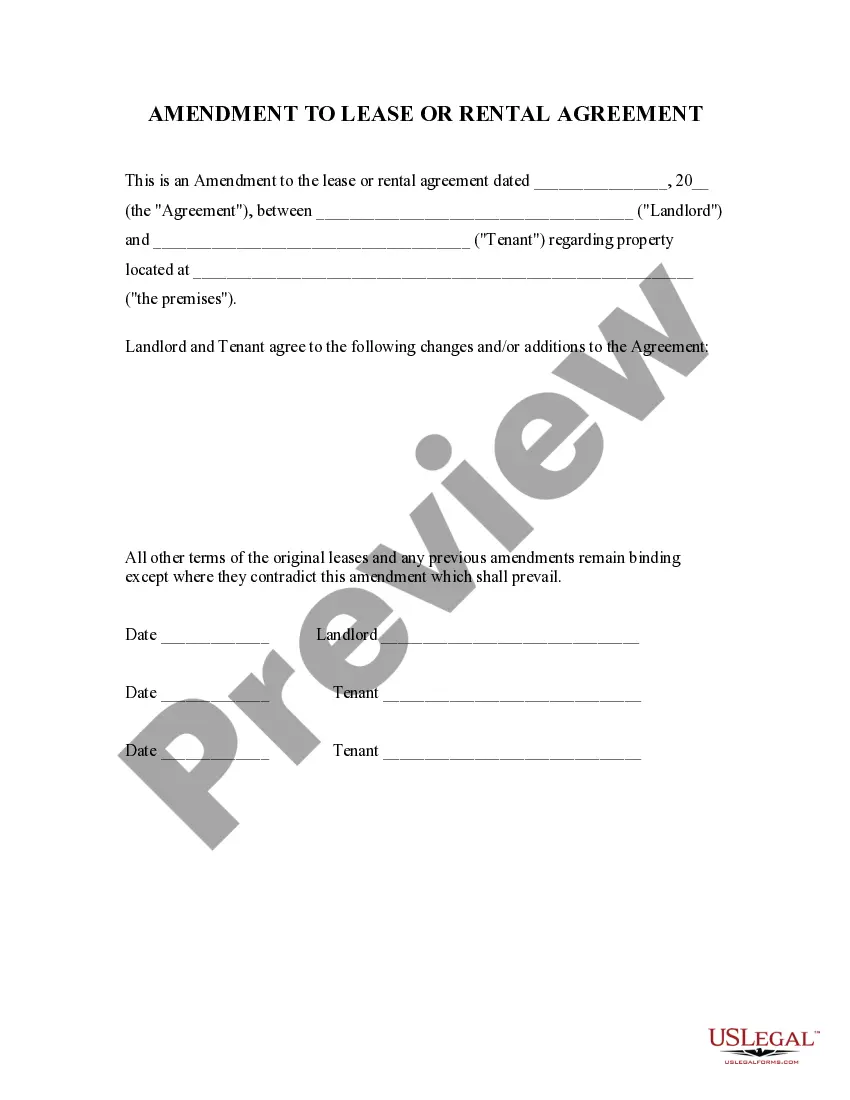

How to fill out San Bernardino California Supplemental Retirement Plan?

Whether you plan to open your business, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you must prepare specific paperwork corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal templates for any personal or business occasion. All files are collected by state and area of use, so picking a copy like San Bernardino Supplemental Retirement Plan is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to get the San Bernardino Supplemental Retirement Plan. Follow the instructions below:

- Make sure the sample meets your personal needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to get the file once you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the San Bernardino Supplemental Retirement Plan in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

A supplemental retirement plan gives your top employees a chance to save more once they've maxed out their contribution to a qualified plan, which can increase engagement and retention.

Supplemental Retirement Plan Benefits SERP withdrawals are taxed as regular income, but taxes on that income are deferred until you start making withdrawals. Much like other tax-deferred retirement plans, SERP funds grow tax-free until retirement.

A Supplemental Executive Retirement Plan (SERP) is a deferred compensation agreement between the company and the key executive whereby the company agrees to provide supplemental retirement income to the executive and his family if certain pre-agreed eligibility and vesting conditions are met by the executive.

Supplemental retirement accounts, or SRAs, work similar to other qualified retirement plans. You can deduct the contributions from your paycheck before taxes, and the funds in the account grow tax-free until you distribute them after 59 1/2.

The CSU 403 (b) Supplemental Retirement Plan (SRP) is a voluntary program that allows eligible CSU employees to save toward retirement by investing pre-tax contributions in tax-deferred investments in either annuities or mutual funds, under Internal Revenue Code (IRC) Section 403 (b).

A supplemental executive retirement plan (SERP) can be a highly effective way to provide additional compensation for a handful of key employees and persuade them to remain with the company longer. A SERP has numerous advantages both for the business and its key employees.

A supplemental executive retirement plan (SERP) is a set of benefits that may be made available to top-level employees in addition to those covered in the company's standard retirement savings plan. A SERP is a form of a deferred-compensation plan.

A SERP is an employer-sponsored, non-qualified deferred compensation plan. It allows employers to select key, highly compensated employees with supplemental retirement benefits in addition to benefits from a qualified plan such as a pension, profit-sharing or 401(k) plan.