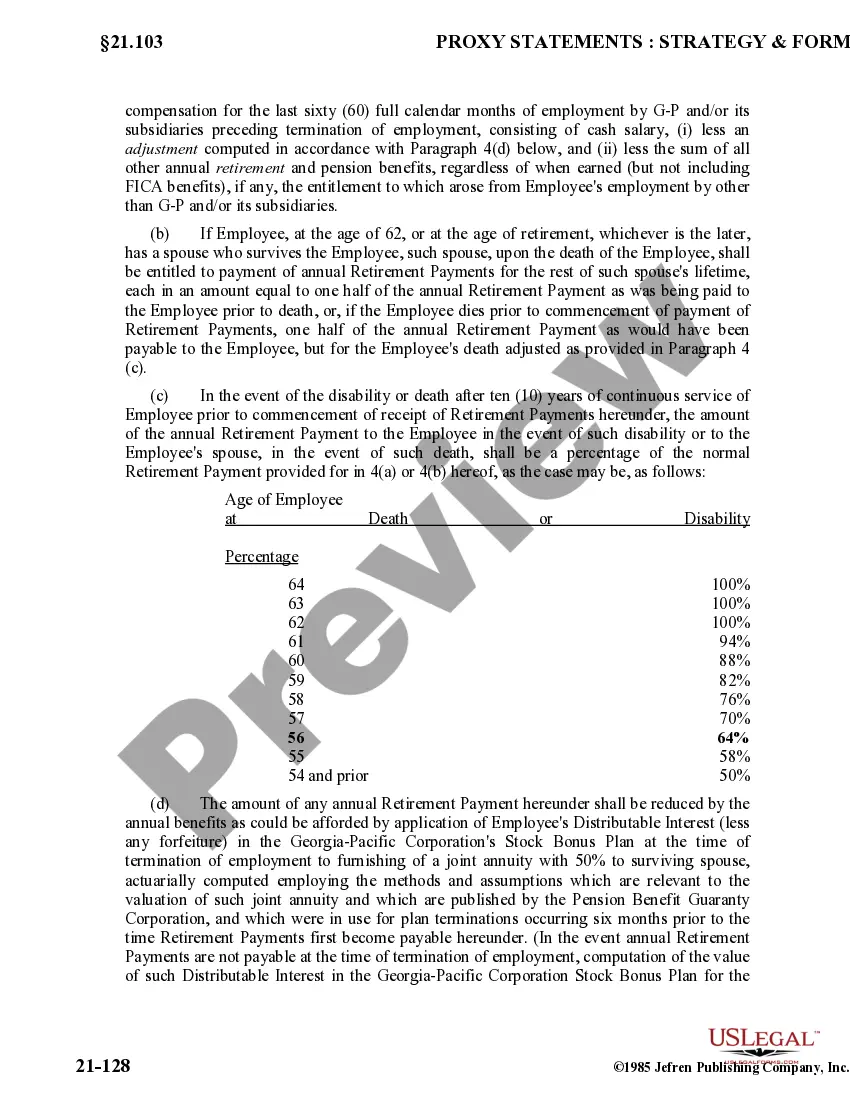

The Collin Texas Executive Retirement Agreement is a specific retirement plan offered by Georgia Pacific Corp., a subsidiary of the multinational conglomerate Koch Industries. This agreement aims to provide a comprehensive retirement package to eligible senior executives who have contributed significantly to the success and growth of the company. The executive retirement agreement is designed to recognize the valuable services rendered by these individuals and ensure that they have a secure and comfortable retirement. It offers a range of benefits and incentives to qualified executives, including financial security through pension plans, healthcare coverage, and other retirement-related perks. Georgia Pacific Corp. offers different types of executive retirement agreements within the Collin Texas area, tailored to meet the specific needs and preferences of each individual. These agreements may vary depending on factors such as the executive's years of service, contribution, and position within the company. While the details of each agreement could differ, they all share a common goal of providing a sound financial foundation for the retiree's future. Some key features that executives may find in the Collin Texas Executive Retirement Agreement of Georgia Pacific Corp. include: 1. Pension Plans: These agreements typically include defined benefit pension plans, where executives receive a fixed amount of income after retirement based on factors like years of service and average salary. The pension ensures long-term financial stability for the retiree and their dependents. 2. Healthcare Coverage: Collin Texas Executive Retirement Agreements often provide post-retirement medical benefits, ensuring adequate healthcare coverage for the executive and their spouse or dependents. This coverage helps alleviate the burden of rising healthcare costs during retirement. 3. Financial Incentives: As a means to reward executives for their contributions, the retirement agreements may include various financial incentives, such as performance-based bonuses, stock options, or executive development programs. 4. Retirement Savings Plans: Executives may also have access to retirement savings plans like 401(k) or similar programs, allowing them to contribute a portion of their income before taxes, benefit from employer matching contributions, and invest in various funds to grow their retirement savings. 5. Other Perks and Benefits: The executive retirement agreement may encompass additional benefits like life insurance policies, disability coverage, access to financial planning services, and support for the transition into retirement. Georgia Pacific Corp. and Collin Texas aim to provide a comprehensive and competitive retirement package to attract and retain top executives. As such, the Collin Texas Executive Retirement Agreement is carefully crafted to ensure the financial well-being and security of eligible executives, ultimately enabling them to enjoy a fulfilling and comfortable retirement.

Mylifechoices Gp

Description

How to fill out Collin Texas Executive Retirement Agreement Of Georgia Pacific Corp.?

Are you looking to quickly create a legally-binding Collin Executive Retirement Agreement of Georgia Pacific Corp. or probably any other document to manage your personal or corporate matters? You can select one of the two options: hire a legal advisor to write a legal document for you or create it completely on your own. Luckily, there's another option - US Legal Forms. It will help you receive professionally written legal paperwork without having to pay unreasonable prices for legal services.

US Legal Forms provides a huge collection of more than 85,000 state-compliant document templates, including Collin Executive Retirement Agreement of Georgia Pacific Corp. and form packages. We provide templates for a myriad of use cases: from divorce papers to real estate documents. We've been on the market for over 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and get the necessary template without extra troubles.

- To start with, double-check if the Collin Executive Retirement Agreement of Georgia Pacific Corp. is tailored to your state's or county's laws.

- In case the form has a desciption, make sure to verify what it's intended for.

- Start the searching process again if the form isn’t what you were seeking by using the search box in the header.

- Select the plan that best suits your needs and proceed to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Collin Executive Retirement Agreement of Georgia Pacific Corp. template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to find and download legal forms if you use our catalog. Additionally, the templates we provide are updated by law professionals, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!