Wayne Michigan Executive Retirement Agreement of Georgia Pacific Corp.

Description

How to fill out Executive Retirement Agreement Of Georgia Pacific Corp.?

Laws and regulations in every domain differ from state to state.

If you are not a lawyer, it's simple to become confused by the multitude of standards when it comes to creating legal documents.

To prevent costly legal help when drafting the Wayne Executive Retirement Agreement of Georgia Pacific Corp., you require a verified template valid for your area.

That's the easiest and most cost-effective method to acquire updated templates for any legal objectives. Find them all with a few clicks and keep your paperwork organized with the US Legal Forms!

- That's where utilizing the US Legal Forms platform becomes remarkably beneficial.

- US Legal Forms is an online repository trusted by millions with over 85,000 state-specific legal templates.

- It's an outstanding resource for professionals and individuals looking for DIY templates for various life and business scenarios.

- All the forms can be utilized repeatedly: once you buy a sample, it stays accessible in your account for later use.

- Consequently, with a valid subscription account, you can easily Log In and re-download the Wayne Executive Retirement Agreement of Georgia Pacific Corp. from the My documents section.

- For new users, a few additional steps are necessary to acquire the Wayne Executive Retirement Agreement of Georgia Pacific Corp.

- Evaluate the page content to ensure you've located the correct template.

- Employ the Preview option or read the form description if available.

Form popularity

FAQ

If all you want to do is close your 401k account, that's easy. Simply go to your human resources department and make a request to stop paycheck contributions. There is no penalty for doing so.

4 Types Of Pension Plans Most Preferred For Retirement Planning NPS. Regulated by Pension Fund Regulatory and Development Authority (PFRDA), the National Pension Scheme or NPS is a popular option if you want to receive a regular pension after retirement.Pension Funds.Annuity Plans.Pension Plans with Life Cover.

One of the most significant differences in benefits between Union Pacific management employees and Union Pacific agreement employees is the UP Pension Plan....Consequences for Pension Benefits. Annual Pension at age 60 if remained in UP Pension Plan$35,160Annual Net Reduction in UP Pension$34,0803 more rows

How to set up a 401k for a small business Create a 401(k) plan document. Create a plan document that complies with IRS Code and outlines the details of your retirement plan.Set up a trust to hold the plan assets.Maintain records of 401(k) employee contributions and values.Provide information to plan participants.

In a traditional 401(k) plan, employees defer part of their salary to a retirement fund pre-tax, but some plans allow for them to be made on a post-tax basis. Contributions made by an employer to a traditional 401(k) plan are also not taxed by the federal government and most state governments.

Georgia-Pacific Corporation offers a 401(k) match up to a defined limit.

The Alternate Retirement Program, or ARP, is a retirement savings program in which certain State employees were automatically enrolled between August 11, 2004, and June 30, 2013 for their first two years of employment with the State of California.

We provide flexible options to meet the needs of our employees and their families through medical, dental, vision, life insurance and disability coverage.

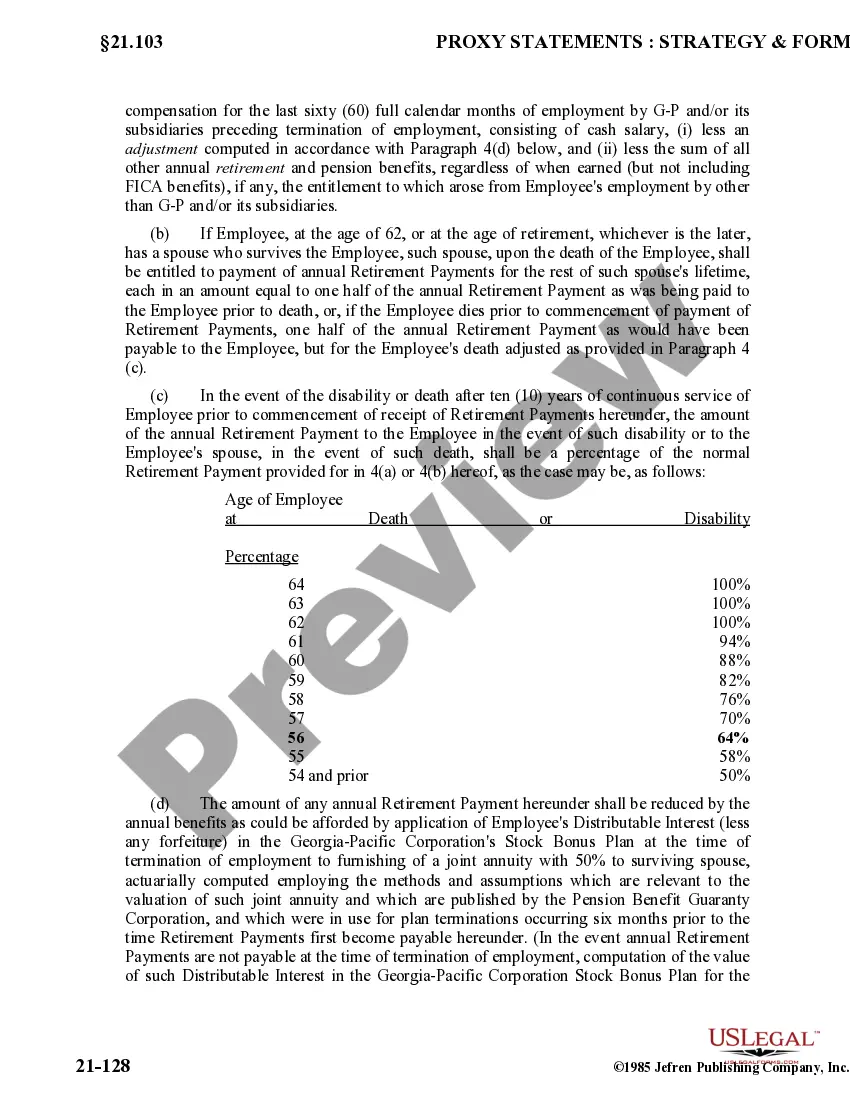

Georgia-Pacific Pension Fund is a private sector pension fund headquartered in Atlanta, Georgia. It offers a defined benefit pension plan to employees of Georgia-Pacific Corporation.