Kings New York Retirement Plan for Outside Directors is a comprehensive retirement package designed exclusively for external directors of the company. This retirement plan offers valuable financial benefits and security to directors who serve on the board of Kings New York. With this plan, outside directors can enjoy a comfortable and worry-free retirement, ensuring their commitment and dedication to the company are adequately rewarded. The Kings New York Retirement Plan for Outside Directors offers multiple options to cater to individual needs and preferences. It includes various types of retirement plans, such as defined contribution plans, defined benefit plans, and non-qualified deferred compensation plans. 1. Defined Contribution Plan: This type of retirement plan allows directors to contribute a specific amount from their salary or compensation towards their retirement fund. The company may also contribute to this plan, matching a portion of the director's contribution. The accumulated funds in the plan are typically invested in a variety of investment options, such as stocks, bonds, and mutual funds, providing potential growth over time. 2. Defined Benefit Plan: Unlike a defined contribution plan, a defined benefit plan guarantees a specific retirement income to the director based on predetermined factors such as salary, years of service, and other relevant variables. The company assumes the responsibility for managing the investment and assumes the risk associated with the plan. This type of plan provides a fixed and secure income stream during retirement, ensuring financial stability for the director. 3. Non-Qualified Deferred Compensation Plan: This plan allows outside directors to defer a portion of their compensation until a later point in time, often retirement. The deferred compensation is typically invested and grows on a tax-deferred basis. Upon retirement, directors receive the accumulated funds, which can supplement their other retirement income sources and help them maintain their desired lifestyle. The Kings New York Retirement Plan for Outside Directors aims to attract experienced and highly qualified individuals to serve on the company's board. It provides an added incentive for potential directors to commit to the organization, knowing that their long-term financial security is taken care of. This retirement plan highlights Kings New York's commitment to recognizing the contributions and value that outside directors bring to the company, ensuring their lasting well-being and satisfaction while serving on the board. In summary, the Kings New York Retirement Plan for Outside Directors offers a variety of retirement options, including defined contribution, defined benefit, and non-qualified deferred compensation plans. It serves as a powerful tool to attract and retain talented individuals to serve on the board, demonstrating the company's dedication to its outside directors' financial security and rewarding their commitment to the organization.

Kings New York Retirement Plan for Outside Directors

Description

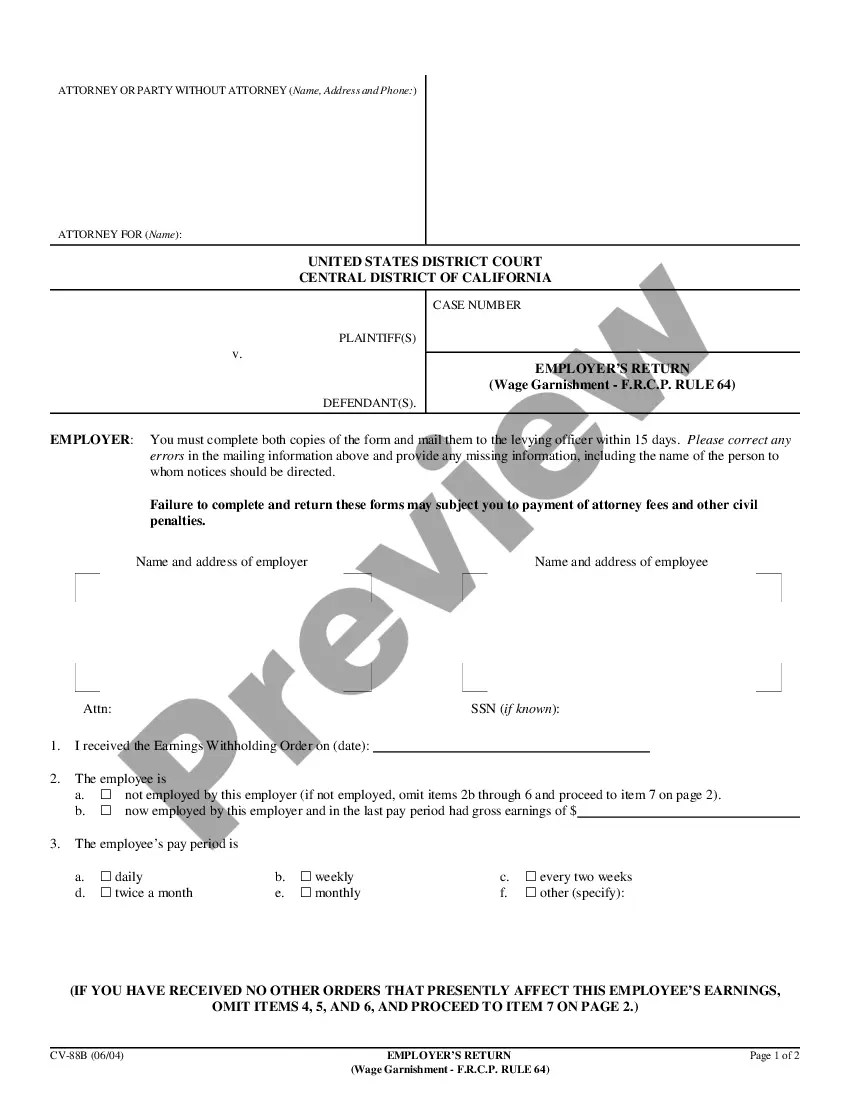

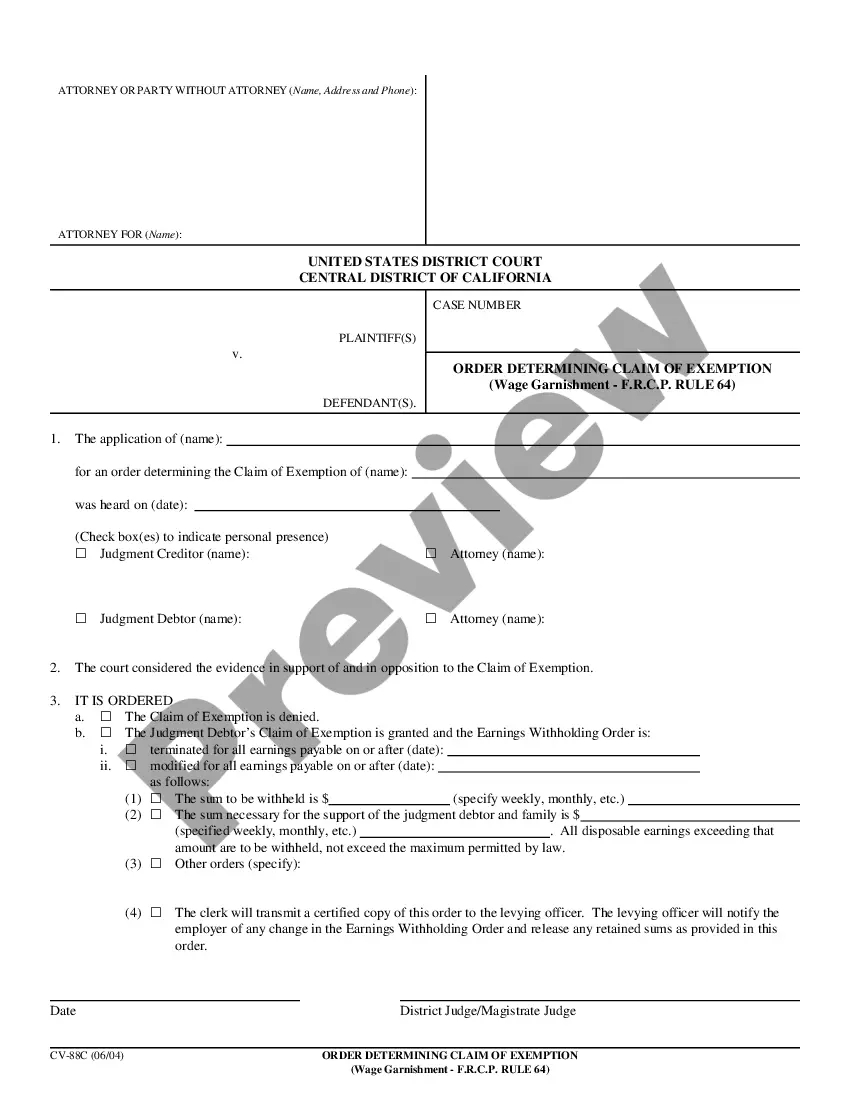

How to fill out Kings New York Retirement Plan For Outside Directors?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask an attorney to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Kings Retirement Plan for Outside Directors, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case gathered all in one place. Therefore, if you need the current version of the Kings Retirement Plan for Outside Directors, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Kings Retirement Plan for Outside Directors:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the document format for your Kings Retirement Plan for Outside Directors and save it.

Once done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

Use these three steps to help think through your needs and create a plan to go from saving to spending in retirement. Identify your expenses. What will you likely need to spend each month in retirement?Identify your income.Match up your money coming in to your estimated expenses in retirement.

Common tax-deferred retirement accounts are traditional IRAs and 401(k)s. Popular tax-exempt accounts are Roth IRAs and Roth 401(k)s. Tax-exempt accounts are useful if your income will be higher in retirement than during your working years.

Nonprofit organizations typically use 403(b) plans, 401(k) plans, SIMPLE IRA plans, and other retirement plans for employees.

Get 401(k) Statement in the Mail. The Department of Labor requires 401(k) plan administrators to send quarterly statements to participants of a retirement plan.Get 401(k) Statement Online.Call Your 401(k) Provider to Send a Statement.Search for Old 401(k) Statements.Don't Hesitate.

The plan usually defines this amount in terms of a percentage of salary or set dollar amount, multiplied by years of service. This section shows a current summary of your earned benefit, as well as an estimate of your benefit at your normal retirement age.

Since September 2020, companies in California that employ more than 100 employees must have the state's Calsavers plan or another qualifying retirement plan in place.

Retirement Plan Proposal Order a customized proposal....Next steps. Reiterate your role. Restate the key issues. Summarize your solution and the benefits. Thank your audience for listening. Make a trial close: Ask for the business if it seems appropriate.

Step 1: Decide Your Retirement Age.Step 2: Start Early To Retire Peacefully.Step 3: Determine Your Retirement Corpus.Step 4: Calculate The Future Value Of Your Current Savings.Step 5: Cut Down On Unnecessary Expenses.Step 6: Plan And Create An Ideal Portfolio Seeking Help Of A Financial Planner.

The 5 steps of retirement planning Step 1: Know when to start retirement planning. Step 2: Figure out how much money you need to retire. Step 3: Prioritize your financial goals. Step 4: Choose the best retirement plan for you. Step 5: Select your retirement investments.

How to create your personal retirement plan Step 1: Start with your goals. Your retirement plan should be based on your specific needs and goals.Step 2: See where you stand.Step 3: Decide how you'll save and invest.Step 4: Check and update your plan, regularly.