The Montgomery Maryland Retirement Plan for Outside Directors is a comprehensive retirement plan designed specifically for directors who are not employees of the company in Montgomery, Maryland. This retirement plan is a way to reward and provide financial security to outside directors for their valuable contributions to the organization. Keywords: Montgomery Maryland, retirement plan, outside directors, comprehensive, financial security, rewards, contributions. The Montgomery Maryland Retirement Plan for Outside Directors offers a range of benefits and options to ensure a comfortable and well-planned retirement. It is designed to cater to the specific needs and requirements of outside directors, acknowledging their unique status within the company. Let's explore some key features and types of retirement plans available: 1. Defined Contribution Plan: This type of retirement plan enables outside directors to contribute a portion of their income or a fixed amount towards their retirement fund. The company may also contribute to the plan on behalf of the directors. The contributions are then invested, allowing the retirement fund to grow over time. The amount available at retirement depends on the performance of the investments. 2. Profit Sharing Plan: The Montgomery Maryland Retirement Plan for Outside Directors may also include a profit-sharing component where a portion of the company's profits is distributed to the eligible directors. This profit-sharing amount can be allocated directly towards the director's retirement fund, providing an additional source of retirement income. 3. Stock Option Plan: Some retirement plans for outside directors may include stock options as a form of long-term wealth accumulation. Directors are granted the opportunity to purchase company stocks at a predetermined price. As the value of the stock increases over time, the director can sell the shares at a profit, adding to their retirement funds. 4. Deferred Compensation Plan: In this type of retirement plan, outside directors can defer a portion of their compensation until retirement. The deferred amount is set aside, growing tax-deferred until the director retires, at which point it is distributed in periodic payments or a lump-sum. This plan allows directors to potentially lower their taxable income during their working years while creating a reliable retirement income stream. 5. Nonqualified Deferred Compensation Plan: A nonqualified deferred compensation plan is similar to a regular deferred compensation plan; however, it provides more flexibility in terms of contribution limits and distribution options. This type of plan is usually available to high-income outside directors and allows them to defer a larger portion of their compensation to reduce immediate tax liability. Overall, the Montgomery Maryland Retirement Plan for Outside Directors offers a range of retirement options tailored specifically for directors, ensuring they receive fair compensation and financial security for their valuable contributions. The plan may combine various elements such as defined contribution plans, profit sharing, stock options, and deferred compensation to deliver comprehensive retirement benefits. By providing these retirement benefits, the company aims to attract and retain top outside directors who play a crucial role in driving the organization's growth and success.

Montgomery Maryland Retirement Plan for Outside Directors

Description

How to fill out Montgomery Maryland Retirement Plan For Outside Directors?

How much time does it usually take you to draft a legal document? Considering that every state has its laws and regulations for every life sphere, locating a Montgomery Retirement Plan for Outside Directors suiting all local requirements can be tiring, and ordering it from a professional attorney is often pricey. Numerous web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, grouped by states and areas of use. Apart from the Montgomery Retirement Plan for Outside Directors, here you can find any specific document to run your business or personal affairs, complying with your county requirements. Experts check all samples for their validity, so you can be sure to prepare your documentation properly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required sample, and download it. You can retain the file in your profile at any time in the future. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Montgomery Retirement Plan for Outside Directors:

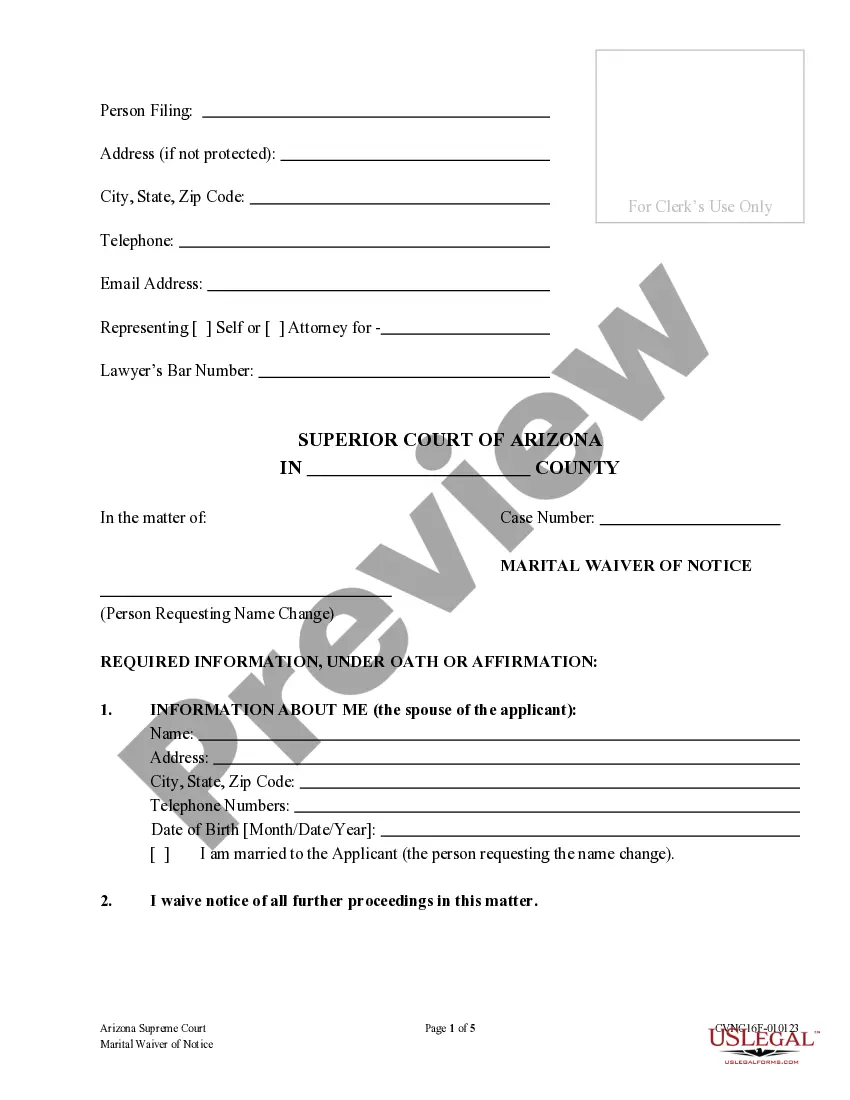

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Montgomery Retirement Plan for Outside Directors.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!