Nassau New York Retirement Benefits Plan is a comprehensive retirement plan designed to provide financial security and stability to retirees in the Nassau County, New York region. It offers several types of retirement benefits to eligible individuals, ensuring a comfortable post-employment life. One of the primary retirement benefits offered under the Nassau New York Retirement Benefits Plan is a defined benefit pension plan. This plan guarantees a specific monthly income to retirees based on their years of service, final average salary, and a multiplier. It ensures a steady stream of income throughout retirement, allowing individuals to maintain their standard of living. Another type of retirement benefit provided by Nassau New York is a defined contribution plan. This plan allows employees to contribute a portion of their salary to a retirement account, usually through payroll deductions. The employer may also make matching contributions to enhance the retirement savings. The funds accumulated in these accounts are then invested in various financial instruments, such as stocks, bonds, and mutual funds. Upon retirement, individuals can access these funds and use them to cover their expenses. Nassau New York Retirement Benefits Plan also offers retiree health benefits, which provide comprehensive medical coverage. These benefits help retirees pay for healthcare expenses, including doctor's visits, hospital stays, prescription drugs, and preventive care. This coverage ensures that retirees can maintain their health and well-being during their post-employment years without incurring substantial out-of-pocket costs. Additionally, the plan includes a range of other benefits to assist retirees in meeting their financial needs. These may include life insurance, long-term care insurance, and death benefits. Life insurance provides a payout to designated beneficiaries upon the retiree's passing, helping to secure their financial future. Long-term care insurance helps cover the costs associated with nursing homes, assisted living facilities, or in-home care if required during retirement. Death benefits offer financial support to surviving family members by providing a lump sum or ongoing payments. Overall, the Nassau New York Retirement Benefits Plan ensures that retirees in the Nassau County area have access to a comprehensive package of retirement benefits. Whether it's the defined benefit pension plan, defined contribution plan, retiree health benefits, life insurance, long-term care insurance, or death benefits, this plan caters to varied retirement needs. By providing a solid financial foundation, it aims to enhance the retirement experience and provide peace of mind for retirees in Nassau County.

Nassau New York Retirement Benefits Plan

Description

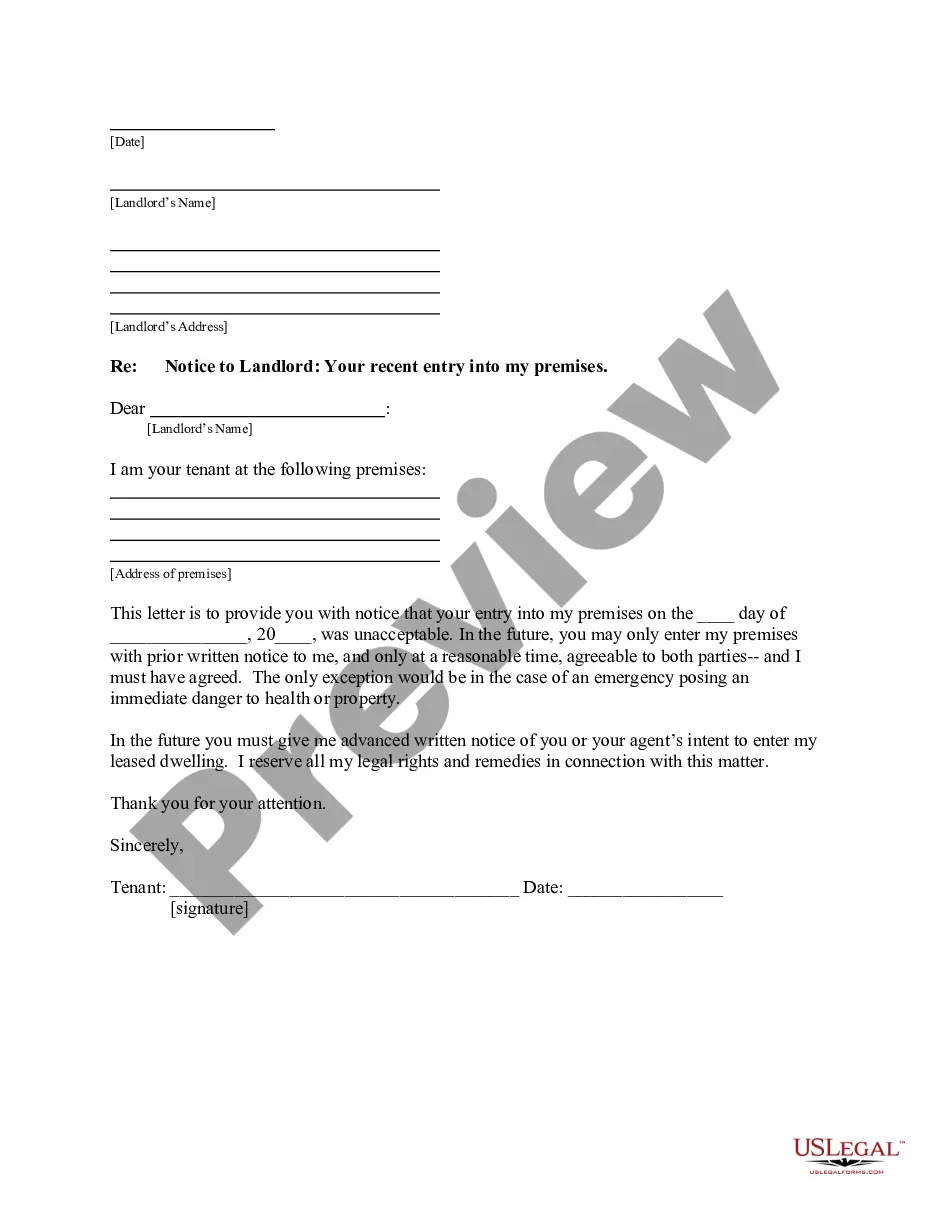

How to fill out Nassau New York Retirement Benefits Plan?

Creating documents, like Nassau Retirement Benefits Plan, to take care of your legal matters is a tough and time-consumming task. A lot of circumstances require an attorney’s participation, which also makes this task expensive. However, you can get your legal matters into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal forms crafted for different scenarios and life circumstances. We ensure each document is in adherence with the laws of each state, so you don’t have to be concerned about potential legal issues associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how effortless it is to get the Nassau Retirement Benefits Plan template. Go ahead and log in to your account, download the form, and customize it to your requirements. Have you lost your document? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is fairly straightforward! Here’s what you need to do before downloading Nassau Retirement Benefits Plan:

- Ensure that your template is specific to your state/county since the regulations for writing legal documents may differ from one state another.

- Learn more about the form by previewing it or going through a quick description. If the Nassau Retirement Benefits Plan isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to start using our service and get the form.

- Everything looks good on your end? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your template is all set. You can go ahead and download it.

It’s an easy task to locate and purchase the needed document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!