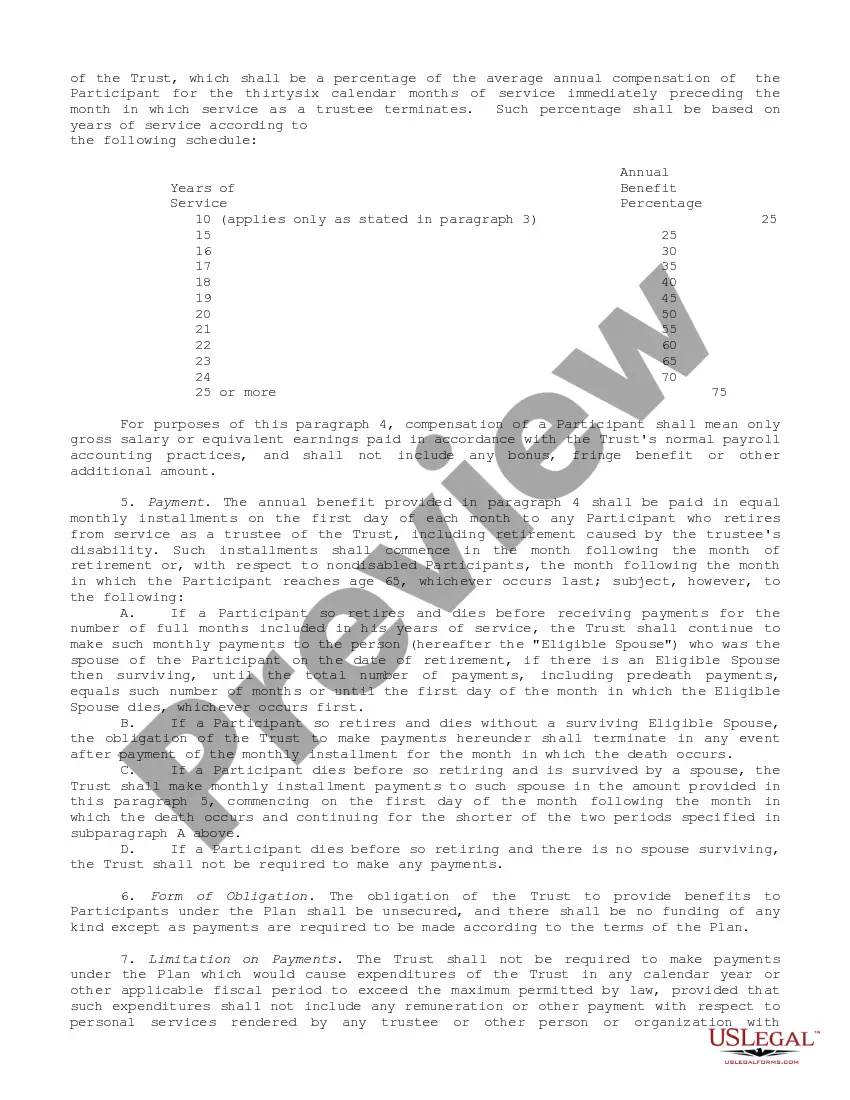

Oakland Michigan Retirement Benefits Plan is a comprehensive retirement plan offered to eligible employees and retirees residing in Oakland County, Michigan. This plan is designed to provide financial security and stability during their retirement years. The plan offers various benefits and options to help individuals plan for and manage their retirement effectively. Keywords: Oakland Michigan, Retirement Benefits Plan, eligible employees, retirees, financial security, stability, retirement years, benefits, options, plan. There are different types of Oakland Michigan Retirement Benefits Plans available depending on the employment status and membership with specific organizations within the county. Let's explore some of these plans: 1. Oakland County Employees Retirement System (OCKERS): OCKERS is the retirement plan available for employees working in various departments and agencies of Oakland County government. This plan offers a defined benefit pension, health benefits, and survivor benefits to eligible participants. 2. Police and Fire Retirement System (FRS): FRS is a retirement plan specifically tailored for police officers and firefighters within Oakland County. This plan provides retirement income, health benefits, and survivor benefits to eligible participants from these professions. 3. Municipal Employees' Retirement System (MERS): MERS encompasses retirement plans for eligible employees of various municipalities within Oakland County, excluding the county itself. These plans provide retirement benefits, including defined benefit pensions, health benefits, and survivor benefits. 4. Deferred Compensation Plan (457(b)): In addition to the comprehensive retirement plans mentioned above, Oakland County also offers a Deferred Compensation Plan. This plan allows eligible employees to save for retirement on a pretax basis through voluntary salary deferral contributions. The contributions grow tax-deferred until withdrawal during retirement. 5. Retiree Health Care Savings Plan (RHC SP): Oakland County provides a dedicated savings plan for retirees to accumulate funds to cover their healthcare expenses during retirement. This plan allows retirees to save pre-tax dollars towards future medical costs. The Oakland Michigan Retirement Benefits Plans aim to provide retirement security through well-structured programs that ensure financial stability and essential benefits for eligible employees and retirees. The availability and specifics of each plan may vary depending on the participant's employment status, organization, or profession within the county.

Oakland Michigan Retirement Benefits Plan

Description

How to fill out Oakland Michigan Retirement Benefits Plan?

How much time does it typically take you to draft a legal document? Considering that every state has its laws and regulations for every life scenario, locating a Oakland Retirement Benefits Plan meeting all local requirements can be tiring, and ordering it from a professional lawyer is often expensive. Numerous web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, grouped by states and areas of use. Apart from the Oakland Retirement Benefits Plan, here you can get any specific form to run your business or personal affairs, complying with your county requirements. Professionals verify all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed sample, and download it. You can retain the file in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your Oakland Retirement Benefits Plan:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Oakland Retirement Benefits Plan.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

The Michigan State Employees' Retirement System (SERS) was established in 1943 to provide retirement, survivor and disability benefits to the state's government employees. The system provides a defined benefit (DB) pension for 18,376 active employees, and 56,288 retirees and beneficiaries.

The Government Pension Offset The Governmental Pension Offset affects SERS retirees who are, or will be, receiving a Social Security benefit based on their spouse's Social Security account. This includes qualifying on an ex-spouse's account. The GPO does not apply to the spouse's own Social Security benefit.

STRS is an educator-only pension fund for Ohio public school system teachers, while SERS provides pension benefits for non-teaching public school employees, such as administrative assistants, bus drivers, cafeteria works, custodians, librarians, maintenance workers, and teacher's aides.

With a graded vesting schedule, your company's contributions must vest at least 20% after two years, 40% after three years, 60% after four years, 80% after five years and 100% after six years. If enrollment is automatic and employer contributions are required, they must vest within two years.

A SERS pension provides lifetime retirement security in the form of regular and consistent benefit payments, which makes it easier for retirees stay on a budget. Retirement with SERS is a matter of eligibility. You must meet one of the age and service credit combinations to be eligible for a monthly, lifetime pension.

What happens to my account? If you withdraw your SERS account, your SERS membership and all service credit earned under your SERS-covered position will be cancelled, as well as any rights to SERS' retirement, disability, and survivor protections.

Service retirement is a lifetime benefit. Employees can retire as early as age 50 with five years of CalPERS pensionable service credit unless all service was earned on or after January 1, 2013, then employees must be at least age 52 to retire.

You will qualify for full retirement at age 60 with at least 10 years of service, or age 55 with 30 years of service. (Exception: If you are an unclassified legislative branch, executive branch, or judicial branch employee, you are vested for a full retirement benefit at age 60 with 5 years of service.)

Service retirement is a lifetime benefit. In general, you can retire as early as age 50 with five years of service credit unless all service was earned on or after January 1, 2013. Then you must be at least age 52 to retire. There are some exceptions to the 5-year requirement.

You are in the Defined Contribution Plan administered by Prudential Retirement. You can access your account information by phone at 833-OAK-GOV1 (833-625-4681) or via the website at COUNTY200b EMPLOYEES RETIREMENT SAVINGS PLAN 401(a) 200b Yrs of Service Completed% Vested58061003 more rows