Allegheny Pennsylvania Approval of Savings Plan for Employees: In Allegheny, Pennsylvania, the local authorities have taken a proactive step by approving a savings plan for employees. This initiative aims to support the financial well-being of the working population in the region. The approved savings plan offers numerous benefits and opportunities for employees to save for their future and achieve their financial goals. The Allegheny Pennsylvania Approval of Savings Plan for Employees provides a variety of options tailored to meet different individuals' needs and circumstances. These plans include: 1. Traditional 401(k) Plan: This retirement savings plan allows employees to contribute a portion of their pre-tax income towards their retirement savings. Employers may also match a percentage of the employee's contribution, enhancing the potential for long-term growth. By participating in this plan, employees can benefit from tax advantages and secure their financial future post-retirement. 2. Roth 401(k) Plan: This plan operates similarly to the traditional 401(k) plan; however, contributions are made with post-tax income. Though employees do not receive upfront tax benefits, their withdrawals during retirement are tax-free. The Roth 401(k) plan provides an opportunity for employees to diversify their retirement savings and potentially reduce their taxable income in retirement. 3. Employee Stock Ownership Plan (ESOP): The ESOP is designed to empower employees by allowing them to own a stake in the company they work for. As employees accumulate shares over time, they become vested owners. This plan facilitates both retirement savings and aligns the employees' interests with the company's success, fostering a sense of ownership, loyalty, and motivation. 4. Flexible Savings Account (FSA): The FSA enables employees to allocate pre-tax dollars towards qualified medical expenses and dependent care costs. By utilizing this plan, employees can reduce their taxable income and save money on eligible healthcare and dependent care expenses. 5. Health Savings Account (HSA): This plan is available for employees enrolled in a high-deductible health insurance plan. Contributions are made on a pre-tax basis and can be withdrawn tax-free for qualified medical expenses. The HSA encourages employees to take control of their healthcare expenses and save for future medical needs. Overall, the Allegheny Pennsylvania Approval of Savings Plan for Employees aims to create a financially secure future for employees in the region. By offering a range of retirement and healthcare savings options, employees can customize their savings strategies to meet their unique goals and circumstances. This initiative demonstrates the commitment of Allegheny, Pennsylvania, to prioritize the financial well-being and long-term stability of its workforce.

Allegheny Pennsylvania Approval of savings plan for employees

Description

How to fill out Allegheny Pennsylvania Approval Of Savings Plan For Employees?

Whether you plan to open your company, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you must prepare certain paperwork meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business case. All files are grouped by state and area of use, so opting for a copy like Allegheny Approval of savings plan for employees is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several additional steps to get the Allegheny Approval of savings plan for employees. Follow the instructions below:

- Make sure the sample fulfills your individual needs and state law regulations.

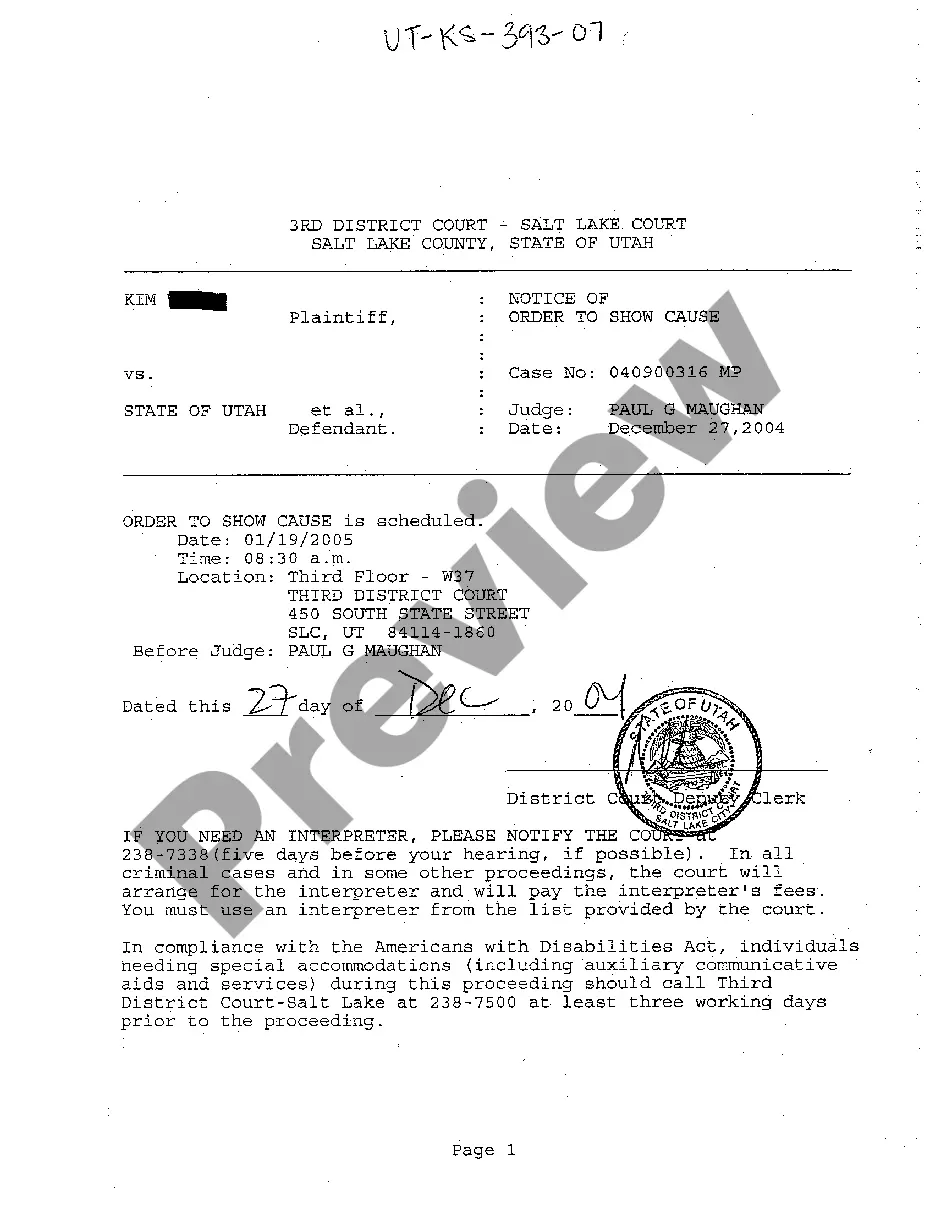

- Read the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the sample once you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Allegheny Approval of savings plan for employees in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you can access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!