Fulton Georgia, situated in north-central Georgia, is a bustling county that houses numerous businesses and organizations. One of the progressive initiatives taken by employers in Fulton Georgia is the Approval of Savings Plans for Employees, which aims to provide financial stability and benefits to their workforce. The savings plan is designed to empower employees by offering them the opportunity to set aside a portion of their salary for retirement or emergency needs, while also providing potential tax advantages. With the Approval of Savings Plans for Employees, workers in Fulton Georgia can develop a comprehensive financial strategy and gain peace of mind regarding their future financial security. There are various types of savings plans available to employees in Fulton Georgia, customized to cater to their unique needs. The most common types include: 1. 401(k) Plan: This well-known retirement savings plan allows employees to contribute a portion of their pre-tax salary towards their retirement fund. Employers often match a certain percentage of the employee's contributions, boosting their overall savings. 2. Roth 401(k) Plan: Similar to a traditional 401(k) plan, the Roth option allows employees to make after-tax contributions. The advantage of this plan is that qualified withdrawals during retirement are tax-free, providing potential tax advantages. 3. Individual Retirement Accounts (IRAs): Employers may also offer IRAs, which are personal retirement savings accounts. These accounts can be funded with pre-tax or after-tax contributions, depending on the type of IRA (Traditional or Roth). Employees can have more control over their investment choices with IRAs. 4. Employee Stock Ownership Plans (Sops): Some employers in Fulton Georgia may offer Sops, which allow employees to become shareholders of the company through stock ownership. Sops provide employees with a vested interest in the company's success and can serve as a long-term savings vehicle. 5. 403(b) Plan: Primarily offered by non-profit organizations and educational institutions, a 403(b) plan is similar to a 401(k) plan but is designed for employees in the non-profit sector. It enables employees to contribute towards their retirement savings in a tax-advantaged manner. Employers in Fulton Georgia recognize the importance of financial planning and understand that offering savings plans enhances employee satisfaction and loyalty. The Approval of Savings Plans for Employees not only promotes long-term financial security but also demonstrates the commitment of employers towards their workforce's overall well-being. By providing a variety of savings plan options, employers in Fulton Georgia encourage employees to take control of their financial future and work towards achieving their retirement goals.

Fulton Georgia Approval of savings plan for employees

Description

How to fill out Fulton Georgia Approval Of Savings Plan For Employees?

Laws and regulations in every area vary around the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Fulton Approval of savings plan for employees, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for various life and business situations. All the forms can be used many times: once you purchase a sample, it remains available in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Fulton Approval of savings plan for employees from the My Forms tab.

For new users, it's necessary to make some more steps to get the Fulton Approval of savings plan for employees:

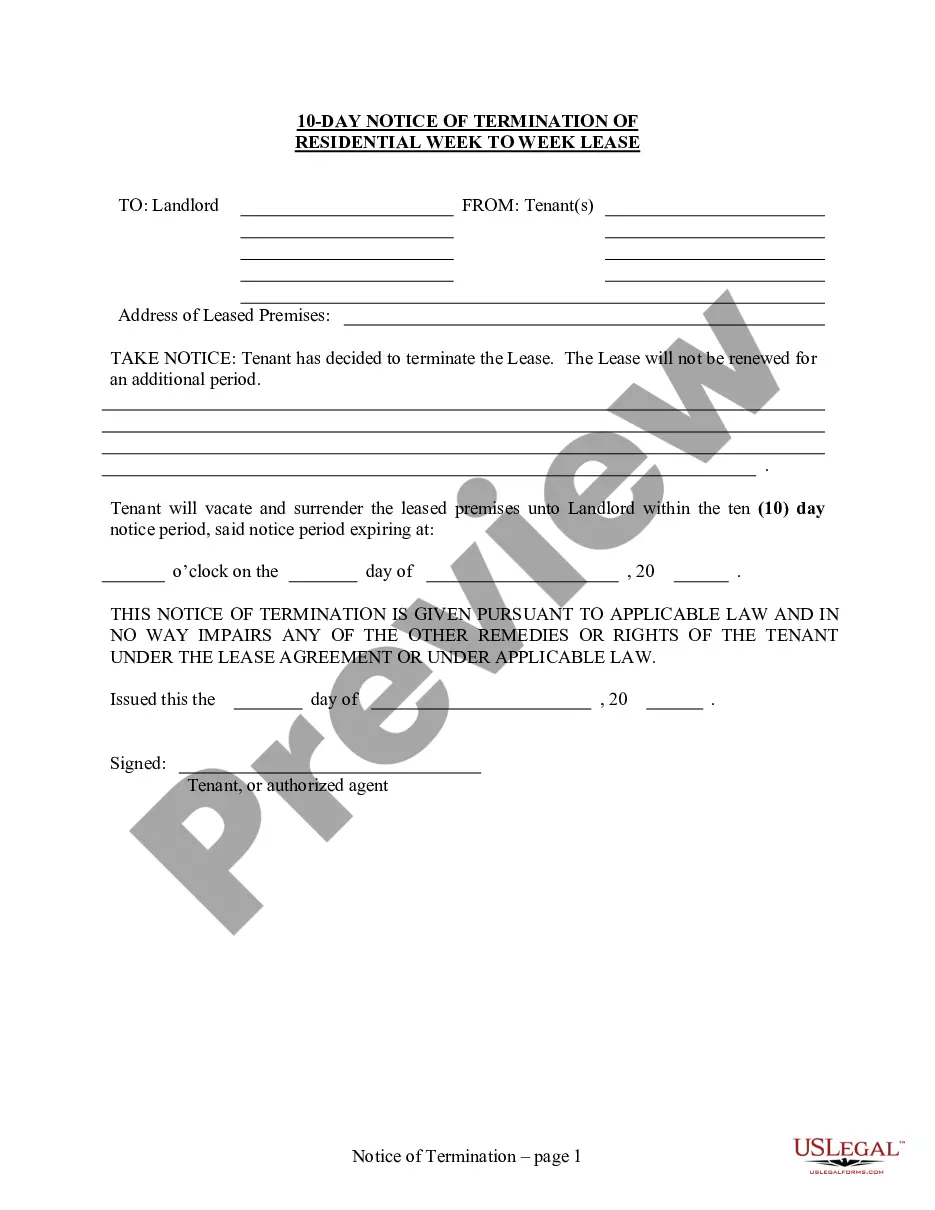

- Analyze the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the template when you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!