Maricopa, Arizona is a vibrant city located in Pinal County, known for its scenic views, thriving community, and opportunities for growth. One significant aspect of Maricopa is the approval of savings plans for employees, which aims to provide financial stability and security for its workforce. The Maricopa Arizona Approval of savings plan for employees encompasses various types of retirement and savings options designed to meet the diverse needs of employees. These plans include: 1. 401(k) Plan: The 401(k) plan allows employees to contribute a portion of their pre-tax income towards retirement savings, which can grow tax-free until withdrawal during retirement. 2. Profit-Sharing Plan: Maricopa may also implement a profit-sharing plan where a percentage of the company's profits are distributed among eligible employees, helping them save for retirement while sharing in the organization's success. 3. Pension Plans: Some employees may have access to traditional pension plans, which provide a guaranteed income for retirees based on years of service and salary history. 4. Roth IRA: In addition to employer-sponsored plans, Maricopa may offer employees the option to contribute to a Roth Individual Retirement Account (IRA). Roth IRAs are funded with after-tax dollars, allowing for future tax-free withdrawals during retirement. 5. Health Savings Account (HSA): Maricopa might further encourage employee savings by offering Health Savings Accounts (Has). Has been tax-advantaged accounts that employees can use to save for medical expenses, providing greater financial security related to healthcare costs. By approving these diverse savings plans, Maricopa demonstrates its commitment to its employees' financial well-being. Providing multiple options ensures that employees can choose the savings mechanism that aligns best with their financial goals, risk tolerance, and individual circumstances. Overall, the Maricopa Arizona Approval of savings plan for employees demonstrates the city's efforts to empower its workforce with valuable tools for long-term financial stability, retirement planning, and enhanced peace of mind. These savings plan play a vital role in supporting Maricopa's employees in achieving their financial dreams and promoting a prosperous community for all.

Maricopa Arizona Approval of savings plan for employees

Description

How to fill out Maricopa Arizona Approval Of Savings Plan For Employees?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to draft some of them from the ground up, including Maricopa Approval of savings plan for employees, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in various types varying from living wills to real estate papers to divorce documents. All forms are arranged according to their valid state, making the searching process less challenging. You can also find detailed resources and guides on the website to make any activities related to paperwork execution simple.

Here's how to locate and download Maricopa Approval of savings plan for employees.

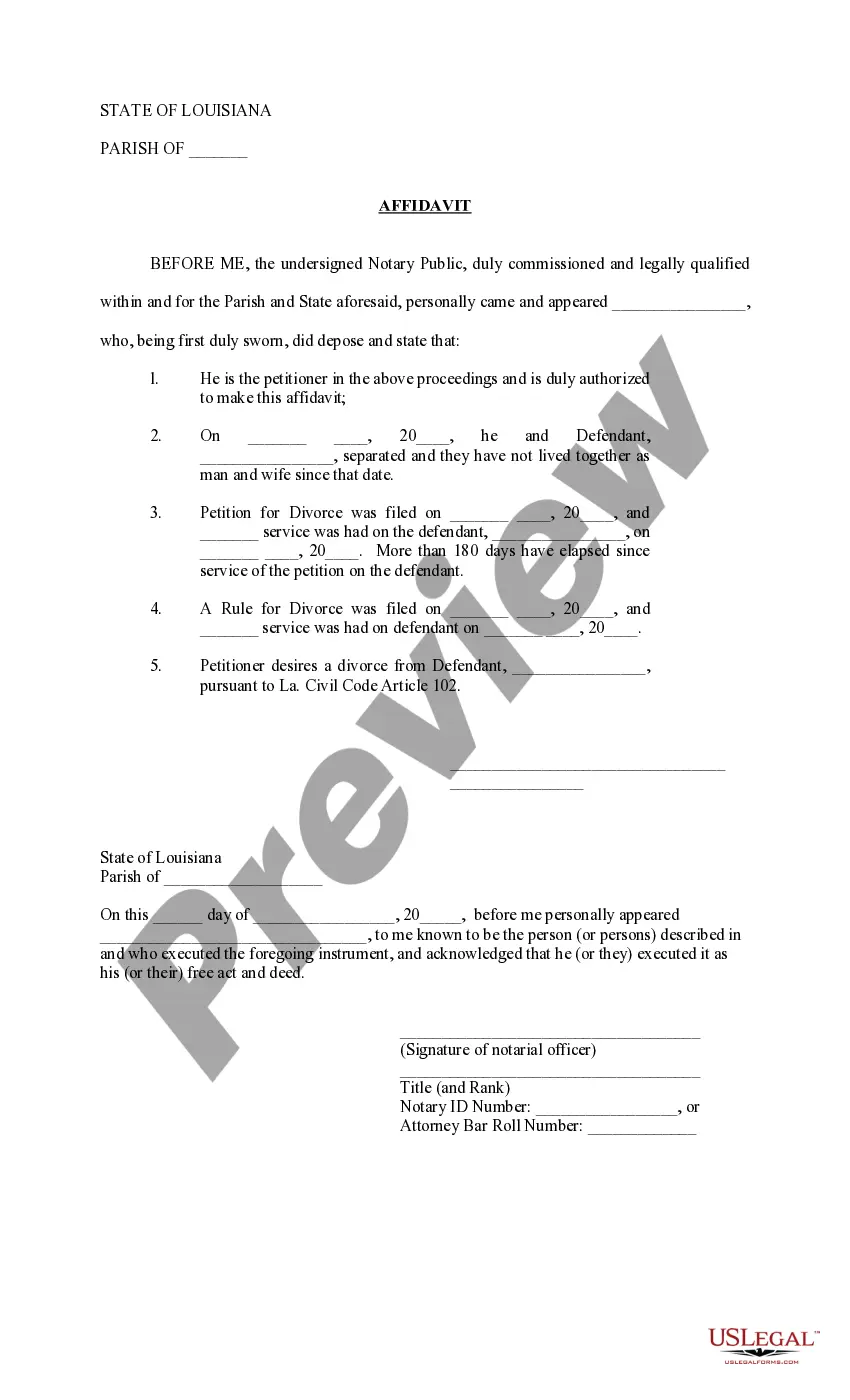

- Go over the document's preview and outline (if available) to get a basic information on what you’ll get after downloading the document.

- Ensure that the document of your choice is specific to your state/county/area since state regulations can impact the legality of some records.

- Check the related document templates or start the search over to find the correct file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a suitable payment gateway, and purchase Maricopa Approval of savings plan for employees.

- Choose to save the form template in any available file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Maricopa Approval of savings plan for employees, log in to your account, and download it. Needless to say, our platform can’t take the place of a lawyer entirely. If you need to deal with an exceptionally difficult situation, we advise using the services of an attorney to review your form before signing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of customers. Become one of them today and purchase your state-specific documents effortlessly!