Maricopa Arizona Savings Plan for Employees is a retirement savings vehicle specifically designed for employees of Maricopa, Arizona, and offered by the municipality as a tax-advantaged option to save for their future. This plan offers various retirement investment options tailored to meet the needs of employees, ensuring a secure and comfortable retirement. The Maricopa Arizona Savings Plan for Employees allows participants to contribute a portion of their salary on a pre-tax basis, lowering their taxable income while simultaneously building their nest egg for the future. Contributions to this plan are deducted automatically from the employee's paycheck, making it a convenient and effortless way to save for retirement. The Maricopa Arizona Savings Plan for Employees offers several investment options to choose from, allowing participants to diversify their retirement portfolio according to their risk tolerance and financial goals. The plan provides access to a range of funds, including but not limited to stocks, bonds, and mutual funds, carefully selected to maximize potential returns while minimizing risk. One of the specific types of Maricopa Arizona Savings Plan for Employees is the Traditional 401(k) plan, which allows employees to contribute a portion of their salary on a pre-tax basis, potentially lowering their current taxable income. The contributions made to this plan grow tax-deferred until retirement, at which point they are subject to income tax when withdrawn. This plan is a popular choice for those looking to reduce their taxable income while benefiting from potential long-term growth. Another type of Maricopa Arizona Savings Plan for Employees is the Roth 401(k) plan, which offers participants the option to make after-tax contributions. While these contributions do not provide immediate tax benefits, the plan allows for tax-free growth and tax-free withdrawals in retirement. The Roth 401(k) plan is an excellent choice for employees who anticipate being in a higher tax bracket during retirement or who want to enjoy tax-free income later in life. Additionally, the Maricopa Arizona Savings Plan for Employees may offer other retirement savings options such as a 457(b) plan, which is a deferred compensation plan available to certain government and non-profit employees. This plan allows participants to defer a portion of their salary on a pre-tax basis, similar to a Traditional 401(k) plan, and enjoy tax-deferred growth until withdrawals. Maricopa Arizona Savings Plan for Employees provides employees with a range of retirement savings options to suit their individual financial situations and goals. By participating in these plans, Maricopa employees can take control of their retirement and work towards a financially secure future.

Maricopa Arizona Savings Plan for Employees

Description

How to fill out Maricopa Arizona Savings Plan For Employees?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare formal documentation that varies from state to state. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. Here, you can easily locate and get a document for any personal or business objective utilized in your county, including the Maricopa Savings Plan for Employees.

Locating templates on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Maricopa Savings Plan for Employees will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guideline to obtain the Maricopa Savings Plan for Employees:

- Ensure you have opened the correct page with your localised form.

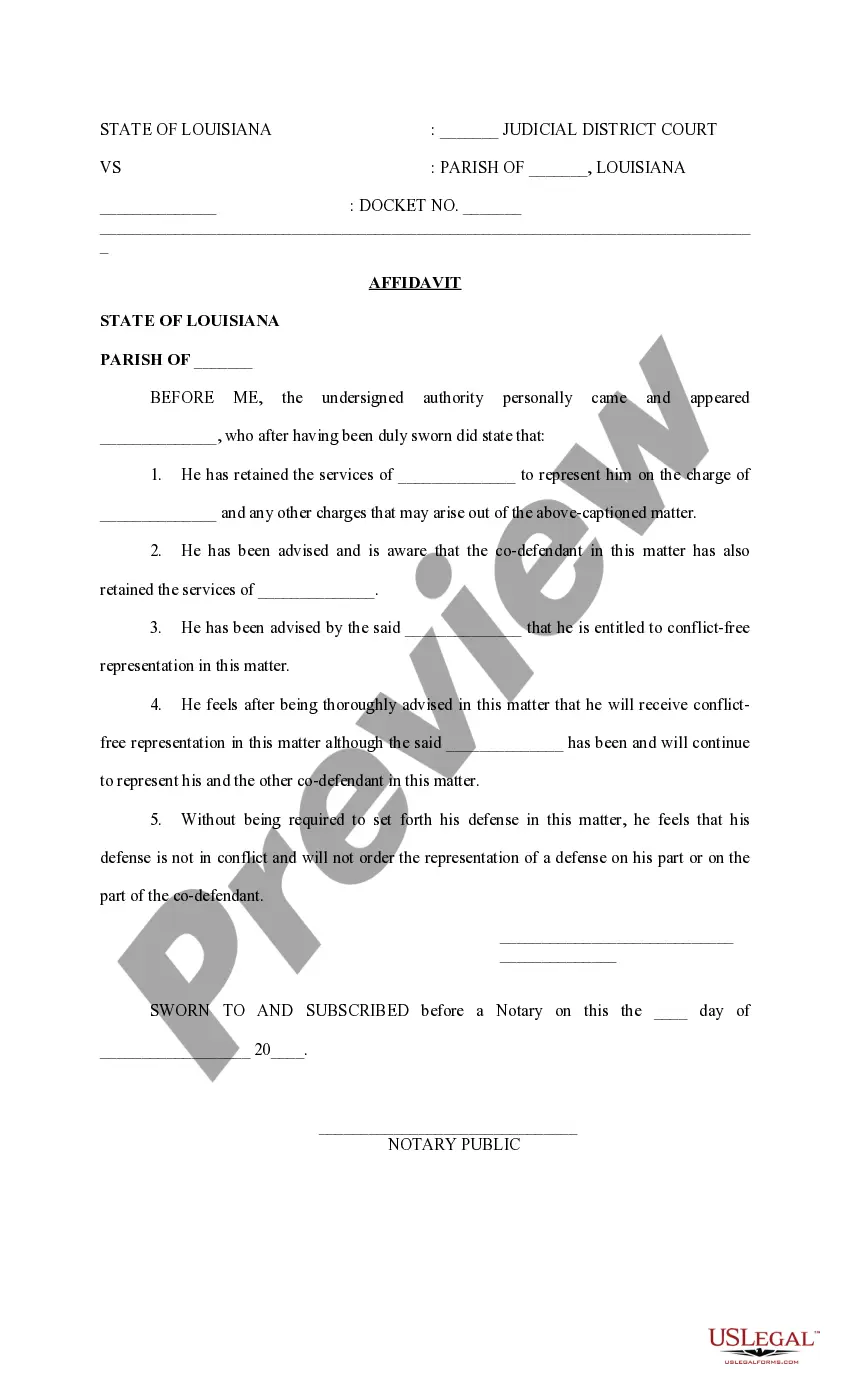

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template satisfies your requirements.

- Look for another document using the search option if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Select the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Maricopa Savings Plan for Employees on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!