The Maricopa Arizona Employees Savings Thrift Plan is a retirement savings plan offered to employees of Maricopa, Arizona. This comprehensive plan allows employees to save and invest a portion of their income for their retirement years. Keywords: Maricopa Arizona, Employees Savings Thrift Plan, retirement savings, retirement years, invest, income. Maricopa Arizona offers different types of Employees Savings Thrift Plans to cater to the specific needs of its employees. Some commonly known types include: 1. Traditional 401(k) Plan: This retirement savings plan allows employees to contribute a portion of their pre-tax income towards their retirement savings. The contributions grow tax-deferred until withdrawal, providing potential tax advantages for participants. 2. Roth 401(k) Plan: Similar to the traditional 401(k) plan, the Roth 401(k) allows employees to contribute a portion of their after-tax income towards retirement savings. The contributions are made with post-tax dollars, and withdrawals during retirement are typically tax-free. 3. Matching Contributions Plan: Maricopa Arizona may offer a matching contribution as an incentive for employees to save for retirement. Under this plan, the employer matches a certain percentage of the employee's contributions to their savings thrift plan, encouraging higher participation rates and potentially boosting retirement savings. 4. Vesting Schedule: Employees participating in the Maricopa Arizona Employees Savings Thrift Plan may be subject to a vesting schedule. This schedule outlines the period of time an employee must work for the employer to fully own the employer's matching contributions. Vesting ensures that employees remain committed to the organization while accumulating retirement savings. Maricopa Arizona understands the importance of retirement planning and offers the Employees Savings Thrift Plan to support its employees in securing their financial future. The plan allows participants to choose from various investment options, such as stocks, bonds, and mutual funds, tailored to their risk tolerance and long-term retirement goals. Through regular contributions and potential employer matches, employees have the opportunity to build a substantial retirement nest egg over time.

Maricopa Arizona Employees Savings Thrift Plan

Description

How to fill out Maricopa Arizona Employees Savings Thrift Plan?

How much time does it usually take you to draw up a legal document? Since every state has its laws and regulations for every life scenario, finding a Maricopa Employees Savings Thrift Plan meeting all local requirements can be stressful, and ordering it from a professional lawyer is often pricey. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, grouped by states and areas of use. In addition to the Maricopa Employees Savings Thrift Plan, here you can get any specific document to run your business or personal deeds, complying with your regional requirements. Experts verify all samples for their actuality, so you can be certain to prepare your documentation properly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can pick the document in your profile at any time in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Maricopa Employees Savings Thrift Plan:

- Check the content of the page you’re on.

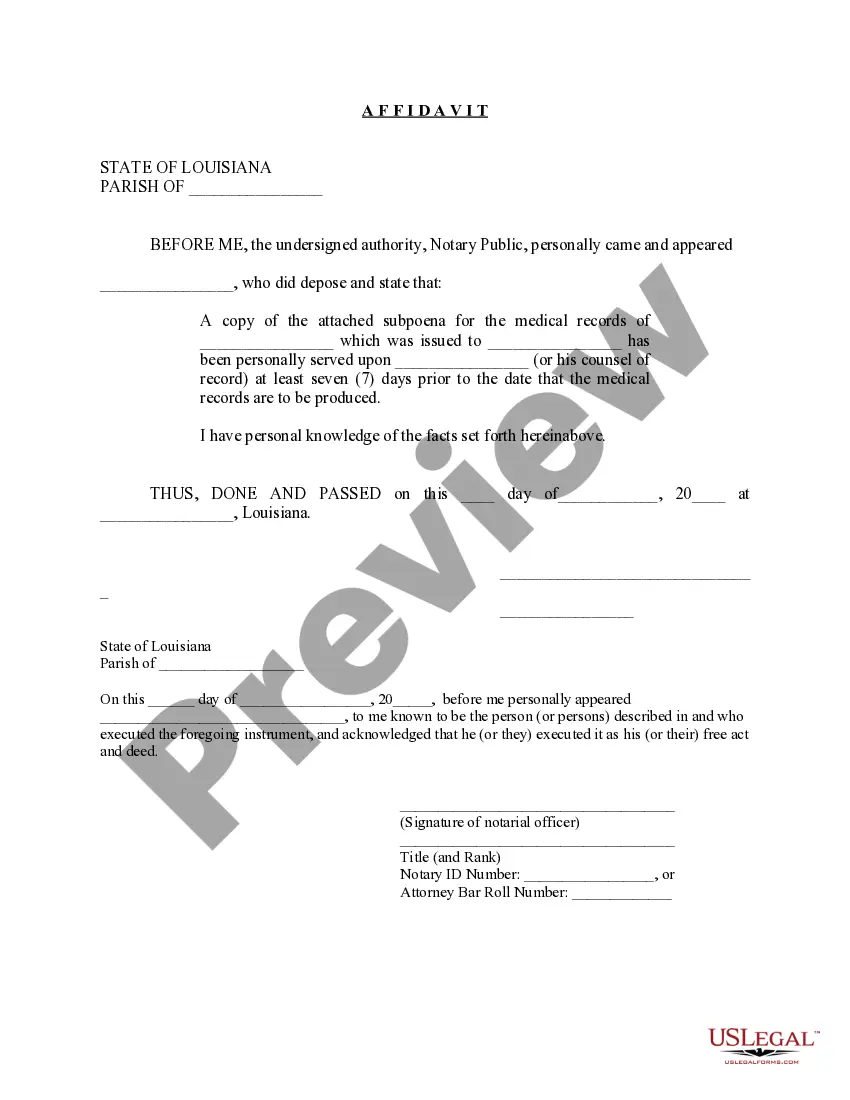

- Read the description of the sample or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Maricopa Employees Savings Thrift Plan.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!