The Philadelphia Pennsylvania Employees Savings Thrift Plan is a retirement savings plan offered to the employees of the city of Philadelphia, Pennsylvania. It is designed to provide a secure and flexible way for employees to save for their future and achieve financial security during their retirement years. This employee benefits program allows participants to contribute a portion of their salary towards their retirement savings, which is invested in a variety of investment options offered within the plan. The Philadelphia Pennsylvania Employees Savings Thrift Plan offers several types of investment funds to cater to the varying risk tolerance and investment preferences of its participants. One of the main benefits of this plan is that participants have control over their investment choices. They can invest their contributions in various asset classes such as stocks, bonds, and mutual funds to create a diversified portfolio. The plan also provides tools and resources to help participants make informed investment decisions, including investment education seminars and webinars. Another key feature of the Philadelphia Pennsylvania Employees Savings Thrift Plan is that it offers a matching contribution from the employer. The plan may match a certain percentage of the employee's contribution, which serves as an additional incentive to save for retirement. This employer match helps to accelerate the growth of the participants' retirement savings and maximize their overall benefit. Additionally, the Philadelphia Pennsylvania Employees Savings Thrift Plan provides participants with the ability to take loans or make hardship withdrawals in certain circumstances, which can provide a degree of financial flexibility during times of need. However, it is important to note that these options may come with specific eligibility criteria and restrictions. Overall, the Philadelphia Pennsylvania Employees Savings Thrift Plan aims to provide a comprehensive retirement savings solution that encourages employees to save for their future. By offering a variety of investment options, education resources, and employer matching contributions, the plan aims to ensure that participants can enjoy a financially secure retirement.

Philadelphia Pennsylvania Employees Savings Thrift Plan

Description

How to fill out Philadelphia Pennsylvania Employees Savings Thrift Plan?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare official documentation that differs from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and download a document for any individual or business purpose utilized in your county, including the Philadelphia Employees Savings Thrift Plan.

Locating forms on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Philadelphia Employees Savings Thrift Plan will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guide to obtain the Philadelphia Employees Savings Thrift Plan:

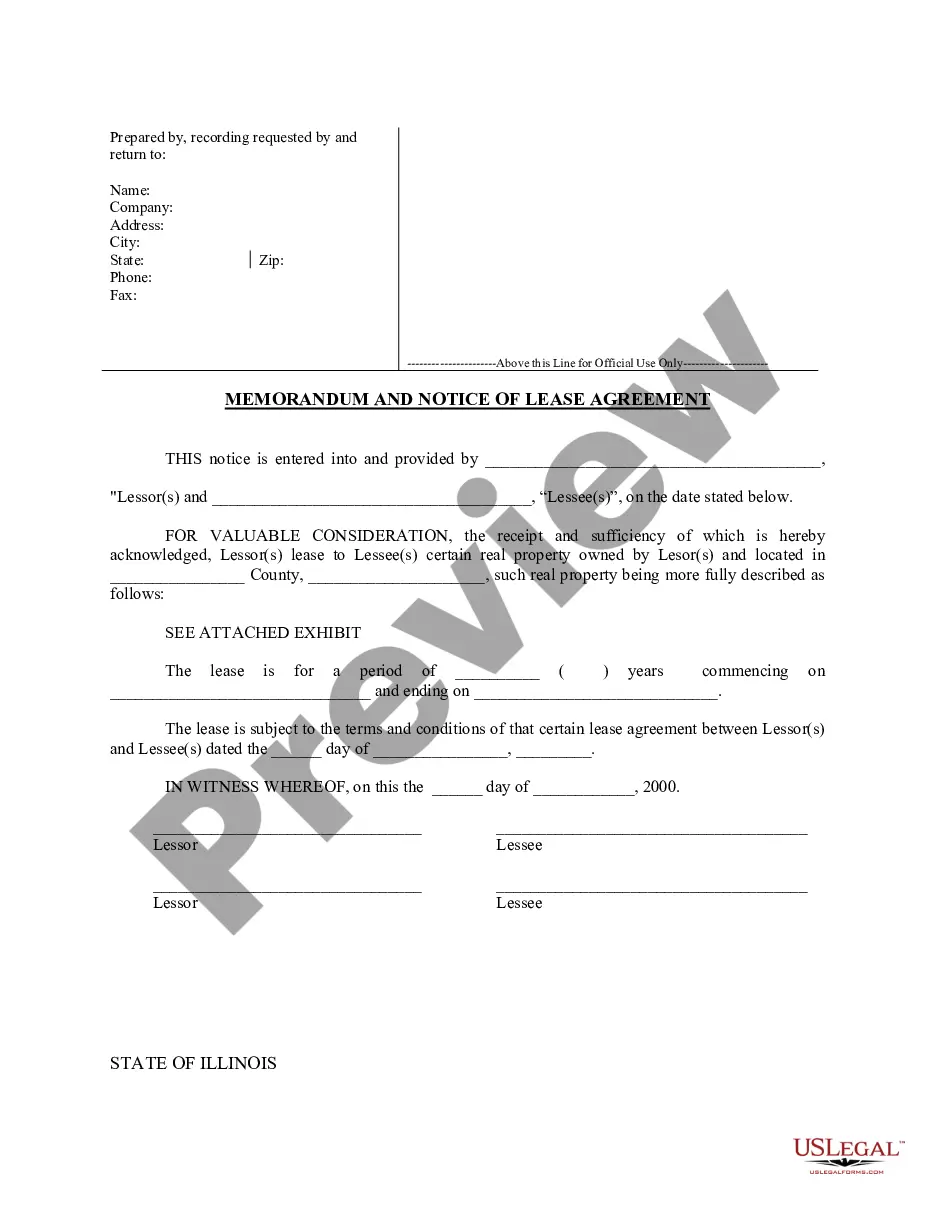

- Make sure you have opened the right page with your local form.

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template meets your requirements.

- Look for another document via the search option if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Philadelphia Employees Savings Thrift Plan on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!