Bronx New York Profit Sharing Plan is a retirement savings plan offered to employees in the Bronx area of New York City. It is designed to provide employees with an additional source of income during their retirement years. The plan allows employers to contribute a portion of their profits to their employees' retirement accounts, which can grow tax-free until they are withdrawn. The Bronx New York Profit Sharing Plan offers several types of investment options to cater to individual preferences and risk tolerances. These options include stocks, bonds, mutual funds, and money market accounts. Employees can choose how their contributions are allocated among these investment options, based on their long-term financial goals and risk appetite. One of the common types of Bronx New York Profit Sharing Plan is a 401(k) plan. In this plan, employees can contribute a portion of their pre-tax income to their retirement account, and their employer may match a certain percentage of this contribution. This type of plan is popular among employers as it offers tax benefits for both the employees and the company. Another type of profit sharing plan is known as the Employee Stock Ownership Plan (ESOP). This plan allows employees to own a portion of the company's stock. As the company's value increases, so does the value of the employee's shares. Upon retirement, employees can either sell their shares back to the company or transfer them to other employees. Bronx New York Profit Sharing Plans are governed by the Employee Retirement Income Security Act (ERICA) regulations, which aim to protect employees' rights and ensure the plan's financial stability. ERICA requires employers to provide detailed information about the plan, including investment options, fees, and vesting schedules, to help employees make informed decisions regarding their retirement savings. In conclusion, the Bronx New York Profit Sharing Plan is a retirement savings plan that allows employees in the Bronx area to benefit from their employers' profits. It offers various investment options and may include different types of plans, such as 401(k) and ESOP plans. The plan is regulated by ERICA to protect employees and ensure the plan's stability. Employees can take advantage of tax benefits and enjoy a secure retirement by participating in this profit sharing plan.

Bronx New York Profit Sharing Plan

Description

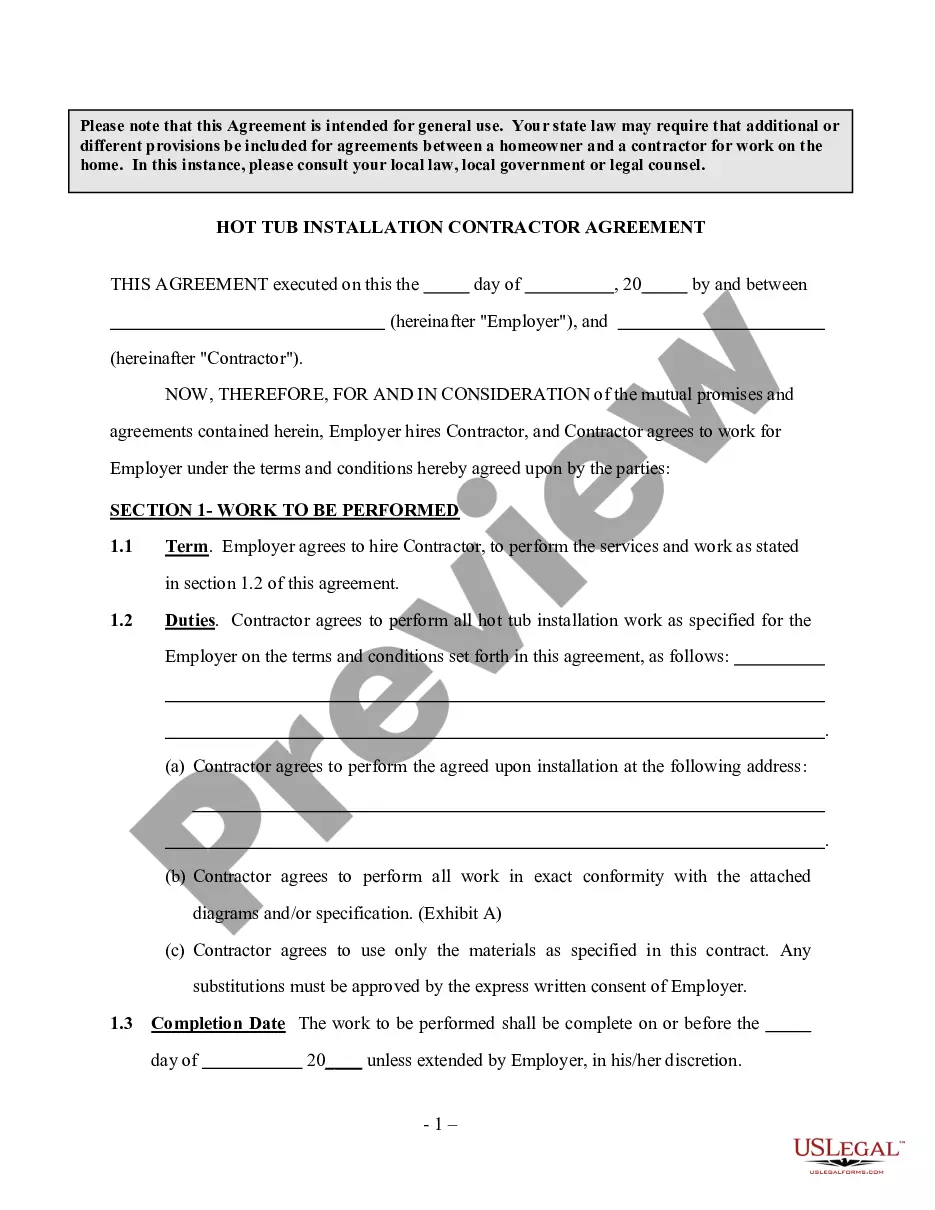

How to fill out Bronx New York Profit Sharing Plan?

Do you need to quickly create a legally-binding Bronx Profit Sharing Plan or probably any other document to take control of your personal or business affairs? You can go with two options: contact a professional to draft a legal paper for you or create it completely on your own. Thankfully, there's another option - US Legal Forms. It will help you receive neatly written legal documents without paying sky-high prices for legal services.

US Legal Forms offers a rich catalog of more than 85,000 state-specific document templates, including Bronx Profit Sharing Plan and form packages. We provide documents for an array of life circumstances: from divorce paperwork to real estate documents. We've been out there for more than 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and obtain the needed document without extra hassles.

- To start with, carefully verify if the Bronx Profit Sharing Plan is tailored to your state's or county's laws.

- In case the document comes with a desciption, make sure to check what it's intended for.

- Start the searching process over if the template isn’t what you were seeking by utilizing the search box in the header.

- Choose the subscription that is best suited for your needs and proceed to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the Bronx Profit Sharing Plan template, and download it. To re-download the form, just go to the My Forms tab.

It's effortless to buy and download legal forms if you use our catalog. Moreover, the documents we provide are updated by industry experts, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!