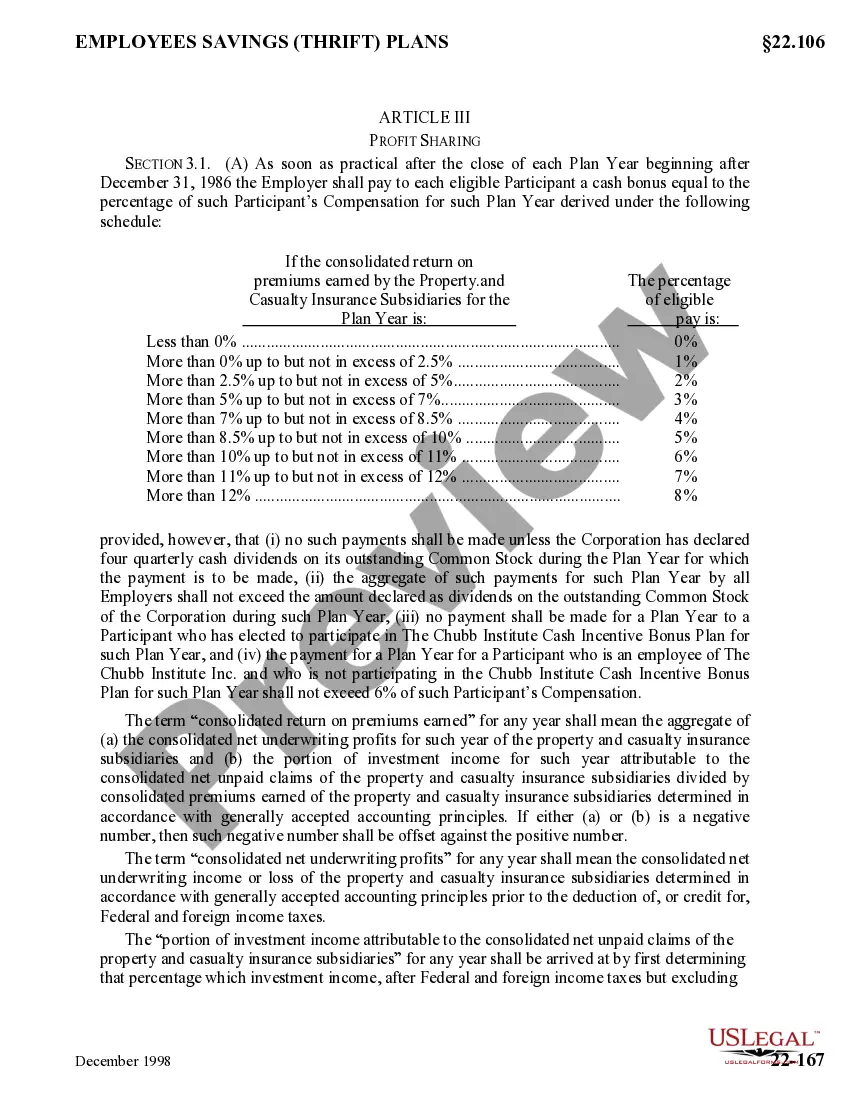

Fulton Georgia Profit Sharing Plan is a popular retirement benefit offered by many employers in Fulton, Georgia. This plan allows employees to share in the profits of the company, giving them an additional financial incentive to contribute to the organization's success. The Fulton Georgia Profit Sharing Plan is designed to provide long-term financial security to employees by offering them a share in the profits generated by the company. It is a defined contribution plan wherein employers make contributions into individual employee accounts based on a predetermined formula, usually tied to the company's profitability. One of the main advantages of the Fulton Georgia Profit Sharing Plan is that it helps to attract and retain talented employees. By offering this plan, employers demonstrate their commitment to rewarding employees for their hard work and dedication. There are several types of Fulton Georgia Profit Sharing Plans that an employer may choose to offer. The most common type is the traditional profit-sharing plan, where employers contribute a portion of the company's profits into eligible employee accounts. However, some employers may also offer a qualified cash or deferred arrangement (CODA), also known as a 401(k) profit-sharing plan, which allows employees to contribute a portion of their salary into their individual accounts on a pre-tax basis. Another variation of the Fulton Georgia Profit Sharing Plan is the employee stock ownership plan (ESOP), where eligible employees are offered company stock as part of their retirement benefits. This type of plan not only allows employees to share in the profits of the company but also provides them with potential stock market appreciation. Additionally, some Fulton Georgia Profit Sharing Plans may have vesting requirements, which determine when employees become entitled to the employer's contributions. Vesting schedules vary among different plans and employers, but typically require a certain number of years of service for full vesting. In conclusion, the Fulton Georgia Profit Sharing Plan is a valuable retirement benefit for employees in Fulton, Georgia. It allows them to accumulate funds for retirement, while also aligning their financial interests with the success of their employer. With different types of plans available, employers have the flexibility to choose the one that best suits their organization's needs and objectives.

Fulton Georgia Profit Sharing Plan

Description

How to fill out Fulton Georgia Profit Sharing Plan?

Preparing legal documentation can be cumbersome. In addition, if you decide to ask an attorney to draft a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Fulton Profit Sharing Plan, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario gathered all in one place. Consequently, if you need the current version of the Fulton Profit Sharing Plan, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Fulton Profit Sharing Plan:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the file format for your Fulton Profit Sharing Plan and download it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

How to Get Money Out of a Profit Sharing Plan Contact your plan administrator -- usually your employer -- and ask if you are allowed to withdraw the funds.Get a withdrawal form from the plan administrator and fill it out.Cash the check when you receive it or deposit it into your bank account.

If you're an S Corporation, LLC or a Partnership and want to make a profit sharing contribution that is deductible in 2021, you'll need to do it by March 15, 2022, unless you obtain an extension to file the entity's tax return by filing Form 7004 by that date.

When transferring money out of a profit-sharing plan into an IRA, you have the option to move a portion of the balance if you don't wish to transfer it all at once. You can also make multiple transfers, as the IRS doesn't impose a waiting period between transfers.

The solo 401(k) contribution deadline for employees is December 31, 2021. Employer profit-sharing contributions are generally accepted until your tax-filing deadline for the tax year.

Typically: You cannot withdraw money in a profit sharing plan before age 59 1/2 without a 10% early withdrawal penalty. But administrators of a profit sharing plan have more flexibility in deciding when a worker can make a penalty-free withdrawal than they would with a traditional 401(k).

GENERAL SAVINGS/PROFIT SHARING PLAN is a DEFINED CONTRIBUTION PLAN. This type of Plan generally establishes an account for each individual Participant where a defined amount is being contributed by the Participant, the employer or both.

Profit sharing is an incentivized compensation plan that gives employees a certain percentage of a company's profits. Employees receive an amount based on the business's earnings over a specified period of time, typically once per year.

sharing plan is a retirement plan that allows an employer or company owner to share the profits in the business, up to 25 percent of the company's payroll, with the firm's employees. The employer can decide how much to set aside each year, and any size employer can use the plan.

All eligible employees are eligible to receive an employer discretionary profit sharing contribution. It's up to the employer to decide how much of its profits it wishes to contribute, and they're capable of changing this amount.

Typically, the process of terminating a profit sharing plan includes amending the plan document, distributing all assets, and filing a final Form 5500. You must also notify your employees that the plan will be discontinued.