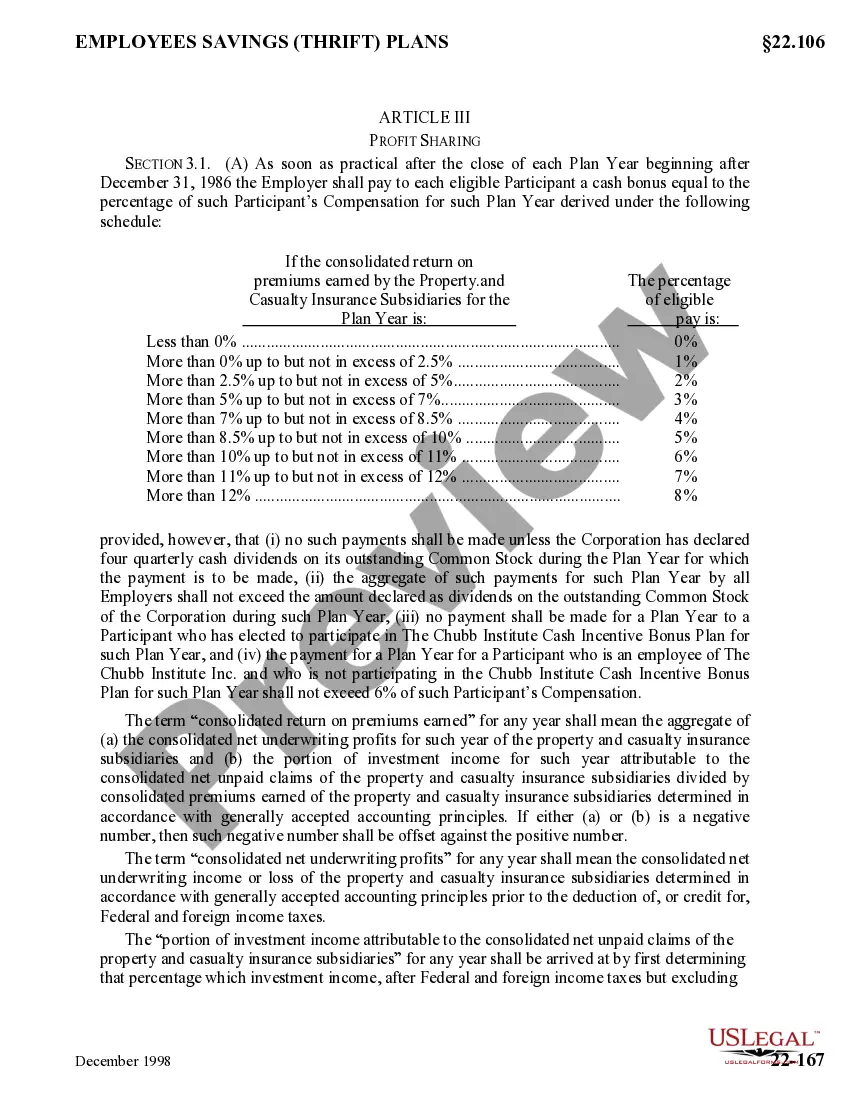

The Houston Texas Profit Sharing Plan is a financial arrangement designed to distribute a portion of the profits of a company or organization to its employees. It serves as an incentive for employees to contribute to the company's success while providing them with a way to accumulate savings for retirement or other financial goals. The plan operates by allocating a certain percentage of the company's profits to be distributed among eligible employees based on predetermined factors such as job performance, length of service, or salary level. One of the most common types of Houston Texas Profit Sharing Plan is a defined contribution plan. In this type of plan, employees are allowed to make voluntary contributions from their salary into an individual account. The employer may also make contributions, either in the form of a fixed percentage of profits or a discretionary amount. The contributions are usually invested in a variety of investment options such as mutual funds, stocks, bonds, or company stock. The ultimate value of the account depends on the performance of these investments. Another type of Houston Texas Profit Sharing Plan is a non-elective plan, where the employer makes contributions on behalf of all eligible employees regardless of their voluntary contributions. This type of plan has the advantage of benefiting all employees, including those who may not be able to afford to make their own contributions. There are also variations of the Houston Texas Profit Sharing Plan, such as age-weighted plans or new comparability plans. Age-weighted plans allocate a higher percentage of profits to older employees who are closer to retirement, recognizing the shorter time they have to benefit from the savings. On the other hand, new comparability plans allow employers to allocate different contribution percentages to different groups of employees based on factors such as job positions or compensation levels. Participating in a Houston Texas Profit Sharing Plan can provide several advantages for both employers and employees. For employers, it can help attract and retain top talent, motivate employees to perform better, and provide tax advantages for the company. Employees benefit from the opportunity to accumulate savings for retirement, potential employer contributions that enhance their retirement nest egg, and potential tax advantages such as tax-deferred growth or tax-free distributions. In summary, the Houston Texas Profit Sharing Plan is a flexible and customizable retirement savings plan that enables employers to share their profits with employees. It comes in various forms, including defined contribution plans, non-elective plans, age-weighted plans, and new comparability plans. By adopting such a plan, companies can incentivize their workforce, enhance employee engagement, and assist employees in building a secure financial future.

Houston Texas Profit Sharing Plan

Description

How to fill out Houston Texas Profit Sharing Plan?

Whether you intend to start your business, enter into a deal, apply for your ID update, or resolve family-related legal issues, you need to prepare certain paperwork meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business case. All files are grouped by state and area of use, so picking a copy like Houston Profit Sharing Plan is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of additional steps to obtain the Houston Profit Sharing Plan. Adhere to the guidelines below:

- Make sure the sample meets your personal needs and state law requirements.

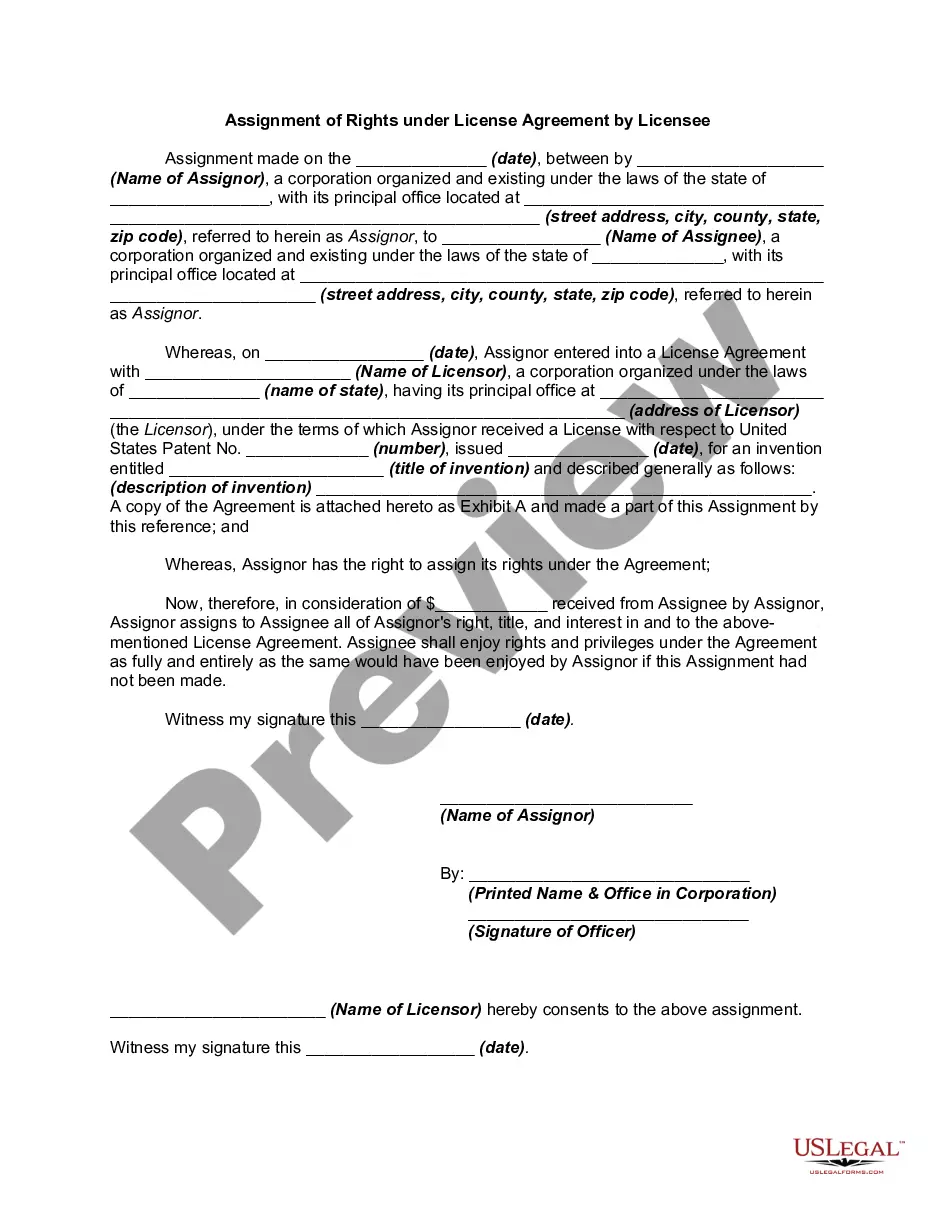

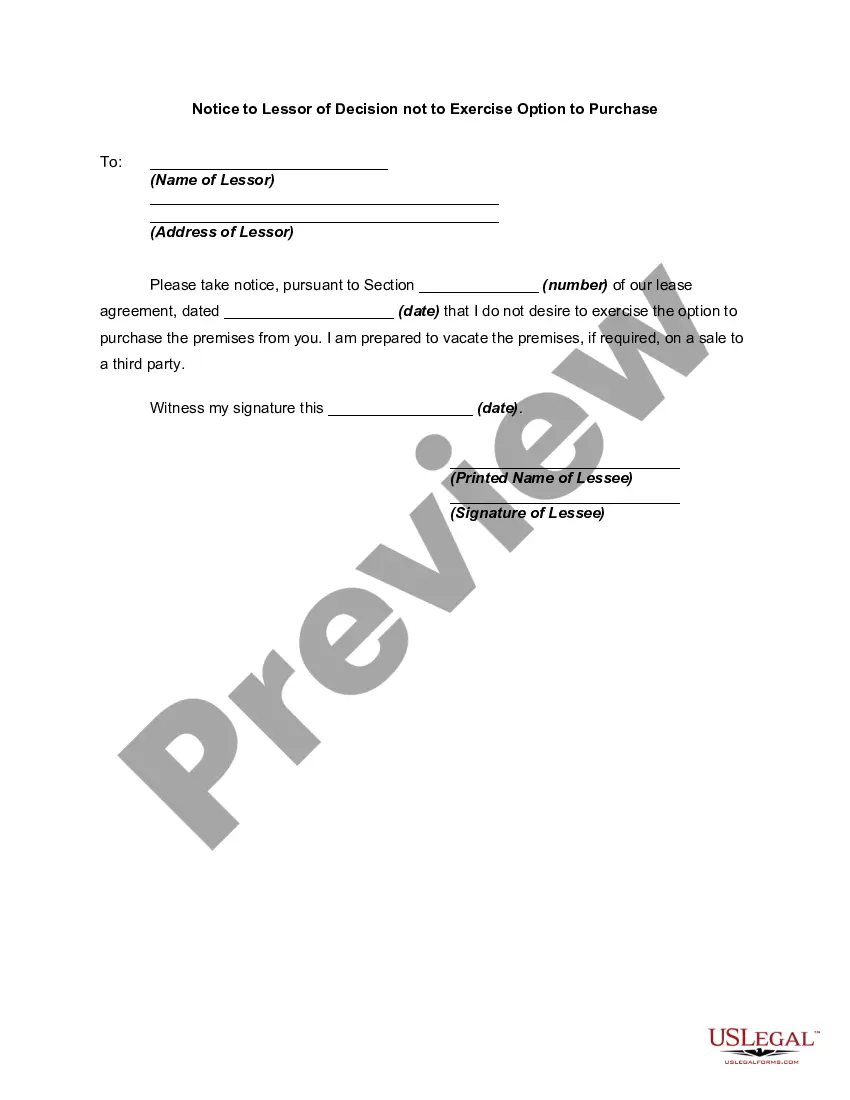

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to obtain the file once you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Houston Profit Sharing Plan in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you are able to access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!