Maricopa Arizona Profit Sharing Plan is a retirement savings plan offered by the city of Maricopa, Arizona, that allows employees to share in the profits of their employer. This plan is designed to provide employees with an additional source of income upon retirement, based on the performance and financial success of the organization. The Maricopa Arizona Profit Sharing Plan offers various benefits and features to eligible employees. These include tax advantages, employer contributions, and investment options. By participating in this plan, employees can contribute a portion of their pretax earnings to their retirement savings account, reducing their taxable income. One of the key advantages of the Maricopa Arizona Profit Sharing Plan is the employer match. The city of Maricopa may contribute a certain percentage of an employee's salary to their retirement account, increasing the overall savings. This employer match can vary based on employee contribution levels and specific plan rules. Another important aspect of this plan is investment options. The Maricopa Arizona Profit Sharing Plan provides employees with a range of investment choices to help grow their retirement savings. These options typically include mutual funds, stocks, bonds, and other investment vehicles. Participants have the flexibility to choose the investment strategy that aligns with their risk tolerance and retirement goals. In addition to the standard Maricopa Arizona Profit Sharing Plan, there may be variations or additional types of profit sharing plans available to employees. For example, there could be a tiered profit sharing plan that offers different employer contributions based on an employee's years of service or position within the organization. Additionally, there may be profit sharing plans specifically tailored for certain employee groups, such as public safety personnel or elected officials. Overall, the Maricopa Arizona Profit Sharing Plan provides employees with a valuable opportunity to save for retirement while benefiting from the financial success of the city. It is important for employees to carefully review the plan documents, understand the contribution limits and vesting schedules, and seek professional advice if needed to make the most of this retirement savings plan.

Maricopa Arizona Profit Sharing Plan

Description

How to fill out Maricopa Arizona Profit Sharing Plan?

Preparing paperwork for the business or personal needs is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state laws and regulations of the specific area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to draft Maricopa Profit Sharing Plan without professional help.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid Maricopa Profit Sharing Plan on your own, using the US Legal Forms web library. It is the greatest online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed form.

If you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Maricopa Profit Sharing Plan:

- Examine the page you've opened and check if it has the document you need.

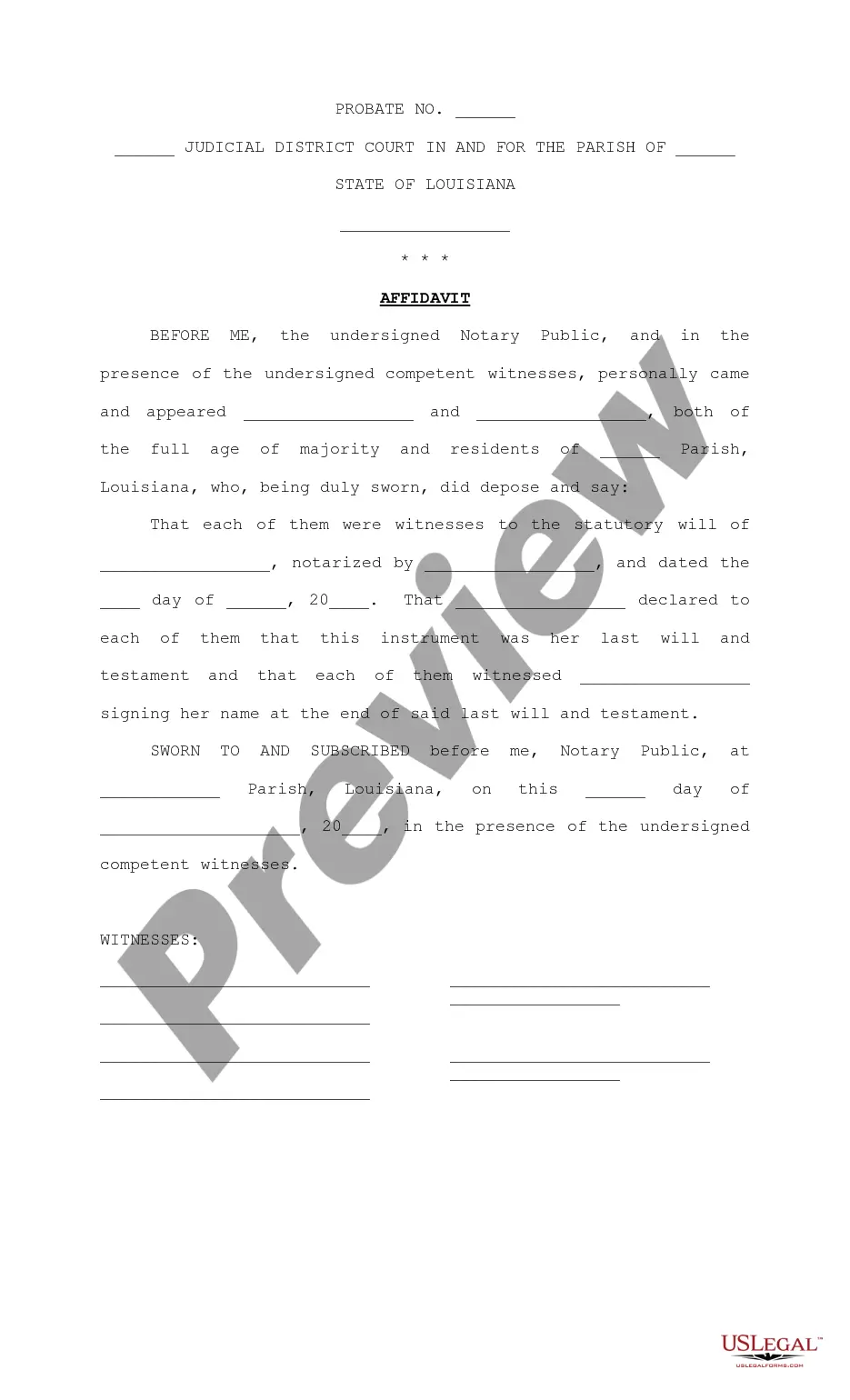

- To do so, use the form description and preview if these options are available.

- To find the one that meets your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any situation with just a couple of clicks!