San Jose California Profit Sharing Plan

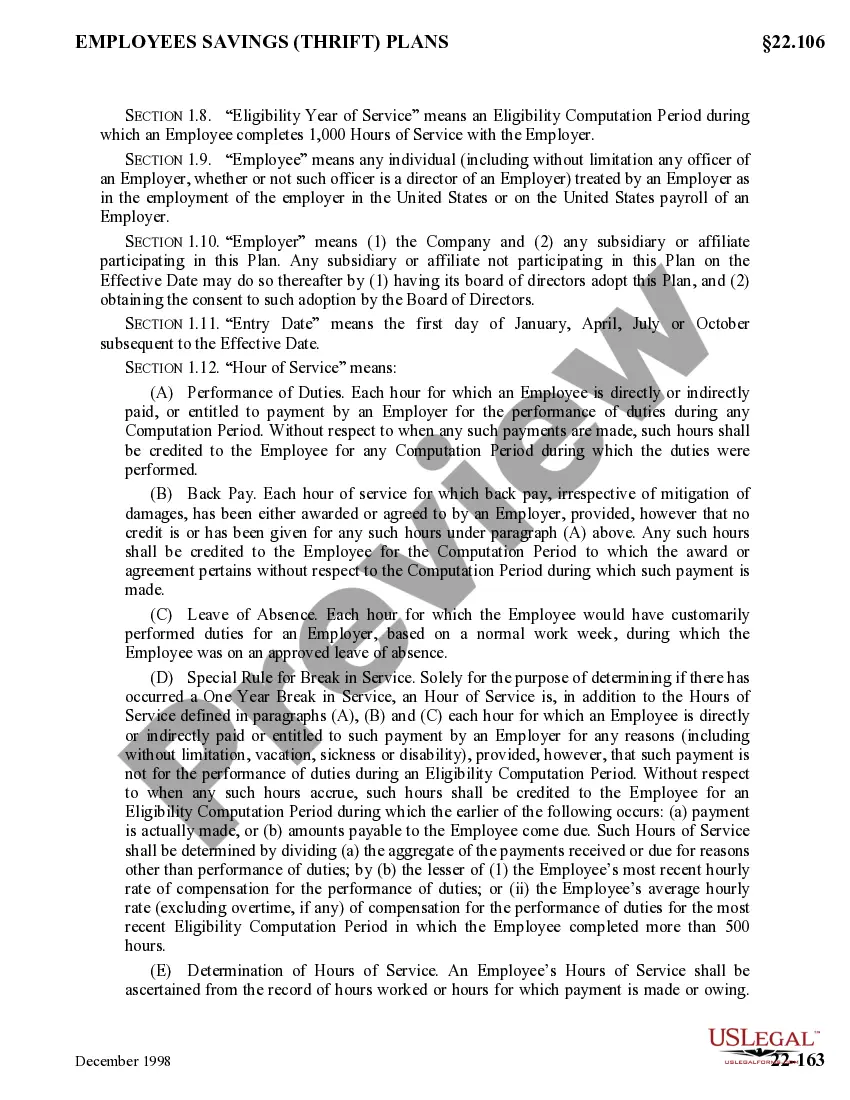

Description

How to fill out Profit Sharing Plan?

Do you need to swiftly develop a legally-enforceable San Jose Profit Sharing Plan or possibly any other document to address your personal or business concerns? You have two choices: engage a legal consultant to draft a legitimate document for you or create it entirely by yourself. Fortunately, there’s a third alternative - US Legal Forms. It will assist you in obtaining well-drafted legal documents without incurring excessive costs for legal assistance.

US Legal Forms provides an extensive collection of over 85,000 state-specific form templates, including the San Jose Profit Sharing Plan and additional form packages. We supply documents for a variety of applications: from divorce forms to real estate paperwork. We have been in operation for more than 25 years and have earned an impeccable reputation among our customers. Here’s how you can join them and secure the necessary template without hassle.

If you’ve already set up an account, you can conveniently Log In, locate the San Jose Profit Sharing Plan template, and download it. To retrieve the form again, simply navigate to the My documents section.

It's effortless to locate and download legal forms when you utilize our catalog. Furthermore, the templates we offer are revised by industry professionals, providing you additional reassurance when managing legal documents. Try US Legal Forms today and experience it for yourself!

- Initially, verify that the San Jose Profit Sharing Plan complies with your state’s or county’s regulations.

- If the form includes a description, ensure you understand its intended use.

- Begin your search anew if the form isn’t what you required by utilizing the search bar at the top.

- Select the subscription that best meets your requirements and proceed to payment.

- Choose the format in which you want to download your form and then download it.

- Print it, fill it out, and sign on the designated line.

Form popularity

FAQ

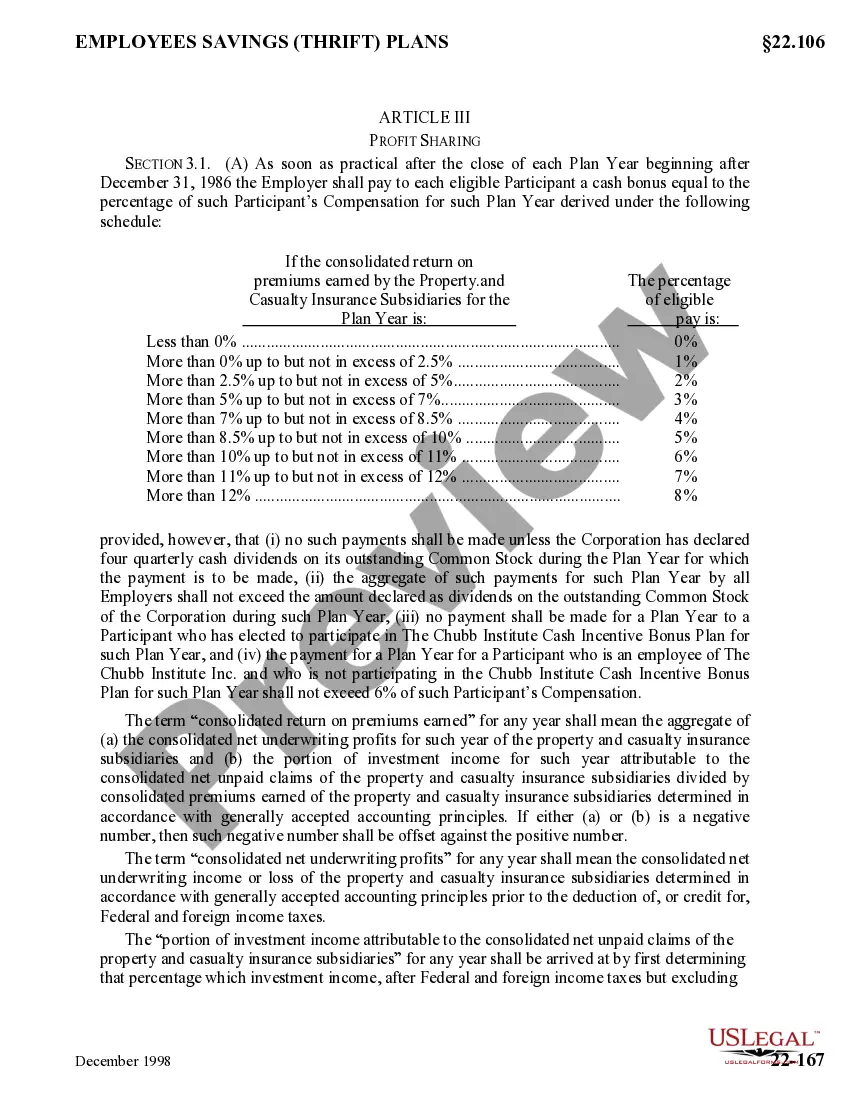

Typical profit-sharing percentages usually range from 3% to 15% of an employee's salary depending on the company's profits and policies. In a San Jose California Profit Sharing Plan, these percentages help align employee performance with company success. By distributing a reasonable share of profits, employers can motivate employees to perform at their best. However, each company should find a percentage that fits its financial capabilities and culture.

One major problem with profit-sharing plans involves potential inequities among employees. In the context of a San Jose California Profit Sharing Plan, some employees may feel overlooked if their contributions aren’t recognized. Additionally, market downturns can result in disappointing profit-sharing results. To mitigate these issues, businesses can implement transparent communication strategies and ensure everyone understands how contributions are calculated.

A good amount for profit-sharing can vary, but common percentages range from 3% to 10% of an employee’s earnings. In the framework of a San Jose California Profit Sharing Plan, setting a balance that is both motivating for employees and sustainable for the business is essential. Employers should consider their profit margins and company goals when determining the percentage. Ultimately, the right amount can enhance employee satisfaction and retention.

When you hear about 3% profit-sharing, it indicates that an employer allocates 3% of the company's profits to employees as a bonus. In the context of a San Jose California Profit Sharing Plan, this means that employees receive a portion of the profits based on their compensation levels and the company’s overall success. This approach helps build a strong team culture and rewards hard work. Remember, the exact benefit can vary among employees based on their roles and contributions.

The 6% profit-sharing rule refers to a common guideline used in San Jose California Profit Sharing Plans. Under this rule, employers may contribute up to 6% of each employee's earnings to the profit-sharing plan. This method encourages employees to be productive, as their contributions directly influence the company's profitability. Ultimately, it fosters a sense of ownership and motivates employees to work towards company goals.

To report profit-sharing accurately, ensure you file IRS Form 5500 for the San Jose California Profit Sharing Plan, detailing all contributions made during the tax year. Employees must also report their respective shares on their W-2 forms. Consistent and thorough record-keeping will make this process more manageable and help avoid potential penalties.

When reporting profit-sharing on your taxes for the San Jose California Profit Sharing Plan, you typically must include details in your personal or business tax return. Profit-sharing contributions are generally tax-deductible, which can reduce your taxable income. For clarity, it may be beneficial to consult with a tax professional or use tax software that supports these entries.

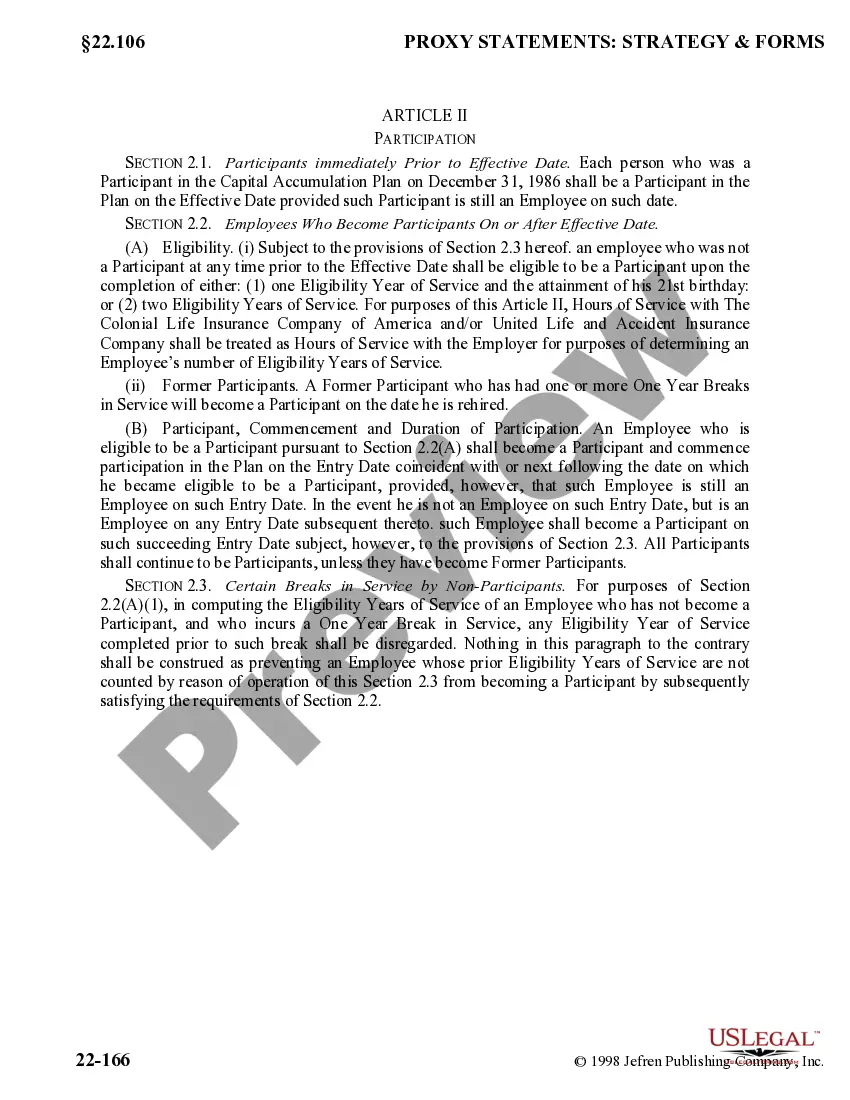

Setting up a San Jose California Profit Sharing Plan requires several steps, starting with defining your goals and eligibility criteria. You must draft a written plan document that complies with IRS regulations, often requiring legal assistance. Utilizing resources such as UsLegalForms can facilitate this process, providing templates and guidance to ensure your plan is properly structured.

Recording profit-sharing within the framework of the San Jose California Profit Sharing Plan involves maintaining accurate and up-to-date financial records. You should track contributions made on behalf of each employee and ensure they match your reports to the IRS. Using software or platforms like UsLegalForms can simplify this process and provide templates for necessary documentation.

For the San Jose California Profit Sharing Plan, the IRS allows a contribution limit of up to 25% of an employee's compensation or a maximum dollar limit, whichever is less. This limit applies to both individual and employer contributions. It is crucial to review these limits regularly, as they may change annually. Staying informed can help your business take full advantage of the potential tax benefits.