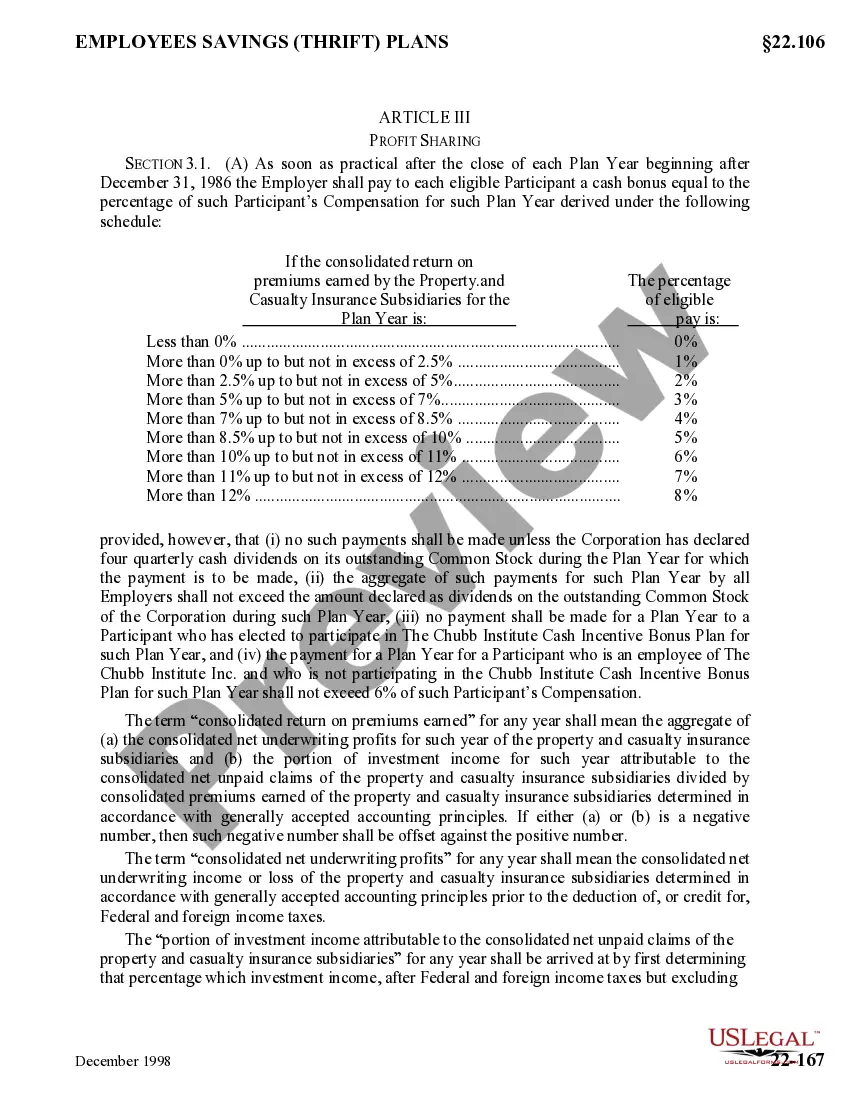

A Santa Clara California Profit Sharing Plan is a retirement benefit program organized by an employer to distribute a portion of the company's profits to eligible employees. This plan encourages employees to contribute to the company's success and provides them with an opportunity to receive a share of the profits generated. In Santa Clara, California, there are several types of profit-sharing plans available to employees. These plans may vary based on the specific guidelines outlined by each employer, but they typically aim to provide retirement benefits while aligning the interests of the employees with the prosperity of the company. One type of profit-sharing plan commonly found in Santa Clara, California, is the Traditional Profit Sharing Plan. This plan allows employers to contribute a portion of the company's profits to a retirement account for eligible employees, based on a predetermined formula. The contributions made by employers may be discretionary and may vary from year to year, depending on the financial performance of the company. Another type of profit-sharing plan in Santa Clara, California, is the Employee Stock Ownership Plan (ESOP). This plan provides employees with an ownership stake in the company, often through the granting or purchasing of company stocks. The value of these stocks can increase over time, providing employees with potential financial gains upon retirement or when the stocks are sold. Furthermore, there are also variations of profit-sharing plans such as the 401(k) Profit Sharing Plan, which combines elements of a traditional profit sharing plan with a 401(k) retirement savings plan. In this type of plan, employees can voluntarily contribute a portion of their salary to a retirement account, while employers may match a percentage of these contributions or make additional profit-sharing contributions. Santa Clara, California profit-sharing plans typically offer several benefits to both employers and employees. For employers, these plans can help attract and retain talented individuals, promote employee motivation and engagement, and provide tax advantages. Employees, on the other hand, benefit from the opportunity to accumulate retirement savings based on the company's success, potentially enjoy tax advantages associated with these plans, and have a sense of ownership in the company's performance. In conclusion, Santa Clara, California offers various types of profit-sharing plans, including Traditional Profit Sharing Plans, Employee Stock Ownership Plans (Sops), and 401(k) Profit Sharing Plans. These plans aim to reward employees for their contributions and align their interests with the success of the company.

Santa Clara California Profit Sharing Plan

Description

How to fill out Santa Clara California Profit Sharing Plan?

If you need to find a trustworthy legal paperwork supplier to get the Santa Clara Profit Sharing Plan, consider US Legal Forms. Whether you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate template.

- You can browse from over 85,000 forms arranged by state/county and case.

- The intuitive interface, variety of learning resources, and dedicated support team make it easy to find and execute different paperwork.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

Simply select to look for or browse Santa Clara Profit Sharing Plan, either by a keyword or by the state/county the form is intended for. After locating needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Santa Clara Profit Sharing Plan template and take a look at the form's preview and description (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Register an account and select a subscription plan. The template will be immediately ready for download once the payment is completed. Now you can execute the form.

Handling your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes this experience less expensive and more reasonably priced. Set up your first business, organize your advance care planning, draft a real estate contract, or complete the Santa Clara Profit Sharing Plan - all from the comfort of your sofa.

Sign up for US Legal Forms now!

Form popularity

FAQ

We Offer: Competitive salary. Excellent benefits (health, dental, vision, 401k/457. Retirement plans. Professional Job training. Work Life Balance (flexible work schedules, sick leave, and paid vacation)

Insurance Basic Group Term Life Insurance. Group Legal Services Insurance. Long-Term Care Insurance. Group Long-Term Disability Insurance. ?State Disability Insurance. Travel and Accident Insurance. Workers' Compensation Program?

New Mexico provides a benefit package that includes employer-paid medical insurance contributions, retirement contributions and paid vacation days, sick days and holidays. Additionally, State employees may take advantage of a Deferred Compensation Plan to supplement their retirement plan.

Eligible County employees participate in the CalPERS defined benefit (DB) pension plan. The plan provides employees with a lifetime pension benefit based on a formula, rather than contributions made to a savings or 457 plan.

CalPERS 457 Plan Participating Agencies Employer NameTypeAbc Unified School DistrictSchools, School Districts, Offices of EducationAlameda Corridor Transportation AuthorityTransportation/Transit DistrictsAlameda County Fire DepartmentFire Protection DistrictsAlameda County Law LibraryLibraries/Library Districts117 more rows ?

The state safety retirement membership was designed to recognize those state employees whose condition of employment requires public protective responsibilities and have regular and substantial contact with inmates or patients charged with a felony.

If you receive a CalPERS benefit payment, have California state taxes withheld, and are moving out of state, you'll need to submit a new signed Tax Withholding Election (PDF) form if you wish to stop California state taxes from being withheld.

The County of Santa Clara provides employees with valuable benefits that help you plan for a secure future. Your retirement benefits include: Participation in the CalPERS defined benefit pension plan.

Why Join Us? Medical Plans. The County offers three medical plan options.Dental Plans. The County offers two dental plans.Vision Plan.Health Care Bonus Waiver.Health Flexible Spending Account (HFSA)Dependent Care Assistance Program (DCAP)Life Insurance.Supplemental Life Insurance.