Chicago, Illinois is a bustling city located in the heart of the Midwest. Known for its rich history, vibrant culture, and thriving business scene, it is a prime hub for various industries. One important aspect of Chicago's business environment is the approval of loan plans specifically tailored for key employees. These loan plans are designed to provide financial assistance and support to key employees who play a crucial role within their organizations. By offering attractive loan options, companies in Chicago aim to motivate and retain their top talent, ensuring their loyalty and commitment to the organization. The approval process for these loan plans is comprehensive and thorough. To qualify, key employees must meet specific criteria established by their respective companies. This may include a minimum number of years of service, consistent performance, and a proven track record of accomplishments. Additionally, candidates must provide detailed financial documentation, including income statements, tax returns, and credit history. Once applications are submitted, they undergo a meticulous review by the loan committee. This committee may consist of high-level executives, financial advisors, and legal professionals, who carefully evaluate each applicant's qualifications and financial standing. Decision-making factors may include income stability, creditworthiness, and the overall impact the loan will have on both the employee and the company. Chicago offers different types of loan plans for key employees, each with its own unique features and benefits. This includes executive loan plans, designed for top-level executives who hold strategic decision-making positions. These loans often have higher borrowing limits and more flexible repayment terms, reflecting the importance of these key individuals to the organization's success. Additionally, there are loan plans specifically tailored for employees in critical roles, such as specialized technicians, researchers, and professionals in high-demand fields. These plans may offer specialized terms, reduced interest rates, or lenient eligibility criteria to attract and retain highly skilled individuals. The approval of these loan plans not only demonstrates the organization's commitment to its key employees but also serves as a tool for strengthening employee morale, motivation, and loyalty. By providing financial support and incentives, companies in Chicago can foster a positive work environment and create a sense of partnership with their key employees. In conclusion, Chicago, Illinois provides various loan plans tailored for key employees, aiming to support and retain top talent within organizations. These loans undergo a thorough approval process, ensuring that qualified individuals are provided with timely financial assistance. Whether it is executive loan plans or specialized loans for critical roles, Chicago's loan approval process for key employees plays a significant role in fostering a thriving business environment within the city.

Chicago Illinois Approval of loan plan for key employees

Description

How to fill out Chicago Illinois Approval Of Loan Plan For Key Employees?

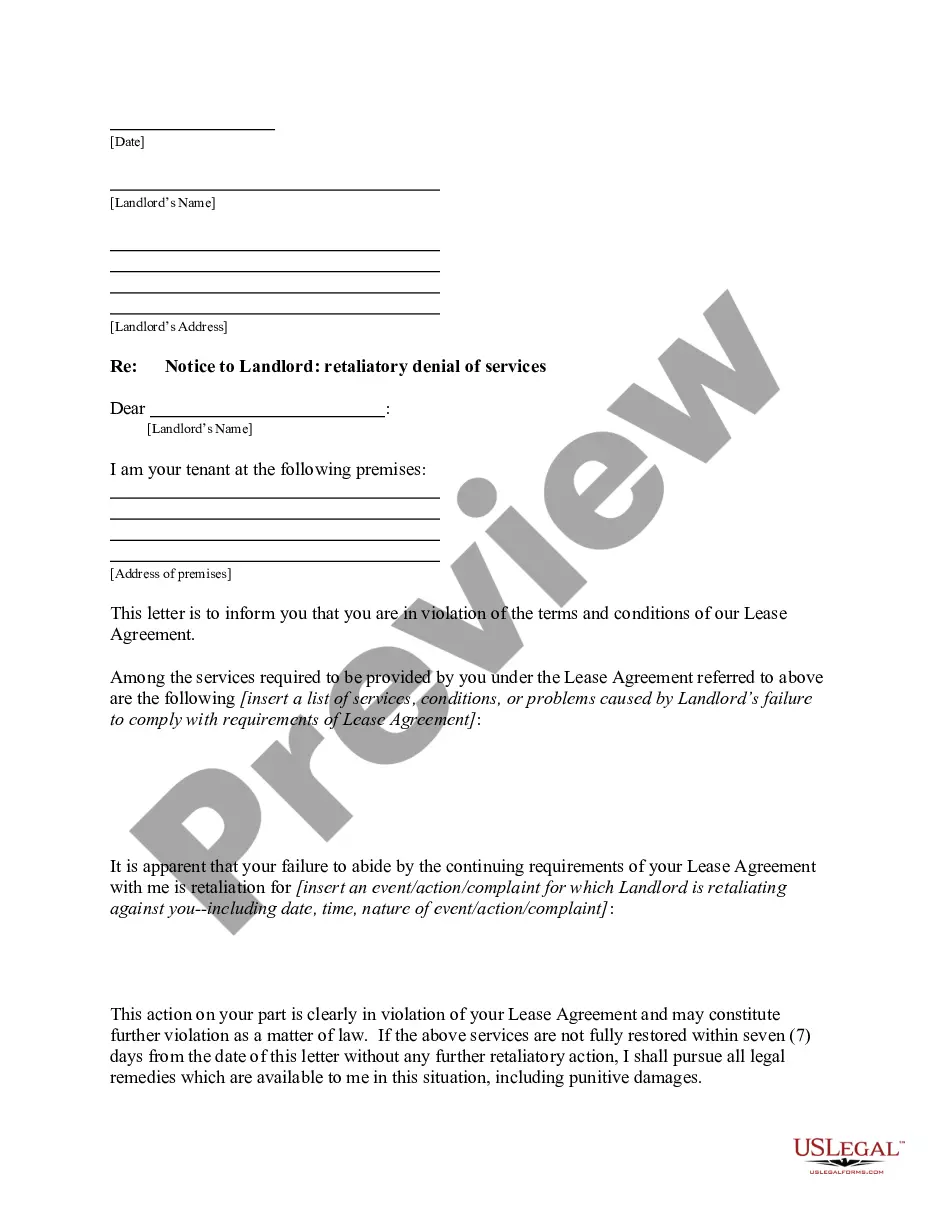

Creating documents, like Chicago Approval of loan plan for key employees, to take care of your legal matters is a challenging and time-consumming task. A lot of circumstances require an attorney’s participation, which also makes this task expensive. However, you can get your legal issues into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal documents created for various cases and life circumstances. We make sure each form is compliant with the regulations of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Chicago Approval of loan plan for key employees template. Simply log in to your account, download the form, and personalize it to your requirements. Have you lost your form? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is just as easy! Here’s what you need to do before getting Chicago Approval of loan plan for key employees:

- Ensure that your template is compliant with your state/county since the rules for writing legal papers may differ from one state another.

- Discover more information about the form by previewing it or going through a quick description. If the Chicago Approval of loan plan for key employees isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or register an account to begin utilizing our service and get the document.

- Everything looks good on your end? Click the Buy now button and choose the subscription option.

- Select the payment gateway and type in your payment details.

- Your template is good to go. You can try and download it.

It’s an easy task to find and purchase the needed document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!