Title: Chicago Illinois Loan Plan for Key Employees: A Comprehensive Overview Introduction: Chicago, Illinois is renowned for its progressive business environment and thriving job market. To attract and retain top-tier talent, many companies offer specialized loan plans tailored exclusively for their key employees. These loan plans provide essential financial support to empower employees in achieving their professional goals and securing a stable future. In this article, we will delve into the details of the Chicago Illinois Loan Plan for Key Employees, highlighting its features, benefits, and the various types available. 1. Types of Chicago Illinois Loan Plan for Key Employees: a) Home Purchase Loan: — Enables key employees to finance their dream home. — Offers attractive interest rates and flexible repayment terms. — Facilitates easier access to the housing market, aiding employee retention. b) Education Loan: — Aimed at supporting the academic pursuits of key employees or their dependents. — Covers tuition fees, books, and related expenses. — Low-interest rates and extended repayment durations help lessen the financial burden faced by key employees. c) Emergency Loan: — Provides immediate access to funds during unforeseen situations, such as medical emergencies. — Helps key employees navigate unexpected financial challenges without compromising their work commitments. — Minimal documentation requirements and quick approval process. d) Relocation Loan: — Facilitates smooth relocation for key employees, ensuring a hassle-free transition. — Covers moving expenses, temporary housing, and other related costs. — Helps attract top talent from other locations, enhancing workforce diversity and expertise. 2. Features and Benefits: a) Competitive Interest Rates: — Chicago Illinois Loan Plans for Key Employees offer highly competitive interest rates. — Employees can borrow funds at affordable rates to meet their financial needs. b) Flexible Repayment Options: — Loan plans provide flexible repayment terms, which can be customized to fit the employee's financial situation. — Employees can choose monthly installments that suit their budget, ensuring minimal financial strain. c) Convenient Application Process: — Loan applications can be easily submitted online or through designated channels. — Streamlined procedures ensure speedy processing, minimizing the wait time for key employees. d) Employee-centric Support: — Dedicated loan specialists are available to guide key employees throughout the loan process. — Tailored financial counseling and advisory services empower employees to make informed decisions. e) Favorable Terms and Conditions: — Loan plans offer favorable terms, including longer repayment periods and reduced collateral requirements. — Flexible loan tenures allow employees to manage loan repayments comfortably. Conclusion: The Chicago Illinois Loan Plan for Key Employees plays a pivotal role in attracting and retaining valuable talent in the city's competitive business landscape. These specialized loan plans, encompassing home purchases, education, emergencies, and relocations, offer numerous benefits that cater to the unique needs of key employees. With competitive interest rates, flexible repayment options, and employee-centric support, these loan plans ensure the holistic financial well-being of key employees, contributing to their professional growth and overall job satisfaction.

Chicago Illinois Loan Plan for Key Employees

Description

How to fill out Chicago Illinois Loan Plan For Key Employees?

Preparing legal documentation can be burdensome. In addition, if you decide to ask a legal professional to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the Chicago Loan Plan for Key Employees, it may cost you a fortune. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case gathered all in one place. Consequently, if you need the latest version of the Chicago Loan Plan for Key Employees, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Chicago Loan Plan for Key Employees:

- Glance through the page and verify there is a sample for your region.

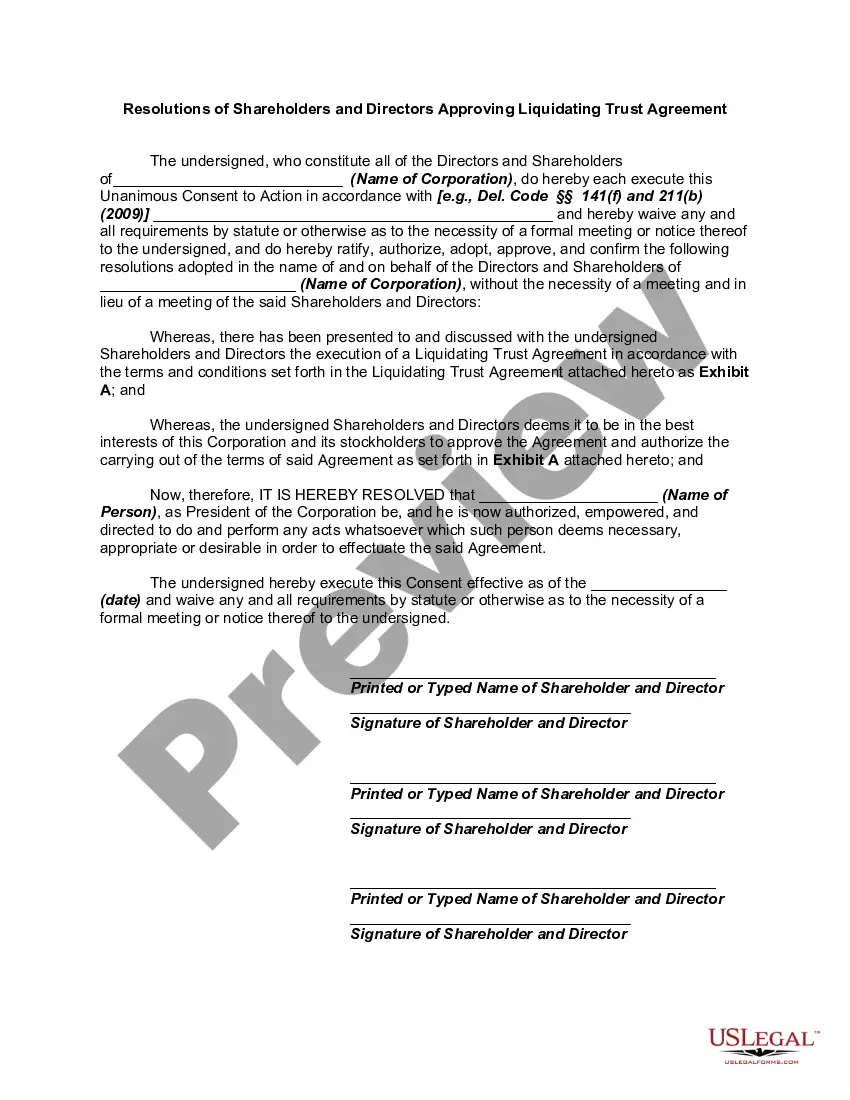

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your Chicago Loan Plan for Key Employees and download it.

Once finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!