The Harris Texas Proposal to approve the adoption of a stock purchase assistance plan aims to provide employees with a valuable opportunity to participate in the company's financial growth and success. This plan would allow eligible employees to purchase company stocks at a discounted rate, thereby encouraging them to become shareholders and align their interests with the organization's long-term goals. By implementing the Harris Texas stock purchase assistance plan, the company strives to enhance employee loyalty, motivation, and engagement. This particular initiative has been proven to drive increased productivity and foster a strong sense of ownership among employees. By investing in the company's stocks, employees have a vested interest in the overall performance and profitability of the organization. The Harris Texas Proposal outlines the key features and benefits of the stock purchase assistance plan, including the eligibility criteria, purchase limits, discount rate, and any potential restrictions on selling or transferring shares. To ensure the plan is fair and inclusive, it is designed to encompass various employee classifications, such as full-time, part-time, and eligible contractors. Additionally, the Harris Texas Proposal may introduce different types of stock purchase assistance plans to cater to the diverse needs and preferences of employees. Some potential variations of the plan could include a performance-based stock purchase plan, where eligible employees who meet specific performance criteria are granted additional purchasing power or more favorable discounts. Another variation might be a matching contribution plan, where the company matches a certain percentage of the employee's stock purchase, further encouraging their participation in the program. The Harris Texas Proposal takes into account the legal and financial aspects necessary for the implementation of the stock purchase assistance plan, ensuring compliance with all applicable laws and regulations. It outlines the required procedures for enrollment, purchase execution, and ongoing administration of the plan, which may involve collaboration with third-party financial institutions or brokerage firms to facilitate employee stock transactions. In conclusion, the Harris Texas Proposal to approve the adoption of a stock purchase assistance plan signifies a strategic initiative to attract and retain talented employees while fostering a sense of ownership and alignment with company objectives. This proposal aims to provide employees with an opportunity to invest in the future success of the organization, contributing to a positive work environment and ultimately benefiting both the company and its workforce.

Harris Texas Proposal to approve adoption of stock purchase assistance plan

Description

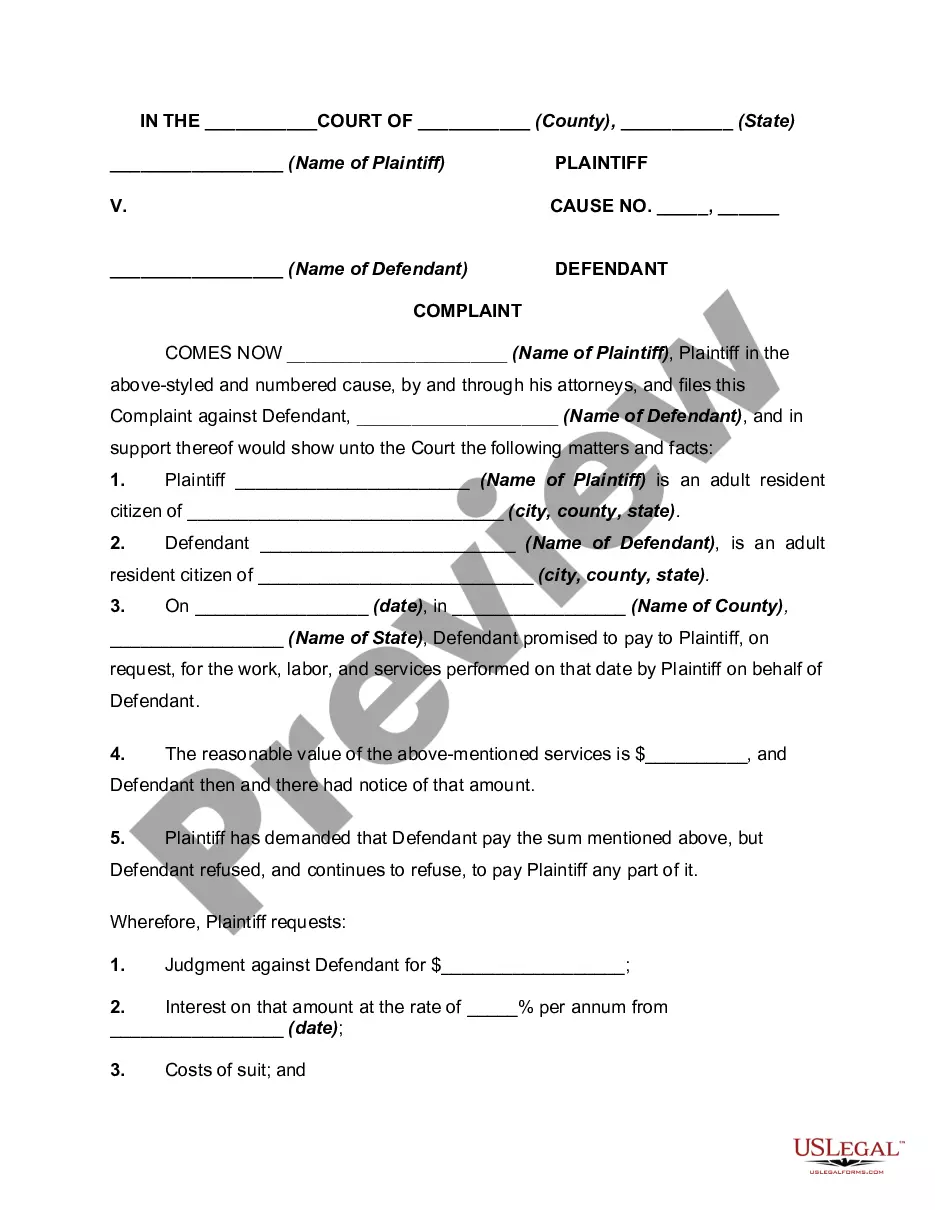

How to fill out Harris Texas Proposal To Approve Adoption Of Stock Purchase Assistance Plan?

Laws and regulations in every sphere vary around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Harris Proposal to approve adoption of stock purchase assistance plan, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals searching for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you purchase a sample, it remains available in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Harris Proposal to approve adoption of stock purchase assistance plan from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Harris Proposal to approve adoption of stock purchase assistance plan:

- Analyze the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the document when you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!