The Cook Illinois Executive Officer Restricted Stock Loan Plan is a specialized program offered by Merry Land and Investment, Inc. Designed exclusively for executive officers, this unique loan plan enables participants to access funds while using their restricted stock holdings as collateral. With a focus on facilitating liquidity and financial flexibility for executives, it allows them to meet personal financial goals without having to sell their valuable restricted stock. Under this program, executive officers at Merry Land and Investment, Inc. can borrow funds against their restricted stock holdings, which are typically subject to certain restrictions or vesting requirements. By utilizing these restricted stocks as collateral, executives can obtain loans at competitive interest rates, all while retaining ownership of their shares. This loan option proves highly advantageous for executives in need of immediate liquidity without sacrificing their long-term investment potential. The Cook Illinois Executive Officer Restricted Stock Loan Plan offers various types of loans tailored to meet the diverse needs of executive officers. These may include: 1. Short-term Restricted Stock Loans: This loan type is ideal for executives seeking quick access to cash for urgent or short-term financial needs. It enables them to borrow against their restricted stock holdings for a specified period, usually ranging from a few months to a year. 2. Long-term Restricted Stock Loans: Geared towards executives requiring a more extensive loan period, long-term restricted stock loans offer extended repayment options. These loans allow executive officers to leverage their restricted stocks for an extended duration, often spanning multiple years, thereby granting them greater flexibility and prolonged liquidity. 3. Performance-based Restricted Stock Loans: This loan type is specifically designed to reward executive officers based on their performance and achievements. It provides executives with an opportunity to borrow against their restricted stock holdings, with the loan amount being tied to predetermined performance metrics. As executives meet or exceed goals, the loan terms and potential interest rates may be adjusted favorably. 4. Customized Restricted Stock Loans: Merry Land and Investment, Inc. understands that executives have unique financial circumstances, and as such, offers customized restricted stock loan options. These loans are tailored to meet specific requirements, providing executives with a bespoke borrowing solution that suits their individual needs. The Cook Illinois Executive Officer Restricted Stock Loan Plan of Merry Land and Investment, Inc. empowers executive officers with a convenient and flexible financing option, offering them the ability to maintain their restricted stock investments while simultaneously accessing liquidity for personal financial needs. By harnessing the value of their restricted stocks, executives can achieve their monetary objectives without compromising their long-term investment strategies.

Cook Illinois Executive Officer Restricted Stock Loan Plan of Merry Land and Investment, Inc.

Description

How to fill out Cook Illinois Executive Officer Restricted Stock Loan Plan Of Merry Land And Investment, Inc.?

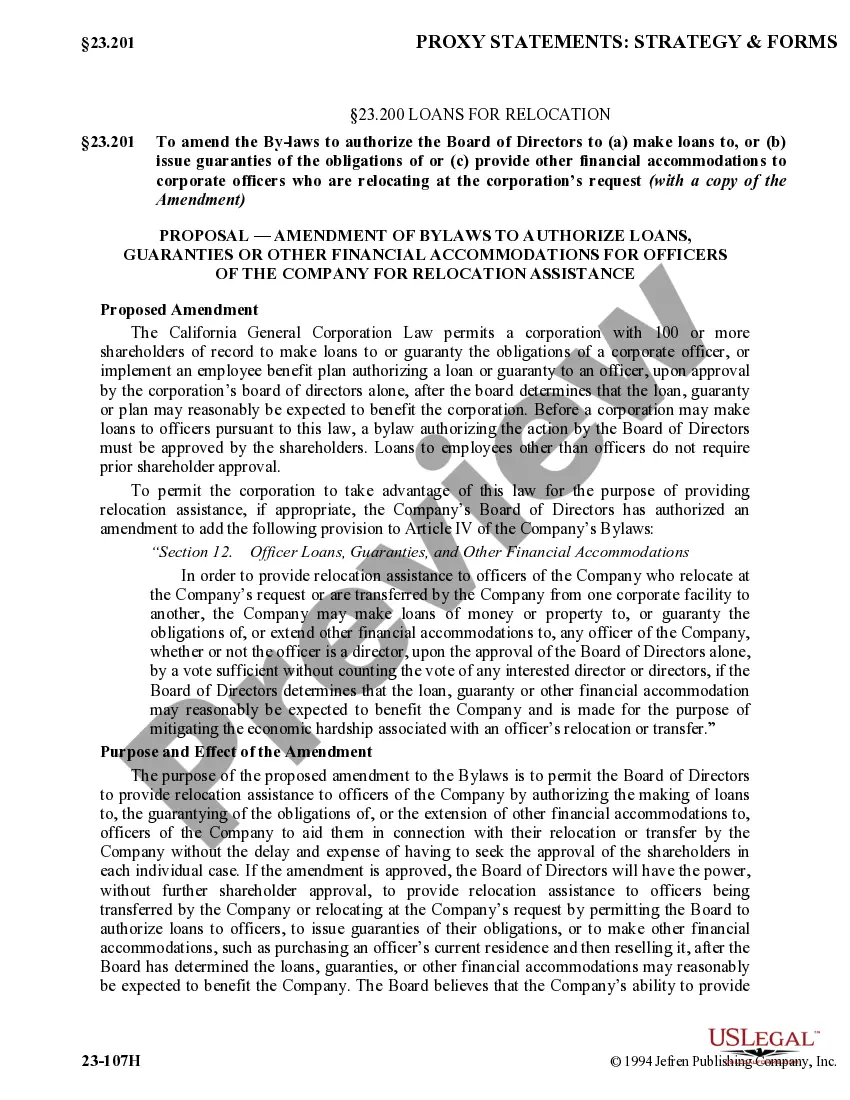

Dealing with legal forms is a must in today's world. However, you don't always need to seek qualified assistance to draft some of them from scratch, including Cook Executive Officer Restricted Stock Loan Plan of Merry Land and Investment, Inc., with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in various types ranging from living wills to real estate paperwork to divorce documents. All forms are arranged according to their valid state, making the searching experience less overwhelming. You can also find detailed resources and guides on the website to make any activities related to document completion simple.

Here's how to find and download Cook Executive Officer Restricted Stock Loan Plan of Merry Land and Investment, Inc..

- Take a look at the document's preview and outline (if available) to get a general idea of what you’ll get after getting the document.

- Ensure that the document of your choosing is adapted to your state/county/area since state regulations can impact the validity of some records.

- Check the similar document templates or start the search over to locate the correct document.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a suitable payment method, and purchase Cook Executive Officer Restricted Stock Loan Plan of Merry Land and Investment, Inc..

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Cook Executive Officer Restricted Stock Loan Plan of Merry Land and Investment, Inc., log in to your account, and download it. Needless to say, our platform can’t replace a lawyer completely. If you need to cope with an extremely difficult case, we recommend using the services of an attorney to review your document before signing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Become one of them today and get your state-compliant documents with ease!