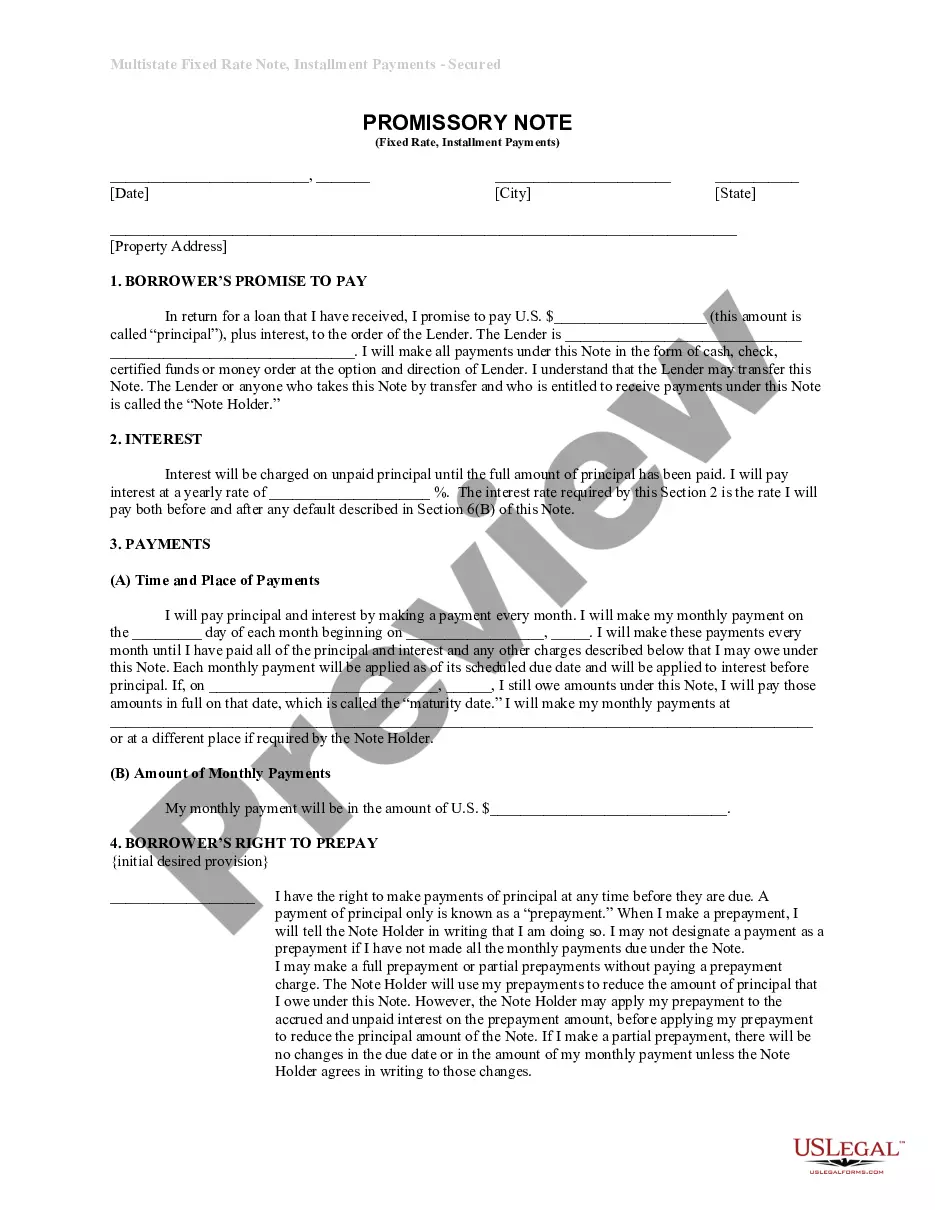

Nassau New York Proposed Employees' Loan and Guaranty Benefit Plan is a comprehensive financial program designed to provide employees of Nassau, New York with the opportunity to access loans and guarantees under favorable terms. The plan aims to support employees in achieving their personal and financial goals by offering a range of loan options and guarantees. With this plan, employees can obtain the necessary funds for various purposes such as education, housing, vehicle purchases, debt consolidation, and more. One of the key features of the Nassau New York Proposed Employees' Loan and Guaranty Benefit Plan is its competitive interest rates, which are lower compared to traditional lending institutions. This enables employees to borrow money at affordable rates, thereby minimizing their financial burden while meeting their specific needs. The plan also offers flexible repayment terms, allowing employees to choose a suitable duration based on their repayment capabilities. Furthermore, the plan provides an efficient and streamlined loan application process, ensuring employees can quickly access the funds they require without unnecessary administrative delays. In addition to loans, the Nassau New York Proposed Employees' Loan and Guaranty Benefit Plan includes a guarantee component. This guarantee feature acts as a safety net, providing employees with financial security and peace of mind in case of unexpected circumstances that may impact their ability to repay the loan. Different types of Nassau New York Proposed Employees' Loan and Guaranty Benefit Plan may include: 1. Personal loans: Employees can apply for personal loans to finance personal expenses, such as medical bills, home renovations, vacations, or other unforeseen expenses. 2. Education loans: This type of loan is designed to assist employees in funding their education or that of their dependents, covering tuition fees, books, and other related education expenses. 3. Home loans: Employees can access home loans to purchase or refinance residential properties, providing an opportunity for homeownership or refinancing existing mortgages. 4. Vehicle loans: This loan option enables employees to finance the purchase of a new or used vehicle, making it more feasible for them to acquire reliable transportation. 5. Debt consolidation loans: Employees with multiple high-interest debts can benefit from debt consolidation loans, which merge multiple debts into a single loan with a lower interest rate, making it easier to manage their financial obligations. Overall, the Nassau New York Proposed Employees' Loan and Guaranty Benefit Plan offers a comprehensive and flexible financial solution for Nassau, New York employees. It empowers employees to fulfill their financial aspirations while providing reliable support and security through favorable loan terms and guarantees.

Nassau New York Proposed employees' loan and guaranty benefit plan

Description

How to fill out Nassau New York Proposed Employees' Loan And Guaranty Benefit Plan?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios demand you prepare formal paperwork that differs throughout the country. That's why having it all accumulated in one place is so helpful.

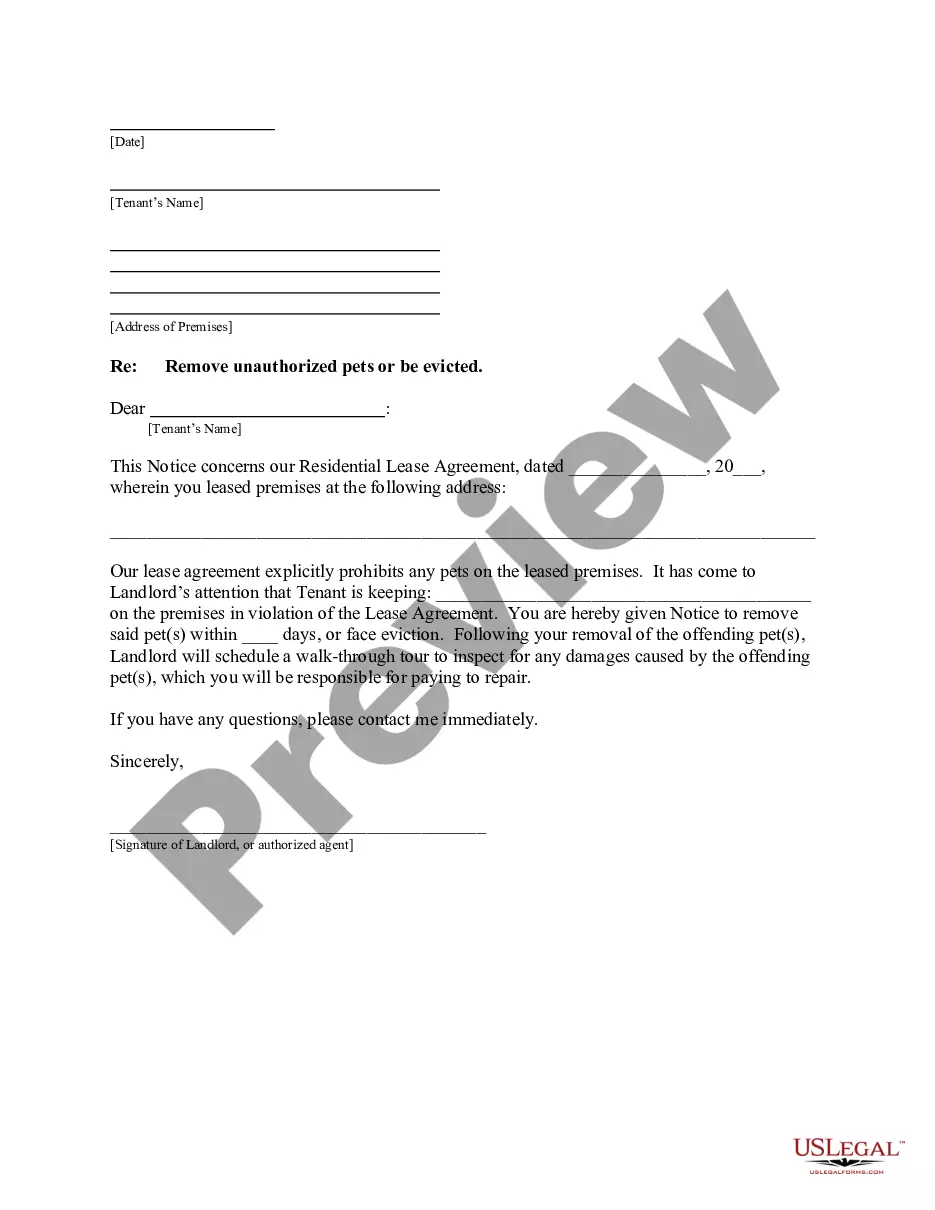

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal templates. Here, you can easily find and download a document for any individual or business purpose utilized in your county, including the Nassau Proposed employees' loan and guaranty benefit plan.

Locating forms on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Nassau Proposed employees' loan and guaranty benefit plan will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guideline to obtain the Nassau Proposed employees' loan and guaranty benefit plan:

- Ensure you have opened the right page with your localised form.

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Search for another document via the search option in case the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Select the suitable subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Nassau Proposed employees' loan and guaranty benefit plan on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

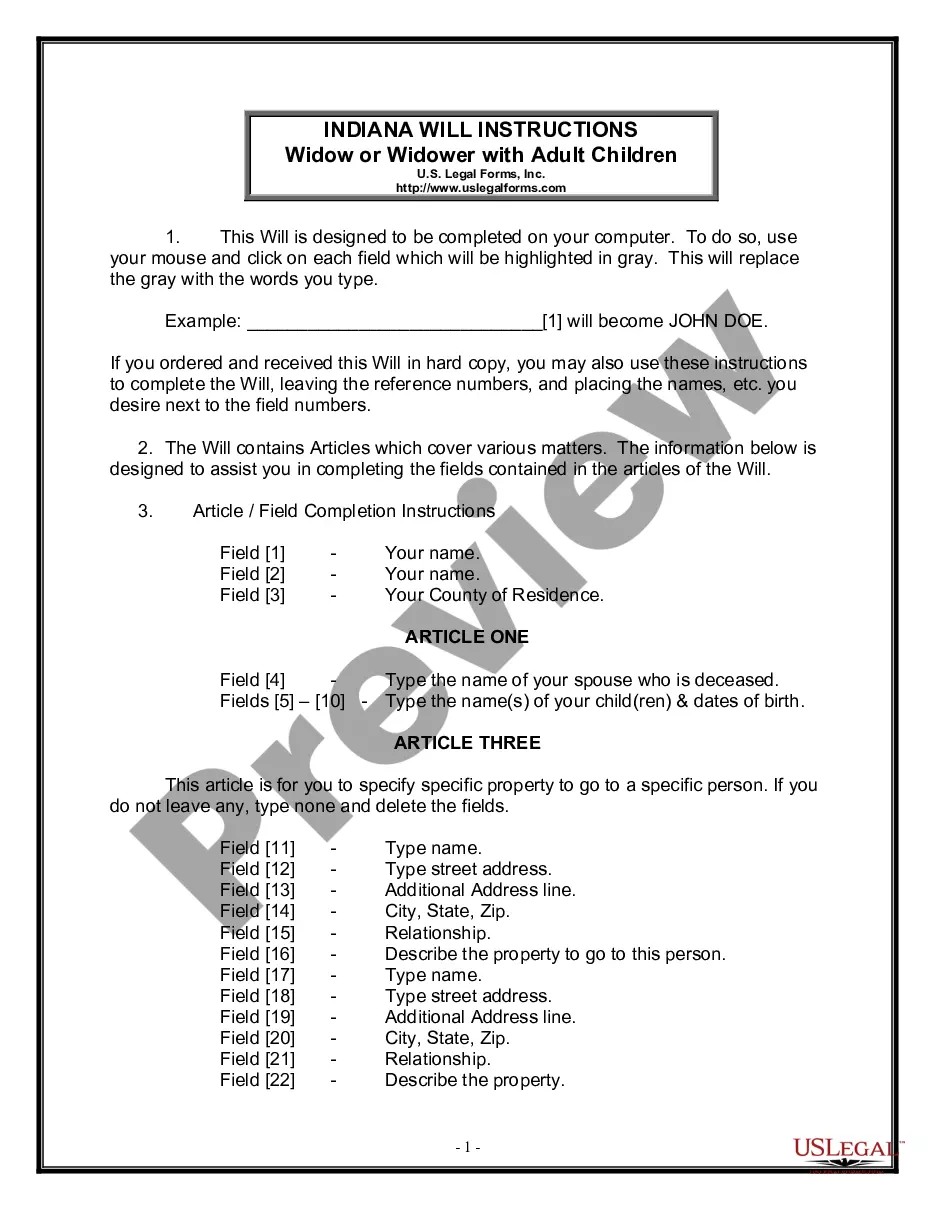

For 2019, the maximum guaranteed amount is $5,607.95 per month ($67,295.40 per year) for workers who begin receiving payments from PBGC at age 65.

You may begin receiving your pension when you retire early, at age 65, or after age 65. Your pension does not begin automatically; you must apply for it in advance.

Call your plan administrator or your employer and ask for a Summary Plan Description. You can also speak with your union, plan administrator, employer, or pension plan sponsor directly to see what insurance amounts apply to your pension. They should be able to tell you if your pension is insured by the PBGC.

PBGC insures about 22.7 million people in Single-employer pension plans. Multiemployer pension plans cover workers of more than one employer, usually companies in the same industry, such as construction, trucking or coal mining. PBGC insures about 10.9 million people in multiemployer pension plans.

Things to remember about applying for benefits: You can apply for a pension if: you are now eligible or will be eligible within the next 180 days to receive benefits from PBGC, under the provisions of your pension plan; and. you would like to begin receiving your retirement benefit within the next 180 days.

PBGC is a federal agency created by the Employee Retirement Income Security Act of 1974 (ERISA) to protect pension benefits in both single-employer and multiemployer private sector pension plans - the kind that typically pay a set monthly amount at retirement.

Can I receive my benefit as a lump sum payment? No, unless your total benefit is very small. PBGC pays lump sums only when a benefit has a value of $5,000 or less. All other benefits are paid as a monthly annuity, which provides a regular stream of income for life.

The Pension Guaranty Corporation is a U.S. Government Agency. PBGC is a part of the Department of Labor and acts to insure defined benefit pension plans.

PBGC insures about 22.7 million people in Single-employer pension plans. Multiemployer pension plans cover workers of more than one employer, usually companies in the same industry, such as construction, trucking or coal mining. PBGC insures about 10.9 million people in multiemployer pension plans.