Orange California Proposed Employees' Loan and Guaranty Benefit Plan is a comprehensive financial benefit program designed specifically for the employees of Orange, California. This plan offers various loan and guaranty options to help employees achieve their personal and professional goals, while ensuring financial stability and security. The Orange California Proposed Employees' Loan and Guaranty Benefit Plan includes several types of loan and guaranty options, tailored to suit the diverse needs and financial circumstances of the employees. These options are: 1. Personal Loans: This type of loan allows employees to borrow funds for any personal expenses such as purchasing a home, funding education, managing medical expenses, or consolidating debts. With competitive interest rates and flexible repayment terms, employees can easily manage their financial obligations. 2. Home Loans: With the Orange California Proposed Employees' Loan and Guaranty Benefit Plan, employees can access home loan options that cater to their housing needs. Whether it's for purchasing a new home or refinancing an existing mortgage, employees can benefit from competitive interest rates, reduced closing costs, and flexible repayment terms. 3. Education Loans: This plan offers education loans to support employees in furthering their education or that of their dependents. The education loans cover tuition fees, books, supplies, and other related educational expenses. These loans have favorable interest rates and flexible repayment options to alleviate the burden of educational costs. 4. Vehicle Loans: Employees can also benefit from vehicle loans provided under this plan. Whether they intend to buy a new or used car, or refinance an existing auto loan, employees can access competitive interest rates, extended repayment terms, and convenient payment options. 5. Guaranty Programs: This plan includes guaranty programs that provide financial security and peace of mind to employees. These programs can help employees secure loans by providing collateral or backing up loan obligations for selected candidates who may not have traditional creditworthiness. The Orange California Proposed Employees' Loan and Guaranty Benefit Plan aims to empower employees with the necessary financial resources to achieve their goals, enhance their quality of life, and pursue personal growth. With a range of loan types and guaranty options, employees can receive the financial support they need, strengthening their overall well-being and contributing to a thriving workforce. Keywords: Orange California, Employees' Loan and Guaranty Benefit Plan, loan options, guaranty programs, personal loans, home loans, education loans, vehicle loans, financial stability, competitive interest rates, flexible repayment terms, housing needs, education expenses, convenient payment options, collateral, loan obligations, financial resources, personal growth, thriving workforce.

Orange California Proposed employees' loan and guaranty benefit plan

Description

How to fill out Orange California Proposed Employees' Loan And Guaranty Benefit Plan?

Laws and regulations in every sphere vary from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Orange Proposed employees' loan and guaranty benefit plan, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for different life and business occasions. All the documents can be used multiple times: once you pick a sample, it remains accessible in your profile for future use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Orange Proposed employees' loan and guaranty benefit plan from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Orange Proposed employees' loan and guaranty benefit plan:

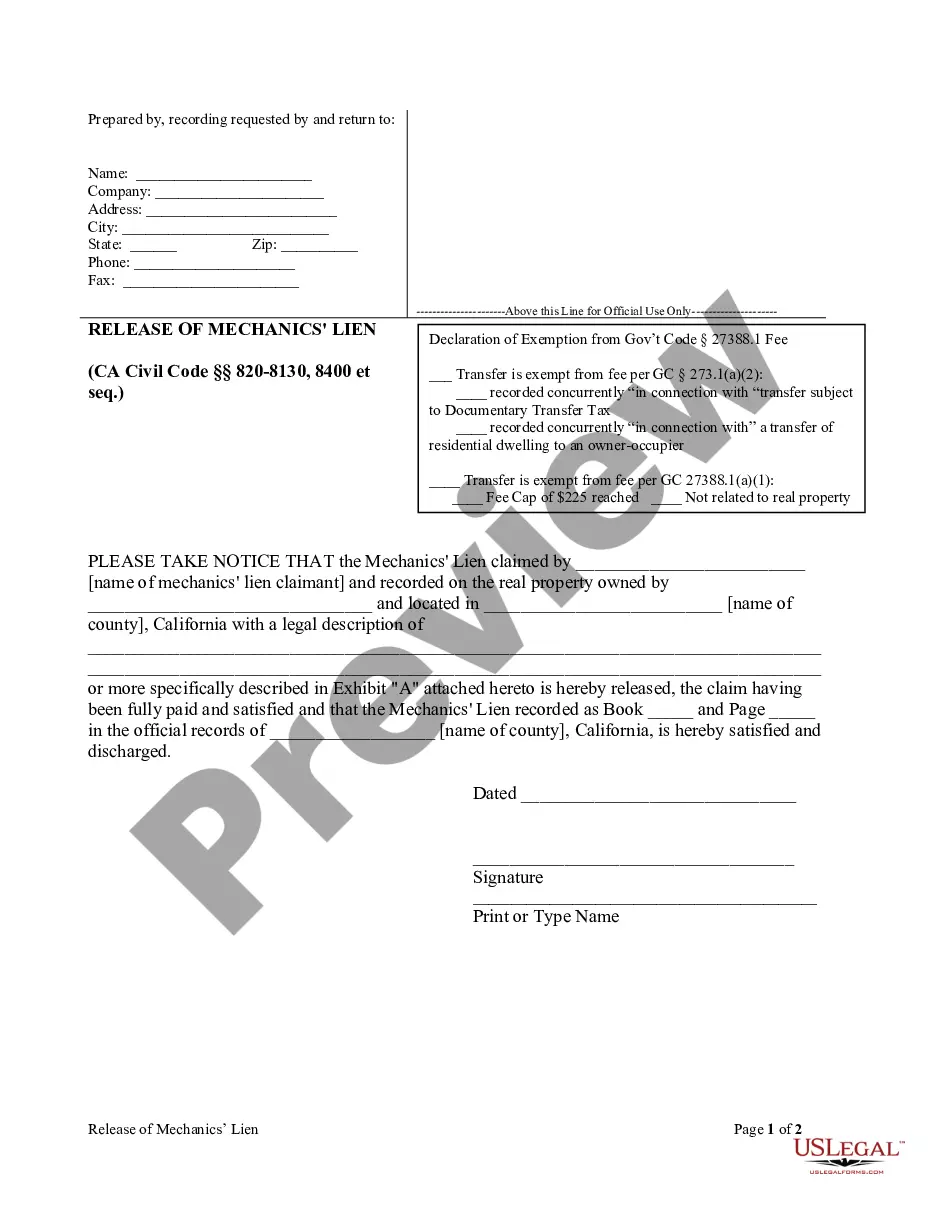

- Examine the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the template once you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!