The Suffolk New York Approval of Executive Director Loan Plan is an initiative that aims to provide financial assistance to executive directors in Suffolk County, New York. This loan plan has been designed to support both existing and potential executive directors in their pursuit of business ventures, professional development, and personal growth. By approving the executive director loan plan, Suffolk County acknowledges the importance of strong leadership and entrepreneurial spirit in the local community. This program encourages individuals to take on leadership roles and provides them with the necessary financial backing to pursue their goals and enhance the economic development of the region. The loan plan offers different types of financial assistance to cater to the diverse needs of executive directors. These include: 1. Startup Loan: This type of loan is specifically targeted towards individuals who are starting a new business or organization as an executive director. It provides the necessary funds to kick-start their venture, covering expenses such as office space, equipment, initial marketing efforts, and working capital. 2. Expansion Loan: For existing executive directors looking to expand their operations, the expansion loan offers financial support for business growth. This loan can be utilized to open new branches, invest in additional resources, hire more staff, or introduce new products/services. 3. Professional Development Loan: Executive directors often require ongoing training and education to stay updated with the latest industry trends and enhance their leadership skills. The professional development loan helps cover expenses related to attending conferences, workshops, seminars, and other training programs. 4. Emergency Loan: In times of unforeseen circumstances or financial emergencies, executive directors may need immediate financial support. The emergency loan provides quick access to funds to address urgent needs such as unforeseen operational expenses, facility repairs, or unexpected cash flow issues. 5. Personal Growth Loan: The personal growth loan is tailored for executive directors who wish to invest in themselves outside their professional duties. It can be used for personal development activities such as pursuing higher education, engaging in wellness programs, or exploring personal ventures alongside their professional responsibilities. The Suffolk New York Approval of Executive Director Loan Plan serves as an indispensable resource for executive directors in Suffolk County. It aims to foster entrepreneurial spirit, promote economic growth, and provide financial stability to these leaders as they navigate the dynamic business landscape of the region.

Suffolk New York Approval of executive director loan plan

Description

How to fill out Suffolk New York Approval Of Executive Director Loan Plan?

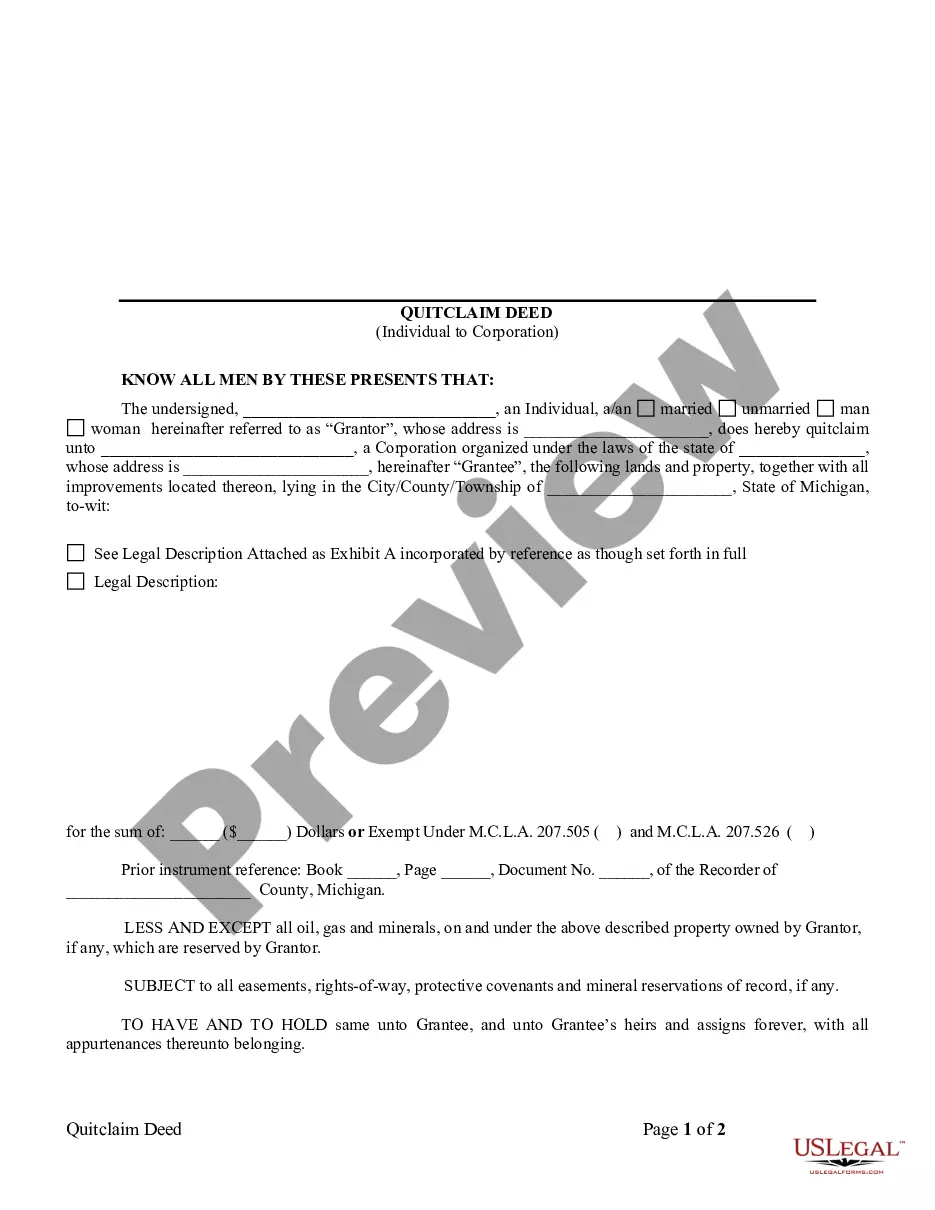

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to create some of them from the ground up, including Suffolk Approval of executive director loan plan, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to choose from in various categories varying from living wills to real estate papers to divorce documents. All forms are organized based on their valid state, making the searching process less overwhelming. You can also find information materials and guides on the website to make any activities associated with paperwork execution simple.

Here's how you can purchase and download Suffolk Approval of executive director loan plan.

- Take a look at the document's preview and description (if provided) to get a general information on what you’ll get after getting the form.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can impact the legality of some documents.

- Examine the related forms or start the search over to locate the right document.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a suitable payment method, and purchase Suffolk Approval of executive director loan plan.

- Choose to save the form template in any available file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Suffolk Approval of executive director loan plan, log in to your account, and download it. Of course, our website can’t take the place of an attorney completely. If you have to deal with an exceptionally difficult situation, we recommend getting a lawyer to review your document before signing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of users. Become one of them today and get your state-specific documents with ease!

Form popularity

FAQ

University of Suffolk Ranking University of Oxford#66University of Suffolk#70UWE Bristol#71University of York#72City, University of London#735 more rows

Subsidized Loans are loans for undergraduate students with financial need, as determined by your cost of attendance minus expected family contribution and other financial aid (such as grants or scholarships). Subsidized Loans do not accrue interest while you are in school at least half-time or during deferment periods.

Federal student loans can be subsidized or unsubsidized. A student's eligibility for subsidized loans is based on financial need. Although both types of loans have to be paid back with interest, the government makes some of the interest payments on subsidized loans.

With a subsidized direct loan, the bank, or the government (for Federal Direct Subsidized Loans, also known as Subsidized Stafford Loans) is paying the interest for you while you're in school (a minimum of half time), during your post-graduation grace period, and if you need a loan deferment.

8) London School of Economics and Political Science (LSE)7) King's College London (KCL)6) The University of Manchester.5) University of Edinburgh.4) UCL (University College London)3) Imperial College London.2) University of Cambridge.1) University of Oxford.

Suffolk University (Sawyer) is ranked No. 102-134 in Best Business Schools and No. 169 (tie) in Part-time MBA. Schools are ranked according to their performance across a set of widely accepted indicators of excellence.

Anglia Ruskin University is a popular university located in East Anglia, United Kingdom. THE Times Higher Education) has consistently ranked Anglia between 301-350 in its world university ranking from 2017 to 2022....University Ranking. Ranked ByThe Guardian - University Rankings20191032020992021802022973 more columns

A degree from the University of Suffolk is an internationally respected qualification from an institution which ranks highly within the UK and abroad. University of Suffolk students on Whatuni say: ?Our University is modern and has stunning surroundings. The facilities are great.?

While financial aid is not the same as student loans, you must first complete the FAFSA® form to apply for a federal student loan. Completing the FAFSA® online is convenient?and it can make your financial aid search easier. Grad students can also apply for aid with the FAFSA. Learn more about graduate financial aid.

For the sixth year running, the Master of Business Administration program at Suffolk University's Sawyer Business School has been ranked Tier #1 by CEO Magazine, which published their 2022 rankings in March.