Allegheny Pennsylvania Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc. is a unique and beneficial financial program designed to facilitate the needs of executive directors residing in Allegheny, Pennsylvania. This loan plan offers exclusive privileges and advantages to eligible executive directors, allowing them to access funds for personal or professional purposes. Hathaway Instruments, Inc., one of the most reputable financial institutions in the region, is entrusted with the responsibility of providing this loan plan. With an impeccable track record and decades of experience, Hathaway Instruments, Inc. ensures the utmost transparency, confidentiality, and professionalism throughout the loan process. The Allegheny Pennsylvania Executive Director Loan Plan is specifically crafted to cater to the diverse needs and requirements of executive directors. It offers competitive interest rates, flexible repayment options, and a simplified application process to ensure ease and convenience. Eligible executive directors can procure funds through this loan plan for a variety of purposes. Whether it is for personal expenses such as home renovations, education, medical emergencies, or professional needs like expanding a business venture, investing in new technology, or upgrading infrastructure, the Allegheny Pennsylvania Executive Director Loan Plan can address all financial requirements. Upon approval, Hathaway Instruments, Inc. provides each borrower with a copy of the Promissory Note, which details the terms and conditions of the loan agreement. The Promissory Note serves as a legal document that outlines the loan amount, interest rate, repayment schedule, and any additional provisions agreed upon between the borrower and the lender. It is essential to note that there might be different types or variations of the Allegheny Pennsylvania Executive Director Loan Plan with a copy of the Promissory Note by Hathaway Instruments, Inc. Some potential variations could include: 1. Short-Term Loan Plan: This variant offers a smaller loan amount with a shorter repayment period. It suits executive directors who require immediate funds for urgent needs and prefer to repay the loan quickly. 2. Long-Term Loan Plan: This option provides a larger loan amount with an extended repayment period. It is suitable for executive directors who need substantial financing for long-term projects or investments and prefer a more relaxed repayment schedule. 3. Low-Interest Loan Plan: This type of Allegheny Pennsylvania Executive Director Loan Plan offers a reduced interest rate, allowing executive directors to save on interest expenses while still obtaining the necessary funds. It is particularly beneficial for those seeking cost-effective financing solutions. 4. Corporate Loan Plan: This variant is tailored for executive directors representing corporations or companies rather than nonprofit organizations. The loan terms and conditions may vary slightly to align with the specific requirements of corporate executives. No matter the type or version of the Allegheny Pennsylvania Executive Director Loan Plan, Hathaway Instruments, Inc. strives to provide reliable financial solutions, ensuring executive directors can meet their financial goals and aspirations efficiently and effectively.

Allegheny Pennsylvania Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc.

Description

How to fill out Allegheny Pennsylvania Executive Director Loan Plan With Copy Of Promissory Note By Hathaway Instruments, Inc.?

Preparing papers for the business or personal demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state laws and regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to draft Allegheny Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc. without expert assistance.

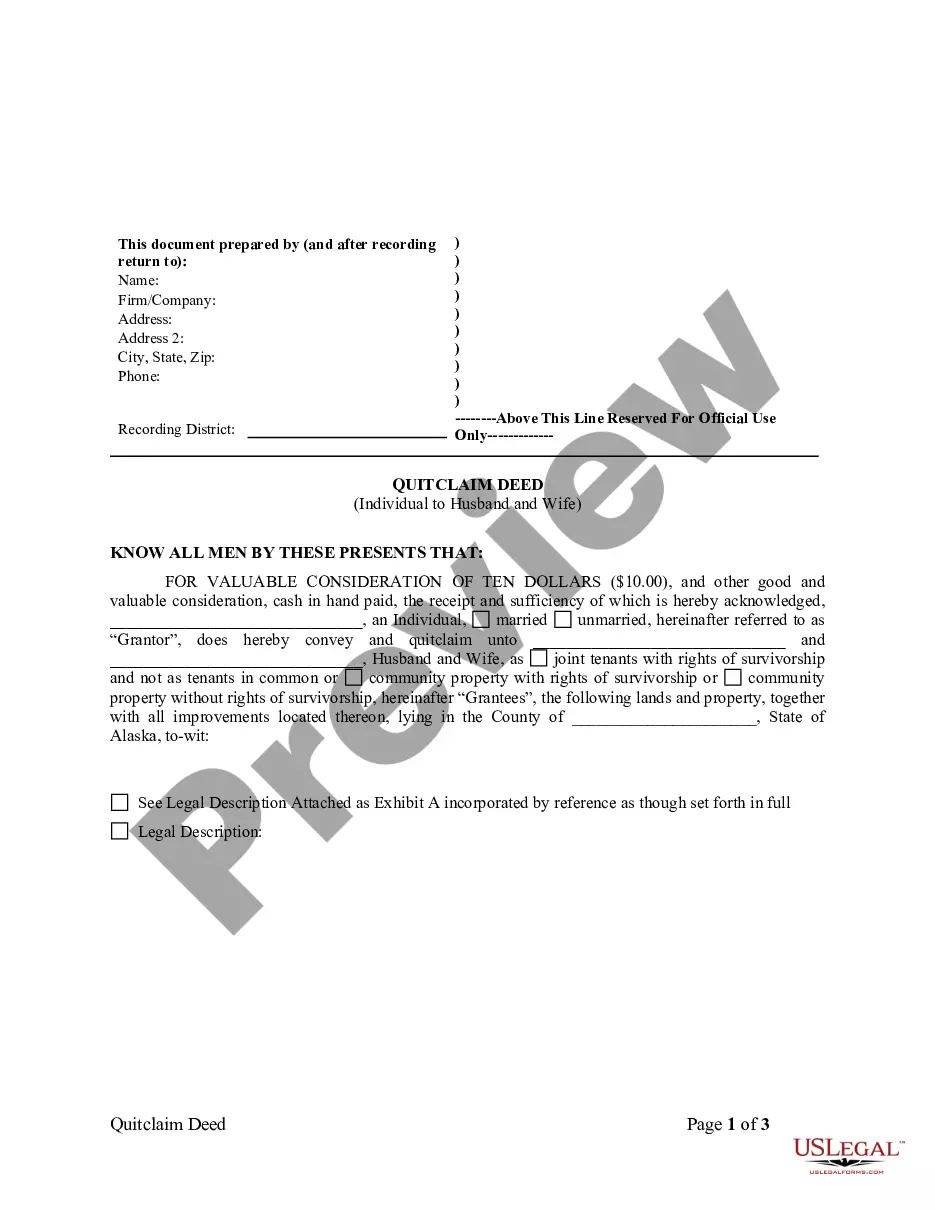

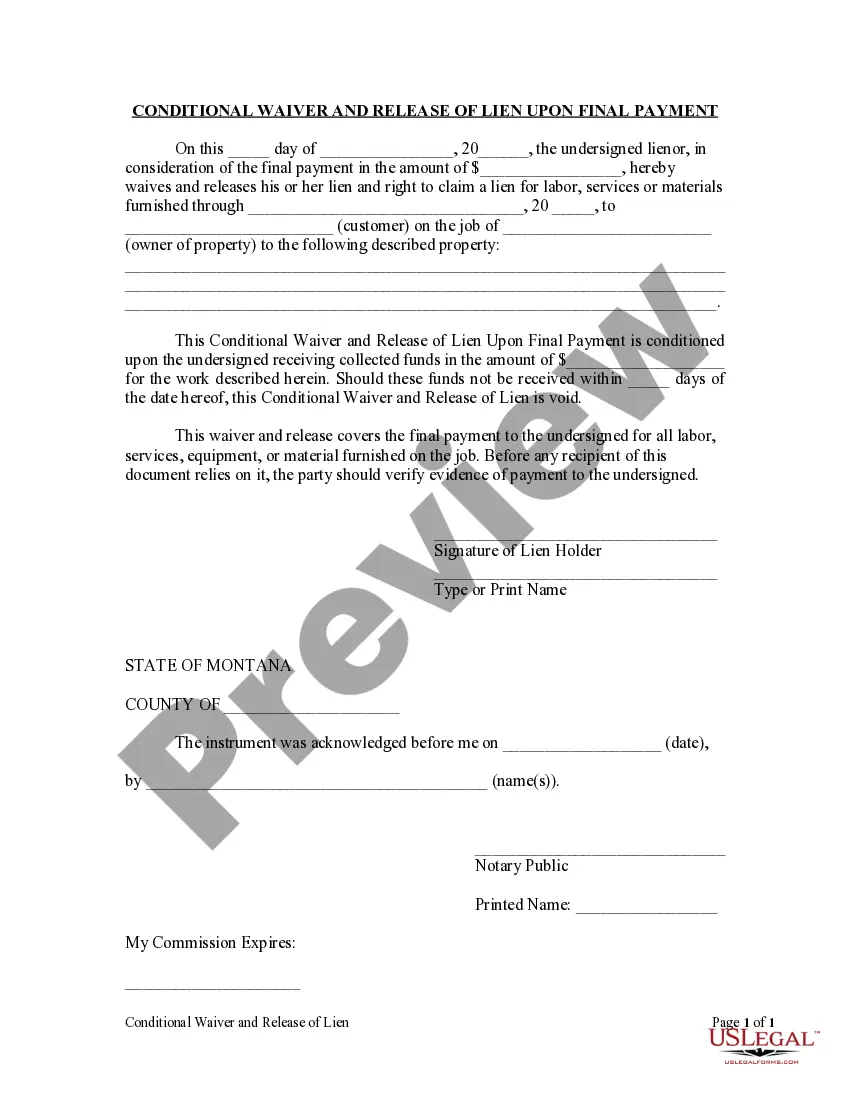

It's possible to avoid spending money on lawyers drafting your documentation and create a legally valid Allegheny Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc. by yourself, using the US Legal Forms web library. It is the largest online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary document.

In case you still don't have a subscription, adhere to the step-by-step instruction below to get the Allegheny Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc.:

- Examine the page you've opened and check if it has the document you require.

- To do so, use the form description and preview if these options are presented.

- To find the one that fits your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any scenario with just a couple of clicks!

Form popularity

FAQ

1. Request loan paperwork from your lender. The lender can provide copies of the documents signed at closing. If the loan has changed hands, contact the most current servicer for a copy of your mortgage or deed of trust documents.

The original copy of a valid promissory note is usually held by the lender, but the borrower should also keep a copy of the signed document. If the borrower does not repay the loan, the lender can pursue appropriate legal action.

If the sum is not huge and the relationship is trustworthy, it is preferred to go with a promissory note to avoid potential legal issues. However, if the sum of money is huge and the relationship is not entirely trustable, make sure to use a secured loan agreement to ensure your money is safe with the borrower.

In general, promissory notes are used for more informal relationships than loan agreements. A promissory note can be used for friend and family loans, or short-term, small loans. Loan agreements, on the other hand, are used for everything from vehicles to mortgages to new business ventures.

A Promissory note is essentially an unconditional written promise to repay a loan or other debts, at a fixed or determinable future date. Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved.

The borrower agrees to pay a certain amount of money (which may include interest on principle), in installments, on demand or in full at a specified time. Today's promissory notes usually fall into two camps: secured and unsecured.

What Is a Promissory Note? A promissory note is a debt instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on-demand or at a specified future date.

Typically, promissory notes are securities. They must be registered with the SEC, a state securities regulator, or be exempt from registration. Most legitimate promissory notes can easily be verified by checking the SEC's EDGAR database or calling your state securities regulator .

A promissory note is breached when payment due, or properly demanded as per the terms of the note, is not received. If you want to enforce a breached promissory note, you must follow the terms agreed upon when making demands for payment.

A promissory note is a written agreement to pay someone essentially an IOU. But it's not something to be taken lightly. "It is a legally binding written document effectuating a promise to repay money," says Andrea Wheeler, a business attorney and owner of Wheeler Legal PLLC of Florida.