Dallas Texas Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc. The Dallas Texas Executive Director Loan Plan by Hathaway Instruments, Inc. is a comprehensive financial solution designed specifically for executive directors based in Dallas, Texas. This plan aims to provide flexible and cost-effective financing options to help these executives meet their financial needs and achieve their personal and professional goals. The Executive Director Loan Plan offers a copy of a Promissory Note, a legally binding document that outlines the terms and conditions of the loan agreement between Hathaway Instruments, Inc. and the executive director. This Promissory Note serves as proof of the loan's existence and specifies details such as the loan amount, repayment terms, interest rates, and other relevant provisions. The Dallas Texas Executive Director Loan Plan offers different types of loan options tailored to meet the specific requirements and goals of executive directors. Some of these loan types may include: 1. Personal Finance Loan: This type of loan is designed to meet the personal financial needs of executive directors, such as purchasing a home, funding education, or handling unexpected expenses. The loan amount, repayment period, and interest rates are determined based on individual circumstances and financial capabilities. 2. Business Expansion Loan: Hathaway Instruments, Inc. also offers executive directors the opportunity to expand their business operations through this loan option. Whether it's investing in new equipment, launching a marketing campaign, or expanding the workforce, this loan aims to provide the necessary financial support to drive growth and profitability. 3. Investment Loan: Executive directors looking to capitalize on investment opportunities can benefit from this loan type. Hathaway Instruments, Inc. offers competitive interest rates and flexible repayment terms to empower executives in making strategic investments that align with their financial goals and objectives. By collaborating with Hathaway Instruments, Inc., executive directors gain access to a reliable and trustworthy partner that understands their unique financial needs. The Dallas Texas Executive Director Loan Plan with a copy of a Promissory Note enables executive directors to secure the necessary funds to pursue their ambitions, enhance personal financial stability, and drive professional growth. Disclaimer: The information provided here is for general informational purposes only and should not be considered legal or financial advice. Please consult with a professional advisor or attorney for specific guidance on your individual circumstances.

Dallas Texas Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc.

Description

How to fill out Dallas Texas Executive Director Loan Plan With Copy Of Promissory Note By Hathaway Instruments, Inc.?

Drafting paperwork for the business or individual demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to take into account all federal and state laws and regulations of the particular area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to draft Dallas Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc. without professional assistance.

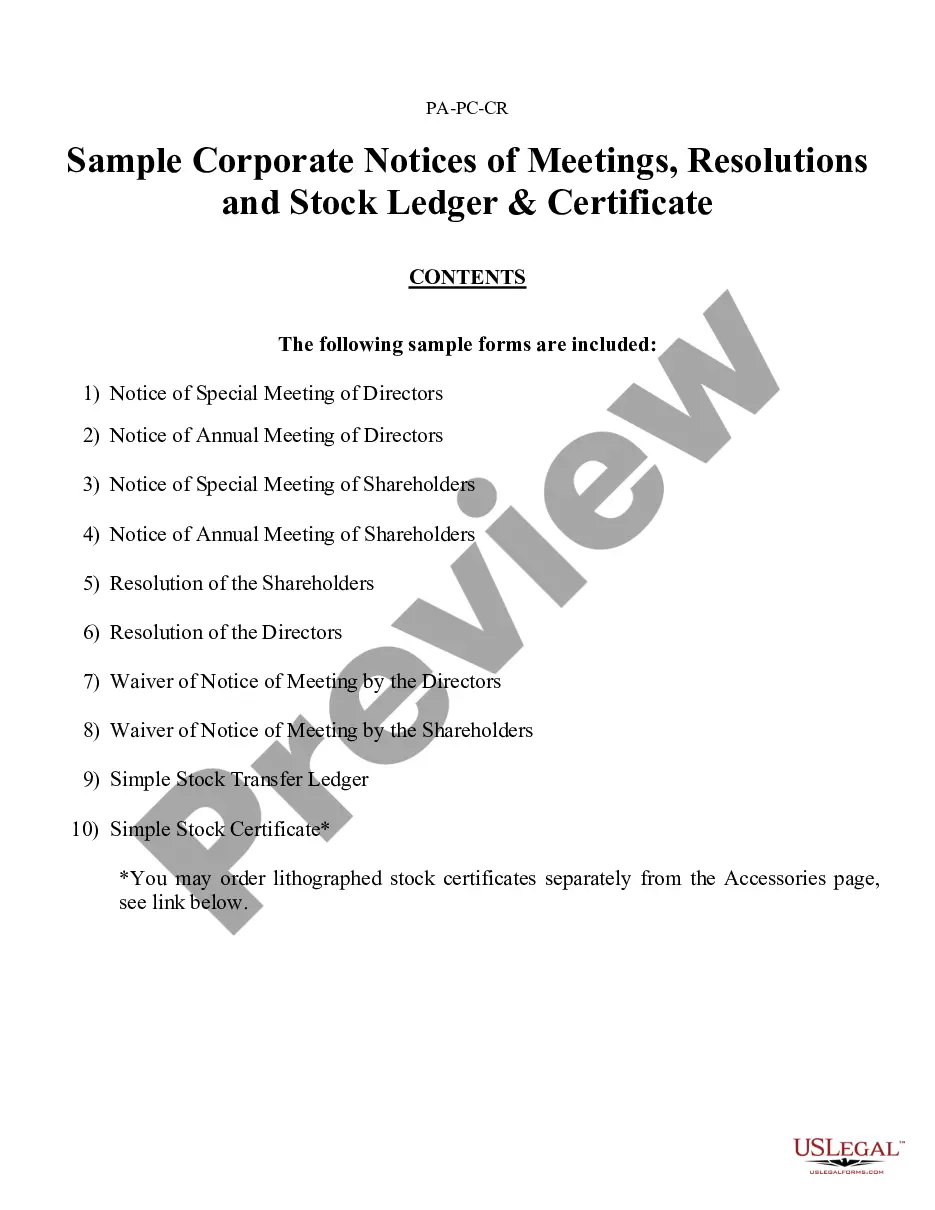

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Dallas Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc. by yourself, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required form.

In case you still don't have a subscription, follow the step-by-step instruction below to get the Dallas Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc.:

- Look through the page you've opened and verify if it has the sample you require.

- To do so, use the form description and preview if these options are available.

- To locate the one that satisfies your needs, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any scenario with just a couple of clicks!