Hennepin Minnesota Executive Director Loan Plan by Hathaway Instruments, Inc. The Hennepin Minnesota Executive Director Loan Plan offered by Hathaway Instruments, Inc. is an innovative financing solution specifically designed for talented professionals serving as executive directors in Hennepin Minnesota. This exclusive loan plan aims to provide financial assistance to qualified individuals who are seeking to further their professional careers or embark on entrepreneurial endeavors. The Hennepin Minnesota Executive Director Loan Plan is structured as a personal loan, tailored to meet the unique needs and obligations of executive directors. It offers competitive interest rates and flexible repayment terms, ensuring that participants can manage the loan efficiently while pursuing their financial goals. To avail the benefits of this loan plan, interested individuals need to meet certain eligibility criteria. These criteria typically include a minimum tenure as an executive director in Hennepin Minnesota, a good credit score, and a solid repayment capacity. Applicants are also required to provide relevant documentation, including proof of income, a copy of the promissory note, and other supporting financial records. By partnering with Hathaway Instruments, Inc., executive directors in Hennepin Minnesota can access different types of loan plans tailored to meet their specific needs: 1. Hennepin Minnesota Executive Director Startup Loan Plan: This plan is designed for executive directors who are planning to start their own business ventures in Hennepin Minnesota. It offers larger loan amounts and longer repayment terms to support the initial stages of a new venture. 2. Hennepin Minnesota Executive Director Career Development Loan Plan: This loan plan is ideal for executive directors who are looking to enhance their professional skills, pursue higher education, or undergo career development programs. It provides financial support to cover tuition fees, training expenses, or any other educational costs required for career advancement. 3. Hennepin Minnesota Executive Director Emergency Loan Plan: Hathaway Instruments, Inc. also offers this loan plan for executive directors facing unexpected financial hurdles, such as medical emergencies or unexpected expenses. It provides quick access to funds to address urgent financial needs. Hathaway Instruments, Inc. ensures that the entire loan process is seamless and efficient. Upon approval, participants receive a copy of the promissory note detailing the loan terms, including the loan amount, interest rate, repayment schedule, and any additional terms and conditions. In conclusion, the Hennepin Minnesota Executive Director Loan Plan with a copy of the promissory note by Hathaway Instruments, Inc. is a specialized financing solution designed to meet the financial requirements of executive directors in Hennepin Minnesota. With various types of loan plans available, qualified professionals can find the optimal financial support required to achieve their career goals and aspirations.

Hennepin Minnesota Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc.

Description

How to fill out Hennepin Minnesota Executive Director Loan Plan With Copy Of Promissory Note By Hathaway Instruments, Inc.?

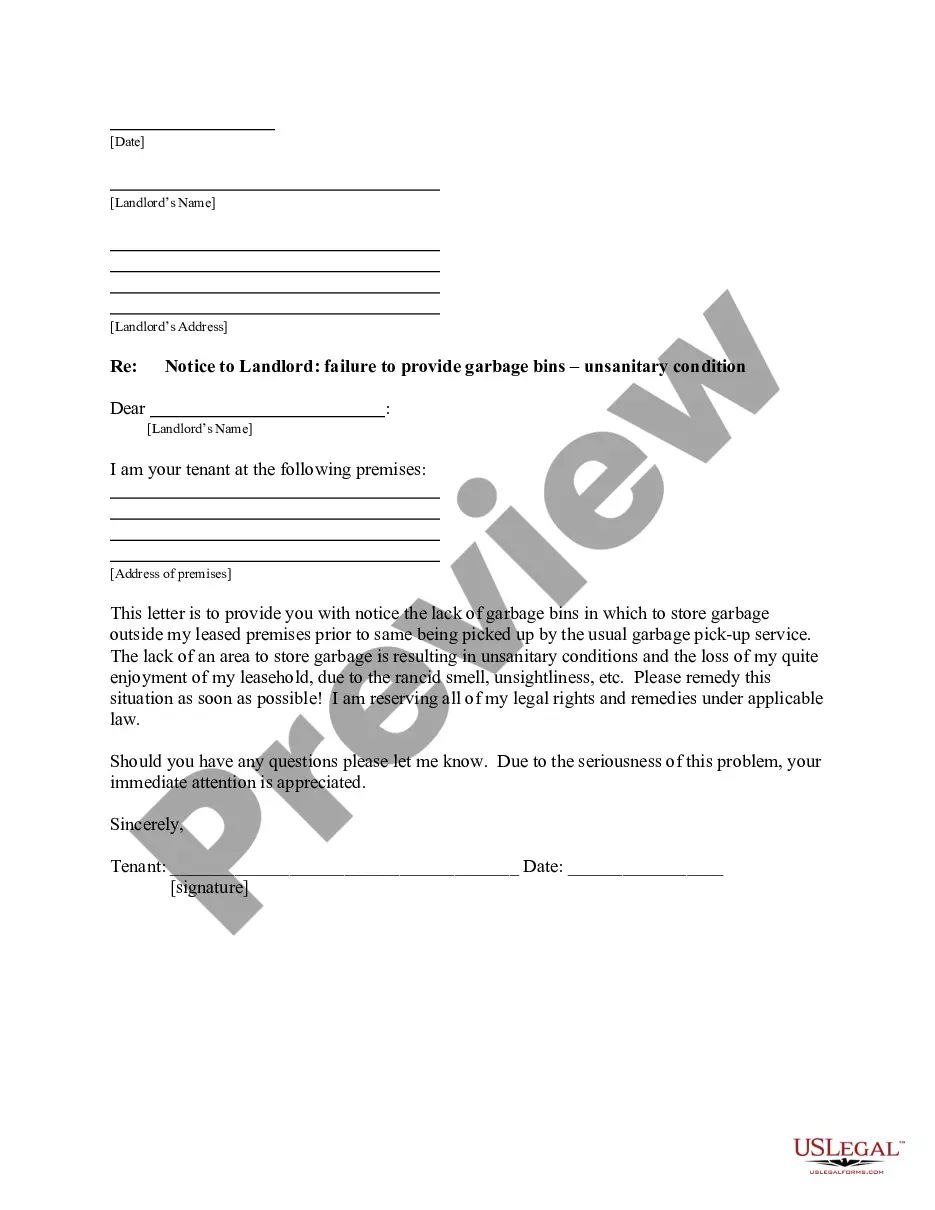

Are you looking to quickly create a legally-binding Hennepin Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc. or probably any other form to handle your personal or business matters? You can go with two options: hire a legal advisor to write a valid paper for you or create it entirely on your own. The good news is, there's an alternative option - US Legal Forms. It will help you get professionally written legal documents without paying unreasonable prices for legal services.

US Legal Forms provides a huge collection of more than 85,000 state-specific form templates, including Hennepin Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc. and form packages. We provide documents for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been on the market for over 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and obtain the needed document without extra hassles.

- To start with, double-check if the Hennepin Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc. is tailored to your state's or county's laws.

- If the form comes with a desciption, make sure to verify what it's intended for.

- Start the search over if the form isn’t what you were hoping to find by utilizing the search bar in the header.

- Select the plan that best fits your needs and move forward to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the Hennepin Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc. template, and download it. To re-download the form, simply go to the My Forms tab.

It's stressless to find and download legal forms if you use our catalog. Moreover, the templates we provide are updated by industry experts, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

The lender usually holds the promissory note until you repay the loan, unless there is a transfer or assignment of mortgage. The mortgage deed could be in the possession of the lender or a title company and your attorney will have a copy, but in most cases there is also a record of it at the County Recorder's office.

Search the county recorder's records. Promissory notes are typically recorded as public documents and accessible shortly after the closing. The trustee maintains the original deed until the loan is satisfied.

Even if a promissory note is lost, the legal obligation to repay the loan remains. The lender has a right to re-establish the note legally as long as it has not sold or transferred the note to another party.

In most situations, you'll sign just one Master Promissory Note for multiple subsidized and unsubsidized loans, and it will last for up to 10 years of continuous education. There are several occasions when you will have to fill out a new Master Promissory Note: You never signed a Master Promissory Note.

Even if a promissory note is lost, the legal obligation to repay the loan remains. The lender has a right to re-establish the note legally as long as it has not sold or transferred the note to another party.

You can get a copy of your Master Promissory Notes by going to studentloans.gov and entering your FSA ID. Click on Completed Master Promissory Notes under the menu bar heading that says My Loan Documents. The completed Master Promissory Notes will appear, and you can download them directly.

A Promissory note is essentially an unconditional written promise to repay a loan or other debts, at a fixed or determinable future date. Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved.

The buyer of the note becomes what is called a holder because they hold your note as the owner of it. A holder has a special right to collect from you right away if you don't pay. But only the holder of an original promissory note can collect from you. A promissory note can change many hands as it is bought and sold.

If you lose your closing papers or they get destroyed, you can obtain a copy of your mortgage note by searching the county's records or contacting the registry of deeds. It's also possible to obtain a copy from the company who services your loan (that is, the company you get billing statements from).