Orange California Executive Director Loan Plan is a financial program offered by Hathaway Instruments, Inc. that provides loans to executive directors in Orange, California. The loan is secured by a promissory note, which serves as a legal document outlining the terms and conditions of the loan. The Orange California Executive Director Loan Plan is designed to offer executive directors in Orange, California a convenient and flexible financing option. This program aims to support the financial needs of executive directors by providing them with access to funds for various purposes such as personal expenses, investments, or business ventures. The loan is facilitated through a promissory note, which is a written agreement between the executive director borrower and Hathaway Instruments, Inc. This document specifies the loan amount, interest rate, repayment period, and any other relevant terms and conditions. The promissory note acts as a legal assurance that the borrower will repay the loan according to the agreed-upon terms. By offering this loan plan, Hathaway Instruments, Inc. recognizes the importance of supporting executive directors in Orange, California, and their unique financial circumstances. The program aims to assist these professionals in achieving their personal and professional goals while providing the necessary financial stability. It's important to note that there may be variations or different types of Orange California Executive Director Loan Plans offered by Hathaway Instruments, Inc. These variations could include different loan amounts, interest rates, repayment periods, or specific eligibility criteria. It's advisable to contact Hathaway Instruments, Inc. directly or visit their website to obtain detailed information about the specific loan plans available and their respective names.

Orange California Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc.

Description

How to fill out Orange California Executive Director Loan Plan With Copy Of Promissory Note By Hathaway Instruments, Inc.?

How much time does it usually take you to draft a legal document? Considering that every state has its laws and regulations for every life sphere, locating a Orange Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc. suiting all regional requirements can be stressful, and ordering it from a professional lawyer is often pricey. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, grouped by states and areas of use. Aside from the Orange Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc., here you can get any specific document to run your business or individual deeds, complying with your regional requirements. Experts check all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required sample, and download it. You can get the file in your profile anytime later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Orange Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc.:

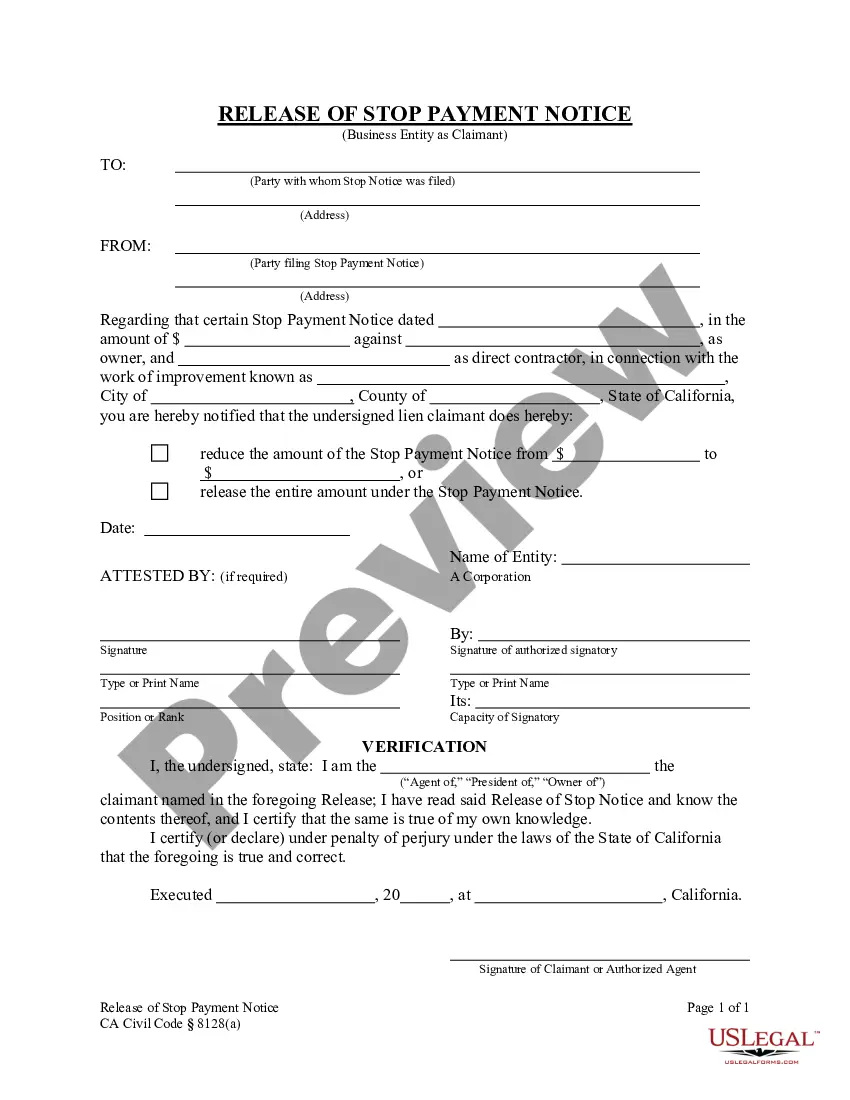

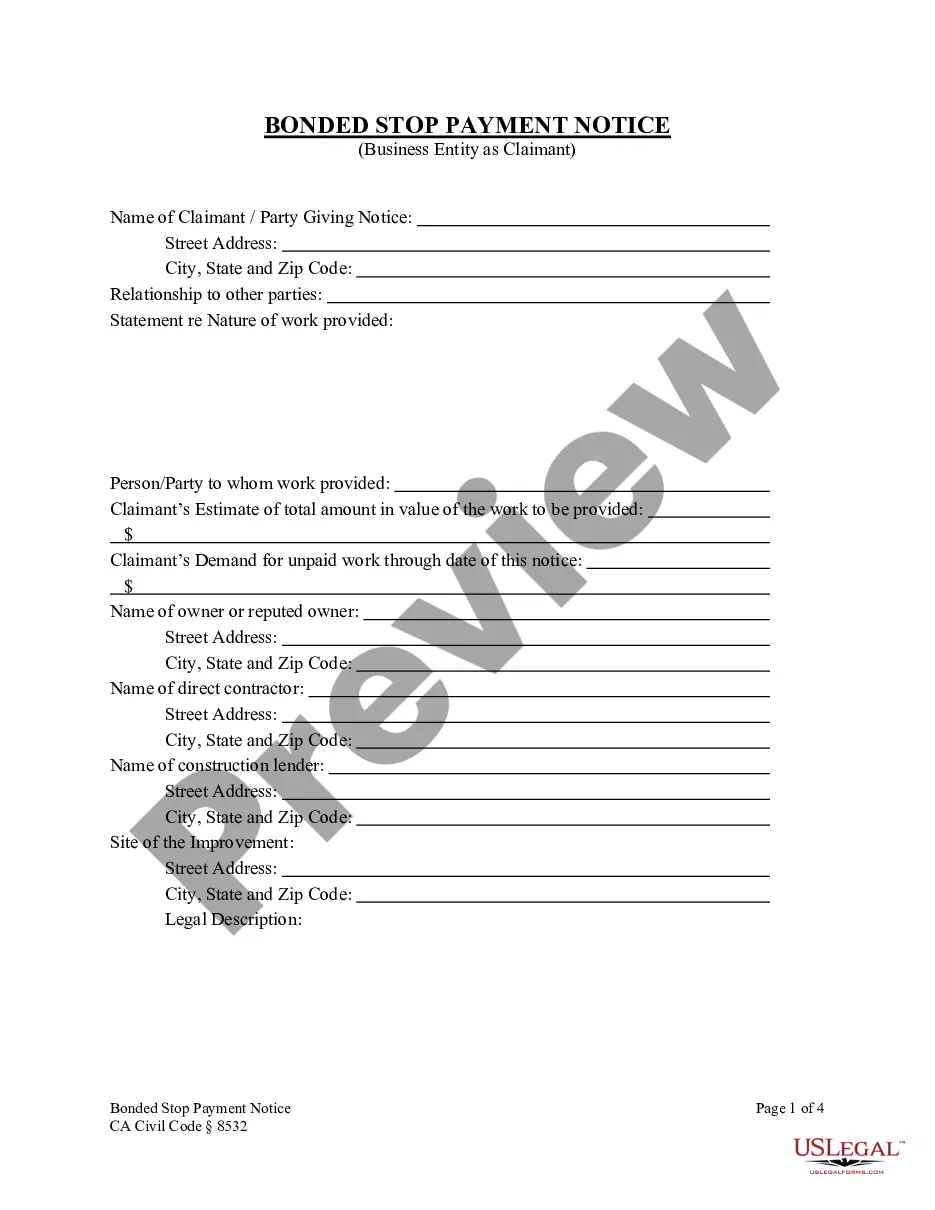

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Orange Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc..

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

Even if a promissory note is lost, the legal obligation to repay the loan remains. The lender has a right to re-establish the note legally as long as it has not sold or transferred the note to another party.

Only the borrower signs the promissory note, whereas both the lender and the borrower sign a loan agreement. The signed document means that the borrower agrees to pay back the loan.

200b200b200b200b200b200bAn MPN is a legal document that contains the Borrower's Rights and Responsibilities and Terms and Conditions for repayment. Direct PLUS and Direct Subsidized / Unsubsidized loans have different MPNs. An MPN can also be good for up to 10 years if certain enrollment requirements are met.

Unlike a deed of trust or mortgage, the promissory note is typically not recorded in the county land records (except in a few states like Florida). Instead, the lender holds on to this document until the amount borrowed is repaid.

Question: Will I need to complete a Master Promissory Note (MPN) every year? In most cases, for Subsidized and Unsubsidized Loans, once you've submitted the MPN and it's been accepted, you won't have to fill out a new MPN for future loans you receive.

You can get a copy of your Master Promissory Notes by going to studentloans.gov and entering your FSA ID. Click on Completed Master Promissory Notes under the menu bar heading that says My Loan Documents. The completed Master Promissory Notes will appear, and you can download them directly.

If you lose your closing papers or they get destroyed, you can obtain a copy of your mortgage note by searching the county's records or contacting the registry of deeds. It's also possible to obtain a copy from the company who services your loan (that is, the company you get billing statements from).

The original copy of a valid promissory note is usually held by the lender, but the borrower should also keep a copy of the signed document. If the borrower does not repay the loan, the lender can pursue appropriate legal action.

Search the county recorder's records. Promissory notes are typically recorded as public documents and accessible shortly after the closing. The trustee maintains the original deed until the loan is satisfied.