Phoenix Arizona Executive Director Loan Plan with Copy of Promissory Note by Hathaway Instruments, Inc. Hathaway Instruments, Inc. offers a specialized loan plan, known as the Phoenix Arizona Executive Director Loan Plan, accompanied by a copy of a Promissory Note. This loan plan is designed to cater specifically to executive directors in Phoenix, Arizona, providing them with financial support to meet their unique needs and requirements. The Phoenix Arizona Executive Director Loan Plan is customizable, allowing executive directors to borrow funds for various purposes such as expanding their business operations, investing in new technologies, or funding personal projects. This loan plan offers competitive interest rates and flexible repayment terms, ensuring that executive directors can manage their finances efficiently. Hathaway Instruments, Inc. understands the importance of trust and transparency in the lending process. As such, they provide a detailed copy of the Promissory Note, which outlines the terms and conditions of the loan agreement. The Promissory Note serves as a legal document, binding both parties involved, and clearly stating the loan amount, interest rate, repayment schedule, and any additional clauses or agreements. The Phoenix Arizona Executive Director Loan Plan offers several types, each tailored to meet specific needs: 1. Growth Loan: This loan type is designed for executive directors seeking financial assistance to fuel the growth and expansion of their business. It provides access to substantial funds that can be used for various purposes, such as procuring new equipment, hiring additional staff, or launching new marketing campaigns. 2. Personal Loan: Executive directors may choose this loan option to meet personal financial goals, whether it be renovating a home, financing higher education, or covering unexpected expenses. The personal loan offers flexibility, providing executive directors with funds to fulfill their personal aspirations. 3. Bridge Loan: Designed to bridge temporary financial gaps, this type of loan assists executive directors who require immediate capital. It can be used to cover payroll expenses, manage cash flow fluctuations, or facilitate business acquisitions until permanent financing is arranged. 4. Technology Loan: In today's rapidly evolving business landscape, investing in technology is crucial. Hathaway Instruments, Inc. offers the Technology Loan specifically for executive directors who need financial support to upgrade their IT infrastructure, purchase cutting-edge software, or implement innovative solutions to stay ahead of the competition. The Phoenix Arizona Executive Director Loan Plan by Hathaway Instruments, Inc., with its variety of loan types and detailed Promissory Note, provides executive directors in Phoenix, Arizona, with the necessary financial resources to achieve their professional and personal goals. With competitive terms, transparency, and flexibility, this loan plan becomes a valuable tool for executive directors seeking financial empowerment.

Phoenix Arizona Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc.

Description

How to fill out Phoenix Arizona Executive Director Loan Plan With Copy Of Promissory Note By Hathaway Instruments, Inc.?

Laws and regulations in every area differ from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Phoenix Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc., you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals searching for do-it-yourself templates for different life and business occasions. All the forms can be used multiple times: once you pick a sample, it remains available in your profile for future use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Phoenix Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc. from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Phoenix Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc.:

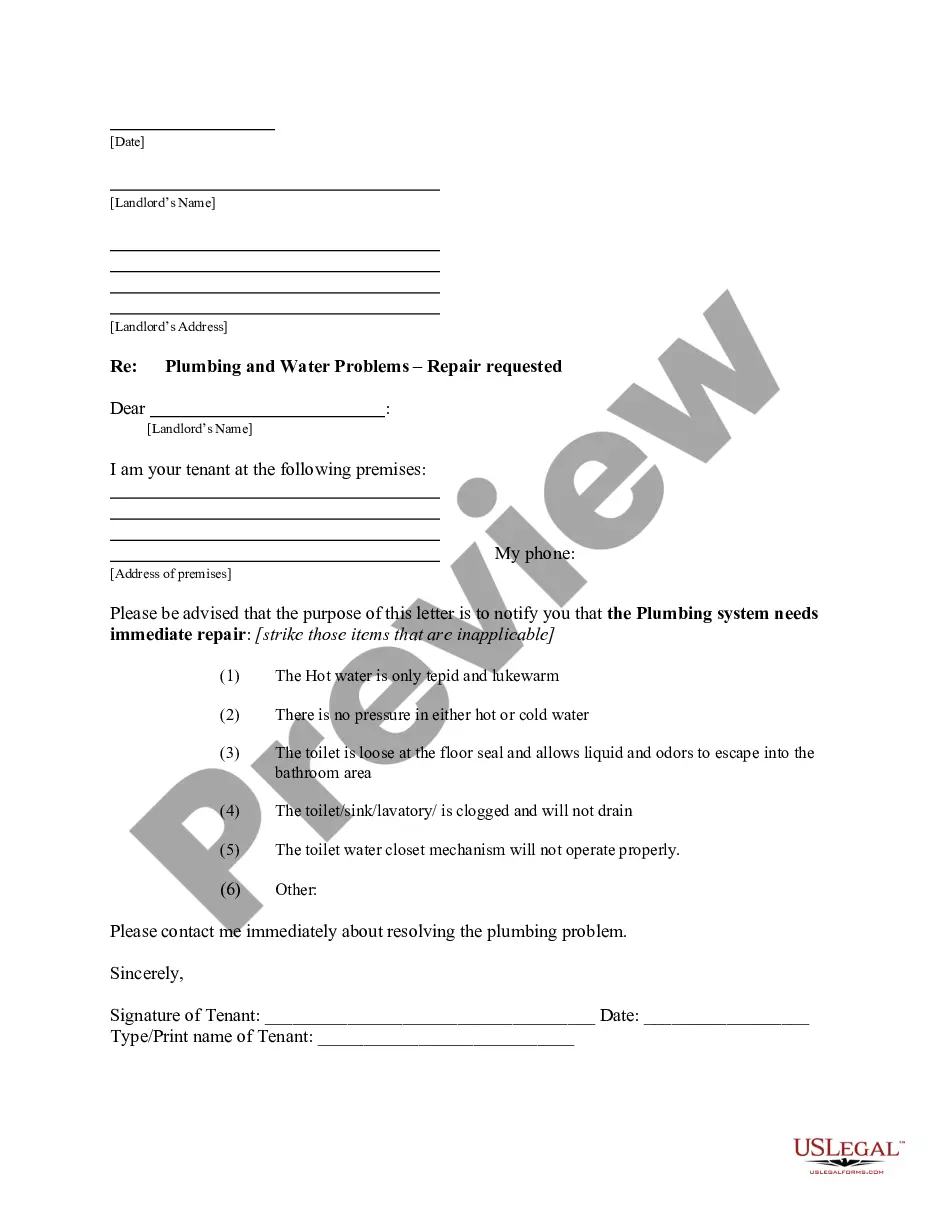

- Take a look at the page content to make sure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the template once you find the proper one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!