San Diego California Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc. is a comprehensive financial program designed to assist executive directors in San Diego, California, with their loan needs. This plan aims to provide financial solutions for executive directors who require funds for various purposes such as home renovations, expanding their businesses, paying off debts, or meeting personal expenses. The San Diego California Executive Director Loan Plan offers competitive interest rates, flexible repayment options, and quick processing times. This plan is tailored to the unique needs of executive directors, taking into account their financial goals and requirements. By partnering with Hathaway Instruments, Inc., a trusted financial institution, this loan plan ensures reliability and credibility. The Promissory Note, an essential component of this loan plan, serves as a legally binding contract between the borrower (the executive director) and Hathaway Instruments, Inc. It outlines the terms and conditions of the loan, including the loan amount, interest rate, repayment schedule, and any additional fees or charges involved. The Promissory Note acts as a guarantee of repayment, providing security to both parties involved. Under this loan plan, executive directors can benefit from different types of loans, including: 1. Small Business Expansion Loan: This type of loan is specifically designed for executive directors aiming to expand their businesses in San Diego, California. It provides the necessary capital to invest in infrastructure, technology, marketing, or hiring additional staff. 2. Home Renovation Loan: Executive directors who wish to renovate or remodel their homes can take advantage of this loan. It offers competitive interest rates and flexible repayment options to ensure that the renovation process is hassle-free. 3. Debt Consolidation Loan: For executive directors burdened by multiple debts and high interest rates, this loan plan offers a smart solution. By consolidating all debts into a single loan, borrowers can simplify their repayment process and potentially save on interest charges. 4. Personal Loan: The San Diego California Executive Director Loan Plan also caters to personal financial needs. Whether it's planning a vacation, funding educational expenses, or dealing with unexpected medical bills, this loan provides the necessary funds with affordable repayment terms. Executive directors in San Diego, California, can take advantage of this loan plan to meet their diverse financial requirements. The Hathaway Instruments, Inc. Promissory Note ensures transparency and accountability in the borrowing process, providing security for both parties involved.

San Diego California Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc.

Description

How to fill out San Diego California Executive Director Loan Plan With Copy Of Promissory Note By Hathaway Instruments, Inc.?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to create some of them from scratch, including San Diego Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc., with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in different types ranging from living wills to real estate papers to divorce documents. All forms are arranged based on their valid state, making the searching experience less challenging. You can also find detailed resources and tutorials on the website to make any activities related to document completion simple.

Here's how you can locate and download San Diego Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc..

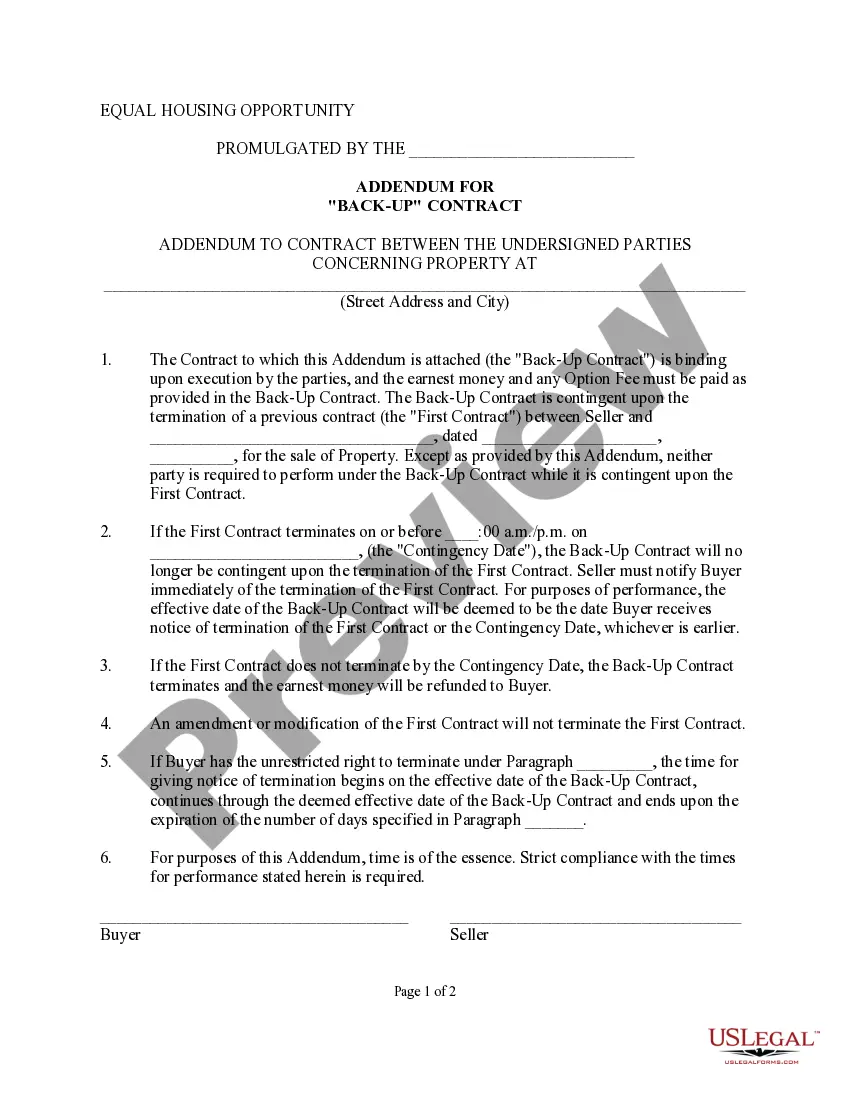

- Take a look at the document's preview and description (if provided) to get a general information on what you’ll get after getting the document.

- Ensure that the template of your choosing is specific to your state/county/area since state laws can impact the legality of some records.

- Check the related document templates or start the search over to locate the right document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a needed payment gateway, and purchase San Diego Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc..

- Select to save the form template in any offered format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed San Diego Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc., log in to your account, and download it. Of course, our website can’t take the place of a legal professional completely. If you have to cope with an extremely difficult case, we advise using the services of a lawyer to check your form before signing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of users. Join them today and get your state-compliant documents effortlessly!